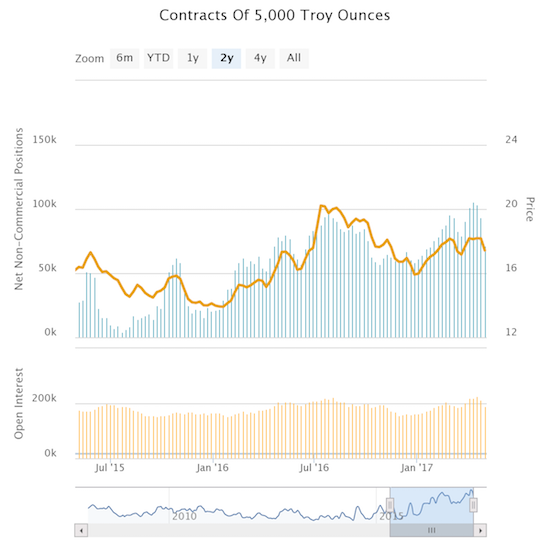

In recent weeks I have wondered aloud why silver speculators were so bullish. In the latest Commitment of Traders (CoT) data it appears speculators are finally asking themselves the same thing.

Source: Oanda’s CFTC’s Commitments of Traders

In just two weeks, the level of net long futures contracts on silver have gone from levels not seen since at least 2008 to a level last seen in late January, 2017. The hasty retreat is understandable. Silver has suffered a vicious plunge since the last peak in April. Speculators likely wanted to reduce further risk (and potential losses) ahead of the U.S. Federal Reserve’s latest pronouncement on monetary policy on May 3rd. The iShares Silver Trust (SLV) fell for a record 14 straight days before FINALLY printing a daily gain at the end of trading on Friday, May 5th. It is probably no accident that this plunge finally took a breather in the same week that maximum bullishness on silver took a big step backward. The silver market is likely due for some capitulation.

Source: FreeStockCharts.com

An end to a selling record is a small baby-step in the direction of encouragement. I cannot get optimistic over the prospects for a bounce until SLV manages to reverse its entire post-Fed loss. At THAT point, I will assume SLV is good for at least a bounce back to resistance at its 50-day moving average (DMA). If the 2017 low gives way, I will assume that SLV is on its way to challenge the low from late December that occurred in the wake of the Federal Reserve’s first rate hike in a year. For now, I cannot identify a specific catalyst that can help to boost SLV except for the technical tailwinds of a relief rally from an oversold condition.

Be careful out there!

Full disclosure: long SLV shares and call options