(This is an excerpt from an article I originally published on Seeking Alpha on June 12, 2014. Click here to read the entire piece.)

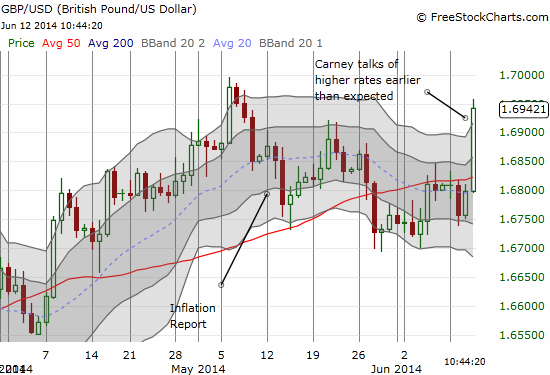

After artfully fending off questions about the timing for higher interest rates, Mark Carney finally gave the market throngs a clearer hint:

{snip}

Mark Carney on timing of first rate rise: the decision is becoming more balanced http://t.co/JI85s5QmNT pic.twitter.com/lxf4c5QWSZ

— Bank of England (@bankofengland) June 12, 2014

Mark Carney, the Governor of the Bank of England (BoE), spoke these words near the beginning and near the end of his address at the Lord Mayor’s Banquet for Bankers and Merchants of the City of London at the Mansion House in London on June 12, 2014.

{snip}

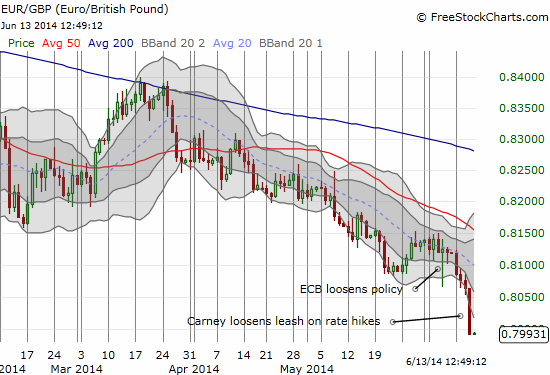

There is delicious irony in warning that rate hikes could come earlier than expected: Carney and his cohort have lulled us (at least me) into thinking that the BoE is quite reluctant to raise rates anytime soon. In fact, the BoE has seemed more interested in preventing the market from getting a head start on higher rate expectations. Moreover, in the last Inflation Report, Carney seemed to float signals that he preferred a lower exchange rate for the British pound. {snip}

I think this surge is a gross over-reaction: the market overly focused on the changed timing of the first rate hike and not the unchanged overall trajectory and scope of those rate hikes. {snip}

So then why shake up the currency market with the magic “sooner than expected” language? While the BoE prefers a lower exchange rate, it also sees imbalances in the economy that are partially a result of extremely low implied volatility, excessive debt, and higher than warranted risk-taking:

{snip}

There is a delicious irony about Carney’s observations on the British housing market. At the last Inflation Report, Carney deftly deflected probing questions from reporters about a potential bubble in the London housing market. Carney has apparently and suddenly found some religion on that score:

{snip}

In other words, the expected overall trajectory for interest rates remains largely unchanged. Carney and the Bank of England have simply and finally convinced themselves it is time to directly remind the UK that those higher rates are indeed on their way.

While I think the currency market over-reacted to the rate hike headlines, I am NOT recommending selling the British pound. {snip}

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 12, 2014. Click here to read the entire piece.)

Full disclosure: net short the euro