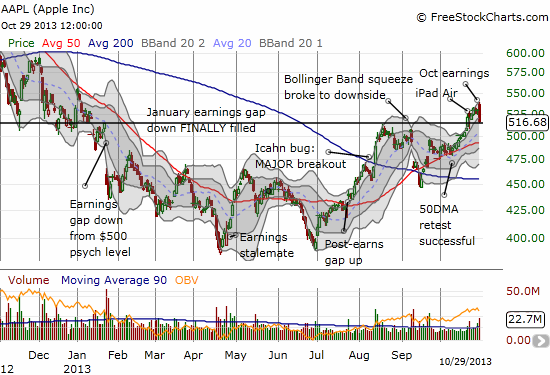

The Apple October post-earnings reaction played out amazingly close to the roadmap I provided in “Apple Earnings Technical Review – October, 2013 Edition“…except there were a lot more squiggles between points A and B than I anticipated…and my execution could have better. In this post, I review the action and recount lessons learned.

First, a reminder of my headline assessment of the Apple pre-earnings trade, October, 2013 editions:

“The short story is that while I remain convinced that AAPL has turned bullish again, the outlook for the one-day post-earnings reaction is pointing downward. The good news is that traders who missed Apple’s latest run may get an opportunity to join the ride at a small discount.”

I managed to tweet my positioning for the pre-earnings trade: a 515/510 December monthly put spread. I chose this expiration after noticing little price differential across all the expirations from this week to the end of the year. It made little sense to make an all-or-nothing bet this week when I could keep the bet on as a hedge if needed.

In retrospect, I think a calendar spread would have been provided a better position given my assessment. For example, selling the weekly $530 call and buying the monthly (Nov 16th) $540 call would have generated $1400 on the short call as it lost almost all its value while the $540 call “only” lost $937 for a net of $463 (excluding commissions). The risk was minimal given my assessment, but it would have taken an extremely large rally in AAPL to start generating significant losses on the trade. For example, at the peak of the day when AAPL mysteriously soared to a 1.7% gain and $539.25 high, this position was still marginally profitable ($60, excluding commissions). [I immediately put that lesson to work on LinkedIn’s (LNKD) earnings.]

Instead of juicy gains, I am sitting on a put spread that closed the day unchanged in value after falling as much as 75% in value. That drop so surprised me, I was slow in realizing that my next move had to be buying puts to fade the pop. Why? Well, the pop simply made no sense given what had transpired before. It also did not match with the tone of after-hours or pre-market trading or the subdued headlines on AAPL earnings or in particular the apparent conclusion that AAPL had “disappointed” investors. More on this last point later…

The after-hours action started the bizarre ride. Here is the after-hours action from a real-time chart on NASDAQ.com.

Click on image for a larger view…

Notice that once earnings were released the immediate, trigger-finger reaction was negative. This is what I call the “real” assessment which must next get disproved or ameliorated by the conference call. That turn-around apparently came in the form of an explanation of margins. However the elation and relief were short-lived as AAPL eventually ground lower and returned to a negative print relative to the close of regular trading. The initial negative assessment remained the headline and media outlets reported AAPL closed 2% lower in after-hours trading. I went to bed preparing to execute the next part of my post-earnings trade: buying the dip.

So imagine my surprise when I woke up to see AAPL soaring in pre-market trading to what proved to be the high of the day. Without finding a smoking gun to explain this bizarre move, I assumed this trading was “fake.” In other words, the previous evenings assessment remained the “real” one. Sure enough, those gains faded with a quickness. Once those gains disappeared, sellers took complete control, eventually sending the stock to a 2.5% loss on the day, not much different than after hours trading the day before!

Click on image for a larger view…

Unfortunately, I compounded my tactical mistake of a missed trade with a premature execution of my next strategy of buying the dip. I set a low ball limit order for a weekly $545 call expecting some kind of sharp bounce (NOT for AAPL to hit $545). While I did manage to see some gains on the first bounce toward $530, that call option lost almost all its value by the close. The Apple Trading Model (ATM) projects 91% odds for an up day at the time of writing (early morning of Wednesday, October 30th). Accordingly, I moved quickly to buy another call option that so far is doing very well (note I am still holding on to the put spread).

My confidence in a bounce is somewhat bolstered by none other than Jim Cramer. On TheStreet.com he called out what he thinks is a complete misunderstanding of what happened with Apple’s margins, amplified by a financial media that could not process the nuances because of its hurry to print a story. Cramer’s piece was aptly called “Foolish Knee-Jerk Reactions.” Here is the key quote (long):

“It happened again. It’s just totally ridiculous. I’m talking about the moronic trading in Apple right after the headlines came out. What did you know? You knew that things were basically in-line on most metrics, and while you didn’t get the big guide-down on gross margins, you didn’t get much good news on that front, either.

Yet, on the strength of that limited knowledge base, people sent this stock down 15 points on hundreds of thousands of shares. It was lunatic.

If you were involved in this sham of a process, you rightfully got your head handed to you, because the earnings release didn’t capture the main reason you might have been negative — the reason why gross margin didn’t go higher: Apple made an accounting change that depressed the announced gross-margin number somewhat artificially. Some revenue that would have normally been included in the quarter got deferred, and that fell right out of the bottom line.

It was pretty shocking to see the scramble back up when the explanation came out on the call.

We are dealing with complicated companies here. Their results are not lending themselves to headline writers who do not understand the complexities that companies face when they try to make their earnings reports as simple as possible. The journalists who follow Apple are almost all uniformly excellent, but, in the end, they are in a race to get the story told. This is race in which there are no winners, because they are all looking at the same models of and the same analysts’ forecasts and plugging in what they see and spitting out a story that has none of the nuances of what management might have to say on the quarter.”

Finally, here is the chart recording the trading on the first post-earnings trading day. Notice the strong fade that formed a bearish engulfing pattern. I take these seriously and am not comfortable with AAPL’s near-term prospects until the stock invalidates this signal by closing above the high of that pattern. Also note how neatly AAPL retested presumed support from the top of January’s gap down (the solid black line). Until the stock breaks BELOW that line, my overall near-term bias will remain bullish, even with the discomfort.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long AAPL shares, calls, and put spread