(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 39.9%

T2107 Status: 19.2%

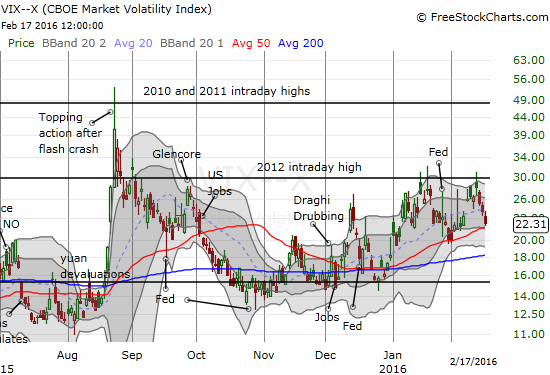

VIX Status: 22.3

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #3 over 20%, Day #2 over 30% (overperiod), Day #47 under 40%, Day #51 below 50%, Day #66 under 60%, Day #407 under 70%

Commentary

On January 28, 2016, Facebook (FB) gained 15.5% in a post-earnings move that I described as “full bull.” The bullishness of the day was confirmed when T2108 finally exited an excruciating oversold period the following day. I am calling this day, February 17, 2016, “Full Bull (FB) Part Two” because FB has recovered from a near complete reversal of all its post-earnings gain to close above its 50-day moving average. This bullish move comes after six straight trading days testing and retesting resistance at the 50DMA only to get turned back.

The road ahead to confirm FB’s bullish move will not (should not?) be nearly as easy as Full Bull Part One. On the positive side, T2108 soared for a third straight day demonstrating broad participation in this current bounce from oversold trading conditions. At 39.9%, T2108 closed exactly at the peak of December’s bounce from oversold conditions.

T2108 is right at critical resistance just as other key indicators are at critical testing points.

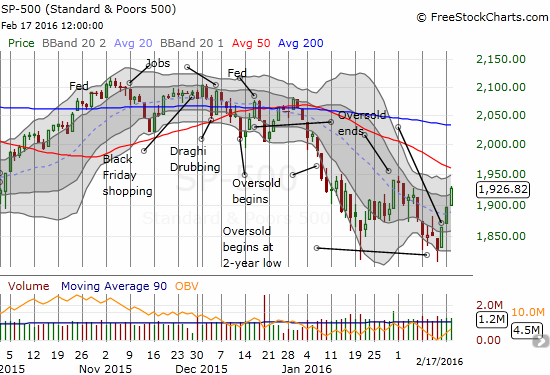

The S&P 500 (SPY) printed its first 3-day gain since December. The index is staring down resistance from the last high in late January.

The volatility index, the VIX, is also facing an important test; this is a test of support.

I used this further plunge in volatility to lock in profits on my put options on ProShares Ultra VIX Short-Term Futures (UVXY).

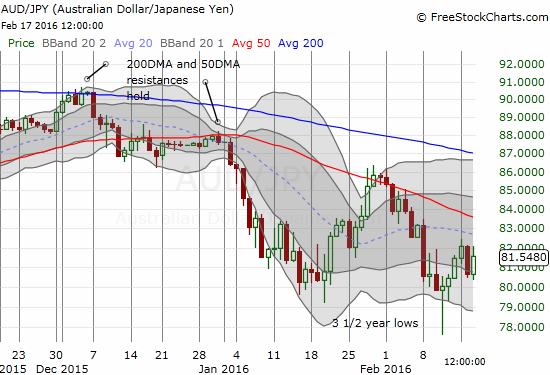

This continued rally surprised me because overnight trading going into the U.S. session featured a resurgent Japanese yen (FXY) and weakening Australian dollar (FXA). For whatever reason, they both turned around and delivered a supportive rally in AUD/JPY. Note however, the recovery was NOT complete and, like the S&P 500, AUD/JPY faces resistance from a rapidly declining 50DMA.

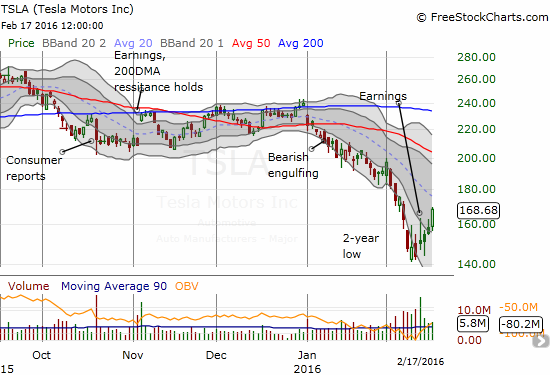

I will conclude here with a chart of Tesla Motors (TSLA). This is one of similar charts of individual stocks surging from recent lows. This move surprised me as I expected TSLA to struggle like other big stocks in the wake of their earnings. Instead, TSLA showed off some of its old flair with a monster 8.7% gain which looks to erase the bad taste of a 2-year low. TSLA is in the open field with a fresh post-earnings high, a fully bullish move.

— – —

For readers interested in reviewing my trading rules for T2108, please see my post in the wake of the August Angst, “How To Profit From An EPIC Oversold Period“, and/or review my T2108 Resource Page.

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

U.S. Dollar Index (U.S. dollar)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO call options, long SSO shares, long SVXY shares, short AUD/JPY, short FB (hedge)

This looks like another bear market rally. I think T2108 is a great short term indicator to use to play the rally, but longer term T2107 is telling the story.

All the data would say that for long term investors, it’s ‘way to early to buy.

The market got a retest of the Jan. lows, and this is just a bounce off of that level. But as you pointed out with the AUD/JPY, most of the indices of note have a ‘rapidly declining 50 day average’. The operative word is declining, and I think that we’re going to break through the retest area before this is over. That would be the time to begin getting in if you have a really long horizon.

The bear market appears to have just started. They usually last for quite a while, and the selloffs can be nasty.

I am not quite ready to say “bear market” yet, but the technical damage is definitely still in place. Buyers have yet to prove that a sustained rally is somewhere in the near future.