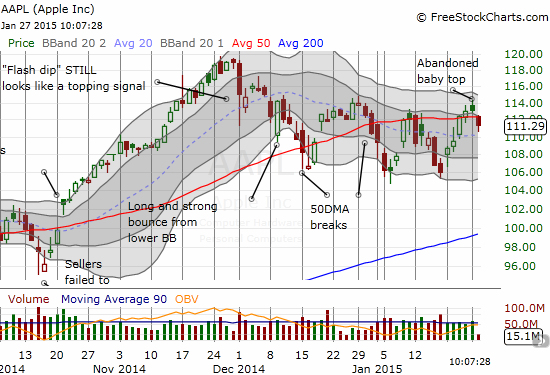

At the time of writing Apple (AAPL) is down 1.6% in sympathy with a poor reaction to Microsoft’s (MSFT) that included warnings about the impact of the strong U.S. dollar (UUP). The drop has formed a bearish “abandoned baby top” kind of technical pattern just as the stock has dropped below the 50-day moving average (DMA) for the fourth time in less than 6 weeks. The current pattern makes the 50DMA look more and more like firm resistance. Moreover, the “flash dip” from December 1, 2014 has yet to get invalidated as a bearish warning.

Source: FreeStockCharts.com

Despite the growing bearish technical signs, optimism in Apple (AAPL) is riding VERY high. Since I am also an AAPL bull, I am sympathetic to the sentiment. But as a technician, I am VERY wary at this point.

This optimism is important perspective as we all prepare to hear what AAPL has to say in earnings tonight (January 27, 2015). Before every earnings, I assess the prospects for AAPL’s trading the day after the report based on a read of sentiment and technicals. I do not have time to replicate all the charts, but interested readers can refer to the pre-earnings trade analysis from October, 2014. You can also get more background on my approach there.

Let’s start with the analysts. According to Schaeffer’s Investment Research, 21 analysts rate AAPL a strong buy versus 4 buys and 6 holds. There are NO sell or strong sell recommendations. This is about as optimistic a bunch as you can find on a stock that is widely held and followed.

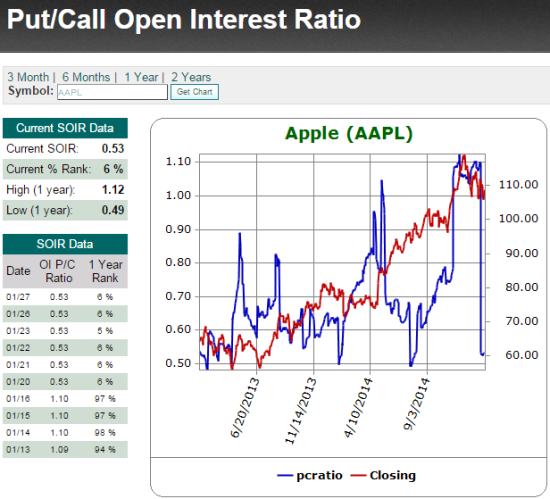

In recent days, the open interest put/call ratio has tumbled toward a 52-week low, a level set last summer. I believe the magnitude of the drop is the most important. Because there is nothing like it over at least the last two years, I interpret the plunge as an extreme in optimism.

Source: Schaeffer’s Investment Research

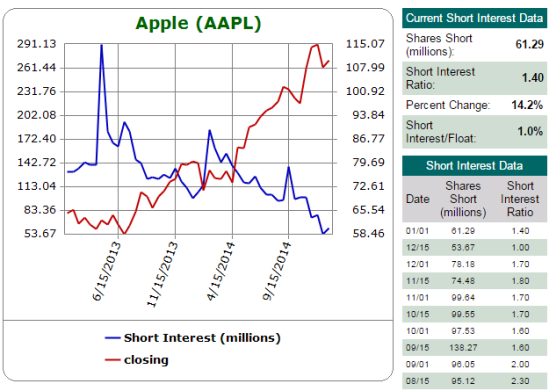

Add to this extreme in optimism, the on-going decline in shares sold short against AAPL. Short interest is now a mere 1.0%. (I believe this chart is split-adjusted).

Source: Schaeffer’s Investment Research

The post-earnings record for Apple in January is poor (starting in 2007). January is Apple’s worst month as far as % of times the post-earnings reaction is negative (again, refer to my October pre-earnings post for more details). January is the near anti-thesis of the great performance AAPL typically displays in April. So, I am particularly wary of the high optimism going into January earnings.

There also tends to be a strong inverse (or negative) correlation between the 7 and 14-day average price change and the post-earnings price change (I still have these averages based on calendar days, not trading days – something I hope to change this year!). Going into today, these numbers are 1.0% and 0.3% respectively. This positive bias, especially for the last week, is another sign of the optimism going into earnings. Note however that the correlations are not strong for January earnings (but the sample size is much smaller as well).

Today’s big drop in price confounds my bearish outlook. There is an inverse correlation for the one-day price change ahead of earnings, but there is also a small positive correlation for January earnings. Certainly, today’s drop takes some of the oomph out of whatever negative reaction would have occurred post-earnings.

So, overall, I would at least NOT make a bullish bet going into earnings. The data above suggest that all the buying power interested in AAPL has positioned itself ahead of earnings. If AAPL pulls of a win, then there are clear hurdles above which AAPL becomes a strong buy again (like clearing $114.50, the top of the abandoned baby top). The data, technicals, and sentiment all point me to speculate on a bearish response to earnings. Note this is VERY different from saying that AAPL will report awful numbers, I am betting on the market’s immediate response. Implied volatility is very high on AAPL right now, returning to pre-earnings levels more typical before 2014. So, the market seems to be trying to brace for a relatively big move.

Be careful out there!

Full disclosure: long MSFT put options

Quick follow-up note…AAPL reported gangbuster numbers but the stock only traded enough to fill today’s gap. he big test will be after the market opens. AAPL needs to get follow-through. It will invalidate the bearish abandoned baby top pattern and it will FINALLY get AAPL moving toward invalidating the bearish “flash dip” from last month.

I will have some notes on my trade execution in the next T2108 Update.