I last wrote about earnings from KB Home (KBH) well over a year ago. While I kept tabs on the stock through my Housing Market Reviews, I never set up specific decision points for getting back into the stock. I finally created a decision point on October 12th when I made a hedged play of call and put options. Given my general bullishness on the housing market, I normally buy call options on home builders. However, the current run-up in KBH is so persistent, so strong, and so steep that technical prudence dictated taking seriously the potential for a near-term pullback.

Source: FreeStockCharts.com

As the chart above shows, the reaction to KBH’s last earnings report was swift and decisive. KBH gapped up and broke out above its 50-day moving average (DMA). The next day, KBH set a new 9-year high and a vigorous repricing began. The stock is now at a 9 1/2 year high. Two main themes came from KBH’s earnings: 1) the unfolding payoff from the company’s on-going efforts to improve operations and profitability, and 2) the overall impact from the hurricanes in Texas and Florida will be minimal.

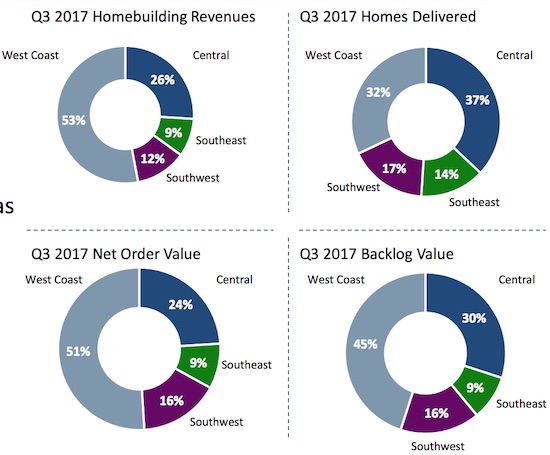

My main caution on KBH is its increasing reliance on the strong results and pricing power in the West, especially the San Francisco Bay Area. For example, in Q3, the West Coast represented 32% of homes delivered but a very dominant 53% of homebuilding revenues.

Source: KBH investor presentation for 2017 Q3

This quote from the transcript of the earnings conference call demonstrates the heavier reliance on California:

“We grew housing revenues to over $1.1 billion as we continue to benefit from our growing scale in California and a larger percentage of our deliveries coming from our highest ASP region. While our overall average selling price in the quarter was up 12% to roughly $411,000, we continue to offer product in locations that appeal to first-time buyers who accounted for 53% of our delivery…

Housing revenues were up in three of our four homebuilding regions with year-over-year increases ranging from 9% in the central region to 47% in the West Coast region.”

(During the Q&A, KBH further emphasized the strength of the first-buyer segment. Management described it as the locus of growing demand that is “very broad” across its markets.)

California’s results were indeed very solid and KBH projects even stronger performance in the future:

“On a regional basis, our West Coast region produced a 26% increase in net order value on a 10% increase in net orders, an impressive result given how strong our net orders and net order value were in California in the third quarter last year. Market conditions remain favorable, both along the coast as well as the inland area. The Bay Area, in particular, continued to generate excellent results. With a growing community count and continued investment in the region, the West Coast is poised to become an even stronger growth vehicle for us going forward.”

KBH further referenced the dominance of California during the question and answer (Q&A) period:

“…we had a mix shift to California, which is also where — within the quarter we saw the strongest pricing power, the combination of being able to take price, at the same time your mix rotates the higher ASP. If you look at our ASPs in the other regions, they really didn’t moved up much more than an incremental increase. And I would say that we are successful in raising price above any direct cost increases that we had, and that’s in part why our margins were able to pick up a little bit.”

So largely thanks to California, KBH can tell a story of on-going improvement over the past year and promise even more going forward:

“Over the last 12 months, we have increased our cash from operations, reduced our debt, and expanded our stockholders’ equity by almost $160 million. And with our returns focused growth plan, we expect this trend to continue. We also believe given our backlog that we can sustain the year-over-year improvement in gross margin for the remainder of 2017 and going into 2018.”

Guidance

KBH is building on California for its strong guidance as well:

“Reflecting the strength of our West Coast region’s third quarter net order value and expected regional fourth quarter backlog conversion rate, we are projecting an average selling price for the 2017 fourth quarter in the range of $425,000 to $430,000, a year-over-year increase of about 10%. This is the result of a changing mix of communities within our region, an expected proportional mix shift towards our West Coast region and the successful implementation of targeted community and plan-specific price increases.”

KBH’s confidence showed in its $4.5B to $4.9B revenue guidance range for fiscal 2018 whose midpoint is a rounding error away from KBH’s 3-year 2019 target of $5B. The projected 20% growth for 2017 adds credence to the confidence given this growth rate well exceeds last year’s projection of 11%. KBH also achieved its gross margin target one quarter early.

KBH will provide full 2018 guidance and update on its 3-year plan (to 2019) at an investor conference call on November 7, 2017.

Impact of Hurricanes Harvey and Irma

Overall, the two big hurricanes that slammed into the U.S. through Texas and Florida will have minimal impact on KBH.

Home sales will be deferred and not lost. KBH homes in Texas did not flood given the newer areas have “more advanced drainage system requirements.” KBH was back to delivering homes in Texas within a week of the disaster. KBH expects negative comparisons in September, but unaffected areas will likely see increases in demand. While KBH is concerned about potential material and labor shortages, the company has baked in the most likely scenario into its guidance. Where it can, KBH is locking down material and labor. The company claims it has control on the materials it knows will be in short supply as a result of post-hurricane rebuilding: lumber, rock, and shingles. So there is potential upside if things turn out not to be as bad as feared.

The repricing

KBH soared 8.6% post-earnings. Since then, the stock has traded down just two days. This kind of repricing is very bullish and represents a sudden recognition that KBH is/was “cheap.” Perhaps shorts are also getting out of the way and creating yet more buying pressure; a whopping 19.9% of KBH’s float is sold short. Even after this run-up, KBH’s valuation sits at 20.9 trailing P/E, 12.9 forward P/E, 0.6 price-to-sales, and 1.3 price-to-book. Builders are usually in distress when they trade anything near 1.0 price-to-book. As a point of comparison, Lennar (LEN) trades at 1.8 P/B and D.R. Horton, Inc. (DHI) trades at 2.0 P/B. KBH is a buy even up here.

Yet, as I noted at the beginning of this piece, I well recognize that these kinds of run-ups are vulnerable to sharp pullbacks. So, I am not changing my strategy to chase KBH (previous buys were done in the middle of sell-offs). Moreover, I am keeping the California concentration in mind as a potential risk factor given the growing issues of affordability in the state. At this point, a hedged approach seems best while I await future opportunities to buy the dips.

Next stop, the KBH investor’s conference.

Be careful out there!

Full disclosure: long KBH calls and puts