(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)

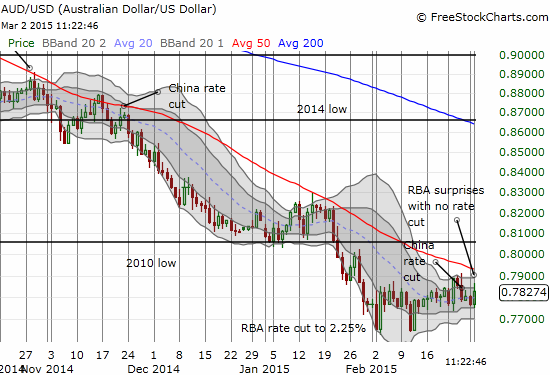

This time around, the currency market seemed well-prepared for a rate cut from the Reserve Bank of Australia (RBA). As luck would have it, the RBA did not cooperate. {snip}

This statement will keep the market guessing for the next month or so trying to read the economic data for clues as to whether the RBA will proceed with rate cuts at the April meeting. While the RBA’s conclusion suggests that the Bank freely consider further rate cuts in the future, the body of the statement included conflicting clues on these prospects:

{snip}

One unsaid factor potentially driving the decision is the muted reaction of the Australian dollar to the last rate cut. {snip} With no reliable reaction function, the RBA is naturally less inclined to cut rates and should be more measured in its deliberations.

{snip} On balance, market conditions appear ripe for range-bound trading. I expect only a particularly strong catalyst can send the Australian dollar materially below recent lows ahead of the next RBA meeting.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)