(This is an excerpt from an article I originally published on Seeking Alpha on July 14, 2014. Click here to read the entire piece.)

Employment picture remains lackluster

On Friday, Statistics Canada painted another disappointing jobs picture for the country. Instead of the 20,000 additional jobs expected by the “consensus” for June, the Canadian economy lost 9,400 jobs. This means that year-over-year, the Canadian economy has only added 72,000 jobs, a growth rate of 0.4% that Statistics Canada described as “…the lowest year-over-year growth rate since February 2010, when year-over-year employment growth resumed following the 2008-2009 labour market downturn.”

{snip}

Source: FreeStockCharts.com

{snip}

Poor jobs growth is not slowing down the high-end of Canada’s housing market

At the same time that employment remains moribund, the high-end of Canada’s housing market is red hot as reported in the 2014 Mid-Year Top-Tier Real Estate Report for Canada produced by Sotheby’s International Realty Canada. {snip}

This dynamic represents a slowly increasing dilemma for monetary policy in slow-growth economies (whether it is GDP and/or employment), and something where I have decided to spend more of my attention. {snip}

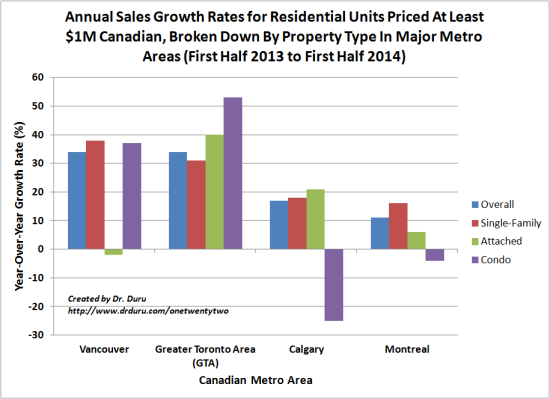

The Sotheby’s report summarizes some amazingly strong year-over-year growth numbers for residential real estate units from the first half of 2013 to the first half of 2014 (sorted in descending order of growth rates):

{snip}

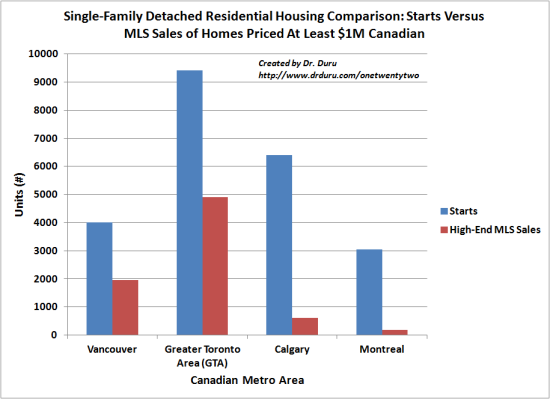

Presumably, some of this robust growth comes from international sales. {snip}

{snip}

{snip}

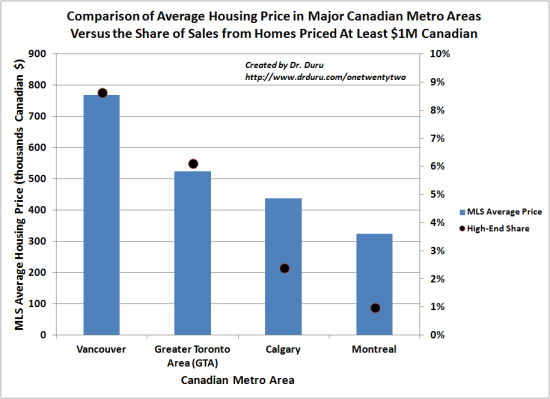

{snip} Regardless, the main point here is that the high-end is small enough for Canada’s central bank to more or less ignore the heat coming from this side of the market. The dichotomy between slow jobs growth and strong growth in the high-end of the housing market can continue for quite some time. {snip}

{snip}

Source for all charts: 2014 Mid-Year Top-Tier Real Estate Report for Canada produced by Sotheby’s International Realty Canada and Canada Mortgage and Housing Corporation’s Housing Market Outlook for 2014 to 2105

Putting all the pieces together

Assuming a soft landing for Canada’s overall housing market, the Bank of Canada will have scope and reason to maintain accommodative policies in the hopes of supporting the disappointing labor market. The sudden rebound in the Canadian dollar this year gives the Canadian central bank the scope for keeping rates low in the hopes of supporting stronger growth in exports through a weaker currency. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 14, 2014. Click here to read the entire piece.)

Full disclosure: long USD/CAD