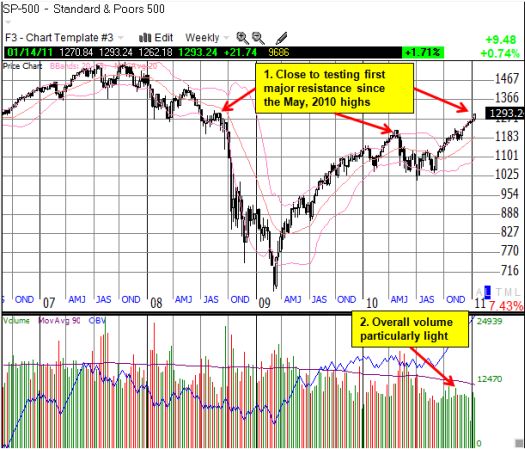

A month ago, I laid out the case for the S&P 500 sustaining its upward momentum. I pointed to 1300-1310 as the next point of strong resistance. As the S&P 500 nears that point (half of a percent away now), I marvel at how quickly this test has come.

T2108, the percentage of stocks trading above their 40-day moving averages (DMAs), continues to surprise me as it stubbornly loiters around the overbought threshold of 70% without making any significant push higher. The S&P 500 has gone nearly straight up for 6 weeks; I would have expected more fireworks from T2108 on such a sustained move higher. This indicates that many stocks are gliding along their uptrends.

Europe turned in the stellar performance of the week. Bond auctions by Portugal and Spain received a strong and positive reception as Spain’s finance minister and vice president Elena Salgado reassured markets that Spanish banks are not reliant on the European Central Bank (ECB) for financing (link includes a video of an informative CNBC interview with Salgado).

When I posted a chart of EWP, the iShares MSCI Spain Index Fund ETF, and a great backgrounder from Planet Money on Spain’s financial pains, I guessed that Spain was about to upset financial markets. I noted how EWP had a terrible 2010 and was on the verge of a fresh breakdown. Unfortunately, I completely neglected to even consider what could happen if market sentiment turned on the results of these recent bond auctions. Needless to say, this was a stellar contrarian opportunity gone to waste (for me). EWP surged 14% in just three days and laid waste to bearish positions (like mine!).

*All above charts created using TeleChart:

The euro also recovered quickly and strongly this week from a critical technical breakdown below its 200DMA. I was a little smarter here, getting out of the way by closing out my EUR/USD short. However, I remain net short the euro. If the euro continues to advance from here (above its 50DMA), I will eventually have to switch to a net long position on the assumption that the markets are embarking on another “giddy phase” where it pretends all is well again in euroland. (Note well that despite the dollar’s weakness this week, gold and silver lost ground – so gold and silver priced in euros had a big plunge this week!)

Source: dailyfx.com charts

For good measure, the number 3 guy at the IMF appears to remain skeptical as Bloomberg reports:

“‘At least for now it looks like the spillover from the European sovereign crisis to areas outside of the region will be limited,’ Naoyuki Shinohara, deputy managing director at the IMF, said in an interview in Tokyo yesterday. “However, if the European sovereign-debt problems were to become bigger, we need to keep in mind that that could bring about considerable downside risks.

The extra yields investors demand to hold Greek and Irish bonds rather than German bunds ‘still remain very high, despite the rescue packages,’ Shinohara said.

‘That means skepticism over the sustainability of their debt in the market hasn’t been cleared away…It’s important that countries reduce their budget deficit, but they also need to tackle structural issues including boosting growth and lowering unemployment.'”

Talk about truisms and understatements! I particularly like Shinohara’s recommended solution…so much easier said than done. Then again, maybe the IMF is just keeping an eye out for its next projects.

Be careful out there!

Full disclosure: long EWP put, net short euro, long GG