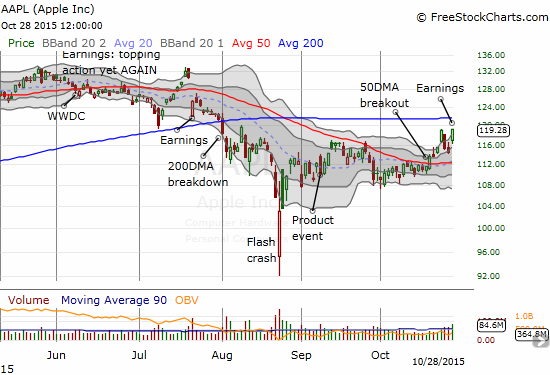

The pre-earnings trade on Apple (AAPL) unfolded exactly opposite of expectations. The model pointed bearishly, but AAPL ended the day with a very impressive 4.2% pop that placed it right back where it closed on Friday’s impressive rally.

Source: FreeStockCharts.com

This particular pre-earnings trade turned out to have too many moving parts and caveats. I placed the odds of success at 60%, but I had not considered the potential impact of the Federal Reserve’s latest announcement on monetary policy. Given I expect the Fed to continue help supporting the market, a bearish pre-earnings trade on AAPL had less chance of success than the model implied! Lessons learned!

Fortunately, I noticed the stock’s bullish underpinnings as well as I had word from a friend who listened to the call that Apple’s results were stellar, China looks good, and guidance was strong. So after shaking off the disappointment from a trade gone bad, I looked for the next opportunity. I managed to double down on my call option (a weekly with $119 strike) early in the day. I was frankly shocked it tumbled from $200+ to $40 even with the expected post-earnings implosion of volatility. Given the calls looked far too cheap, I had no problem doubling down. As luck would have it, AAPL’s strong close allowed me to close out the long side at breakeven as my new cals increased in value by 160%.

I decided to just hold onto the put spread side of the trade. I will use it as a small hedge for what I see as many bullishly biased trades to come in the next few weeks. Unlike the hedge I held ahead of and through the flash crash, I do NOT expect this put spread to deliver profits by November’s expiration.

The other lesson from this failed pre-earnings trade is that April has become even more attractive as the lone month to try trading Apple pre-earnings. Otherwise, post-earnings trades are making more and more sense. I hope to develop a post-earnings model before January’s earnings. Stay tuned…

Be careful out there!

Full disclosure: long AAPL put spread