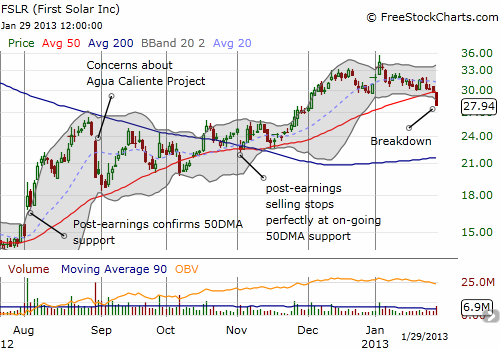

It has been a good run, but it seems that First Solar’s best gains are behind it for now. First Solar (FSLR) declined 5.9% on Tuesday, January 29 on heavy trading volume. FSLR is now trading below its 50-day moving average (DMA) for the first time since October. This breaks a primary uptrend that has delivered a 151% gain for FSLR since the end of July (all-time lows were set the month before). The stock is now down 9.5% year-to-date while the S&P 500 (SPY) is UP 5.7% on a strong run of its own.

Source: FreeStockCharts.com

I have argued before that FSLR has lifted largely thanks to the absence of bad news. Now, I am assuming this breakdown is occurring in advance of imminent bad news. Other indicators of imminent bad news are mixed.

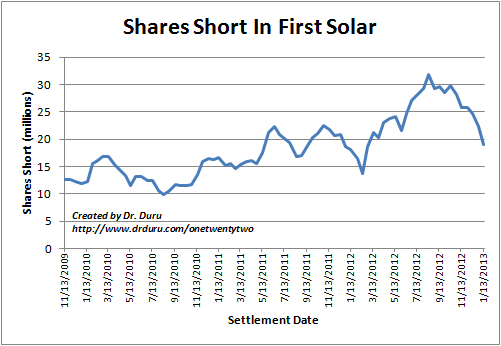

Shorts continue to back off FSLR with shares short back to levels last seen at the end of February, 2012.

Source: NASDAQ.com short interest

Normally, I would consider this retreat bullish and the resulting short-covering an explanation for the rise in FSLR’s stock. However, short interest peaked in mid-August of last year. After FSLR peaked another two weeks later, it took another three months before the stock could gain a fresh high. Indeed, it is very possible that FSLR bears have cashed in their short shares for (much less risky) put options. The open interest put/call ratio has soared from 0.90 ahead of November earnings to as high as 1.42 last week (hitting the 99 percentile rank). The put/call interest has settled back down to 1.23. All things considered, I interpret this as a sign that traders are still betting on an imminent sell-off in the stock. Moreover, shorts are STILL 38% of float.

First Solar’s valuation is still at rock bottom levels: price/sales of 0.82 and price/book of 0.70. These levels reflect the on-going liquidity risk in FSLR if anything goes awry in its large-scale utility solar power business. FSLR’s cash levels remain relatively high at $717M, but free cash flow has been negative three of the last four reported quarters. Total debt is now at $530M. These are some of the reasons why I continue to maintain that FSLR is still just a trading stock.

In early March, 2012, I recommended selling long-dated puts (LEAPS) on FSLR as a way to speculate on an eventual recovery in the stock. It was basically a bet that at some point in two years the stock would experience a substantial rally. I was definitely early as the stock proceeded to get chopped in half over the next three months. While I did not sell another put as I should have, I did stay patient. Now, ironically, over 10 months later, FSLR is trading where I first launched the trade. Whereas shares would have gotten me nowhere, the short put has benefited from the erosion of time premium and a drop in implied volatility. When FSLR erased all its early gains for the year on January 7th, I rushed in to buy a protective March 27 put. If I had not done it then, I would definitely do it now with the current breakdown in the stock. With earnings about a month away that should include extremely conservative (if not poor) guidance for 2013, it is finally time to protect bullish positions in FSLR.

Be careful out there!

Full disclosure: long and short FSLR puts