(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are highly likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 83.0% (7th overbought day)

VIX Status: 13.5

General (Short-term) Trading Call: Next short position when S&P 500 closed below today’s low (1472.12)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

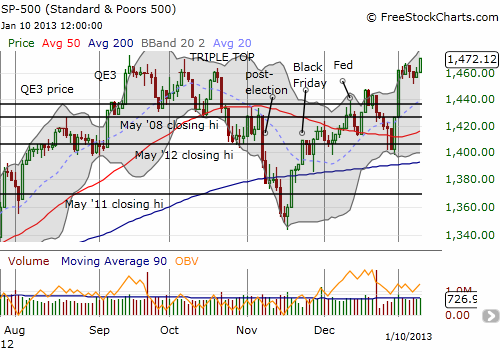

The S&P 500 closed up 0.8% and is now a hair’s length away from finally clearing resistance at the triple top I have pointed out so often.

T2108 pushed to an 11-month high as it printed 83.0%. This is the seventh overbought day. Overbought conditions continue to get more and more extreme as the VIX spent another day below 15 and is scraping at the very bottom of its trading range.

As a reminder, the duration of an overbought period is 9.2 days and the median is only 4.0 days. Once T2108 overbought conditions last about 20 days, the market outlook gets very bullish. So, at this point, I have changed the trading strategy from initiating a small short position to waiting until the S&P 500 shows some kind of sign of weakness before shorting (again). One example would be a simple close below today’s low. This would demonstrate some ability of sellers to take the market down. In the face of strong momentum, a bearish trader will need all the help s/he can get to make a bearish trade work under current conditions.

Last year, I looked at how to trade after and between overbought periods. I found that a very valid strategy for trading overbought periods that become extended is to short once the overbought period ends (and then stop out once/if T2108 becomes overbought again). As mentioned in my previous post, I built two tranches of SSO puts on days #2 and #3 of the overbought period and decided to just sit on them. In parallel, I was holding VXX shares and puts. I sold the puts today for less profit than I had hoped (I tweeted the trade using the #120trade hashtag). If the market is still motoring higher come Monday (January 14th), I will dump the VXX shares.

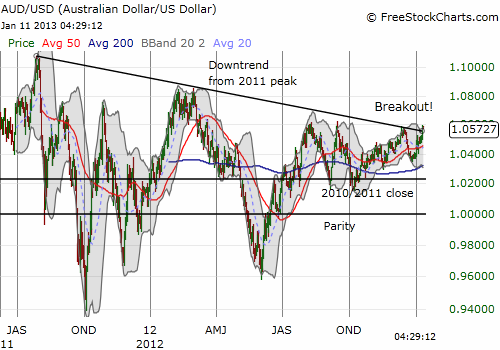

In the previous T2108 Update, I noted several points of technical tension. One got resolved: the Australian dollar has finally broken its downtrend versus the U.S. dollar. This is a bullish sign given the overall tendency of the Australian dollar and the S&P 500 to trade in the same direction. I hope to soon dedicate a post to re-examining and updating this relationship. Note that this one signal does NOT turn the overbought period into a buying opportunity. Instead, it increases the likelihood that the next bout of selling in the stock market will be a buying (short-covering) opportunity before a likely subsequent fresh run-up.

Note that I have not yet stopped out my latest short on the Australian dollar. I am looking for follow-through first. Otherwise, I will be clamoring to get out on the next dip!

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long VXX shares and puts; long SSO puts, long GLD