When I examined the trading patterns in Google’s stock (GOOG) between earnings reports, I found little consistency for forming a trading strategy. For October’s earnings cycle, I chose to play one of the few promising historical patterns: 67% of the times that GOOG opened up in response to earnings, the maximum close until the next earnings report was at least 10% above the post-earnings open. If history repeats itself, this means GOOG should hit at least $600 by mid-January.

On Wednesday, GOOG essentially hit my aggressive price target of $580 before November’s expiration of options. However, I locked in the profit on the corresponding call spread play. This week, I reloaded the GOOG post-earnings play by going long the January 600/610 call spread which is the spread I would have picked last month if using a less aggressive trade.

The strategy for the call spread remains the same as last time. If GOOG pulls back, I will cover the short side of the spread once the stock reaches oversold conditions. I will then try to ride the long side of the spread the rest of the way. Otherwise, I ride the current upward price trend.

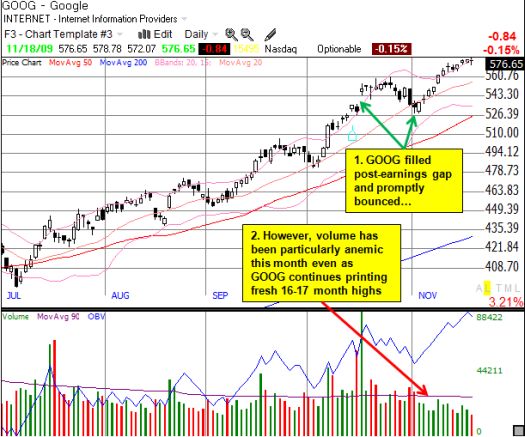

The chart below shows that GOOG closed its post-earnings up-gap like so many other stocks this earnings season. However, at that point, GOOG reached oversold conditions (stochastics not shown) and managed to bounce promptly. Within a week, GOOG recovered its post-earnings gains, and it has printed fresh 16-17 month highs ever since. The anemic trading volume during this run is the biggest red flag for the stock. The new multi-month highs should be attracting more participation, not less. This poor response motivated the conservative structure of this next post-earnings trade and the contingency planning for a pullback.

Be careful out there!

Full disclosure: long GOOG call spread

3 thoughts on “Reloading the GOOG Post-Earnings Trade”