A lot of Trump trades have gained great favor over the past month. Twitter (TWTR) is one potential trade I am still waiting to pop.

Trump’s Twitter habit is of course well-known and probably legendary at this point. As a result, Twitter has become a household name more than ever across the social and media spectrum. “Twitter” is a strong brand name, and “tweeting” or a “tweet” might as well be the equivalent of must-see, breaking news. When it comes to theme-based trading, these attributes are typically enough to launch an associated skyward. Unfortunately for Twitter, its easily recognized brand also comes with a lot of baggage that has already weighed heavily on the stock.

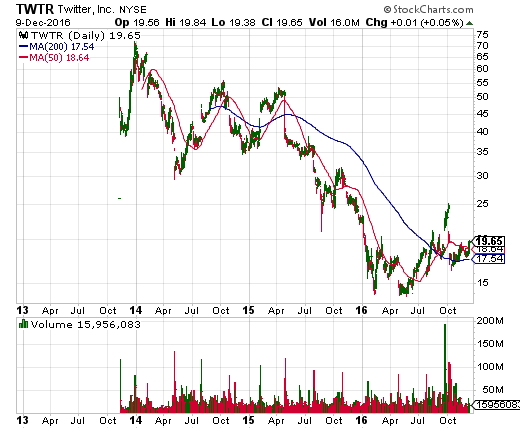

Source: FreeStockCharts.com

While TWTR is up 6.9% since the election, the stock generated most of that gain in the first day of post-election trading. TWTR even lost all of those gains over the course of the following two weeks. TWTR is now up 6.3% for December. The first daily chart above shows that TWTR is on the edge of a breakout. Even if no follow-through occurs in December, I fully expect a friendly January with the relief from the pressure of end-of-year selling. Note that TWTR’s post-election gain is ahead of the S&P 500’s (SPY) 5.6% post-election gain and the NASDAQ’s (QQQ) 4.8% gain, but it is peanuts compared to the post-election gains in the likes of U.S. Steel (X) of 72% or Goldman Sachs (GS) of 33%.

I made a big mistake in failing to take profits on my short put when the M&A rumors were hot and heavy. That position is now back to roughly even. After the M&A excitement completely fizzled out, I stubbornly took out a fresh short position on a January $15 2018 put. That position allows me to buy TWTR for under $12.50 whereas the first one has a break-even at just under $20. My main outstanding question is whether Twitter will retain its cachet after inauguration…

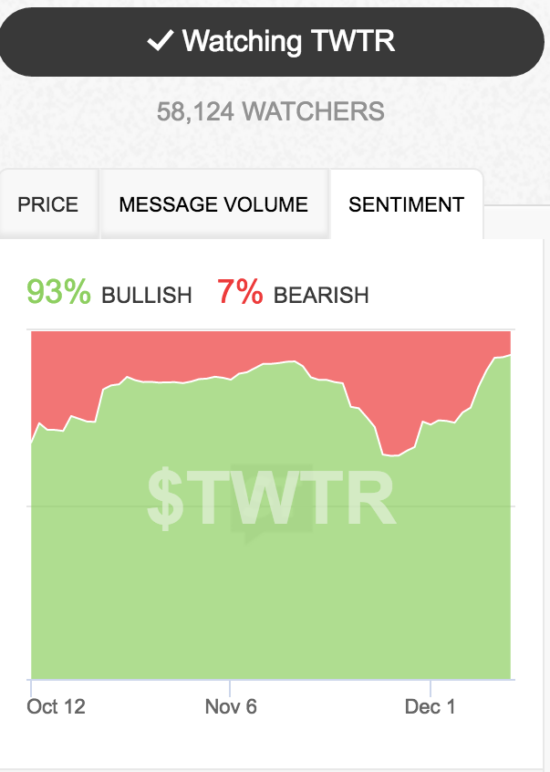

Source: StockTwits

Be careful out there!

Full disclosure: short TWTR put options