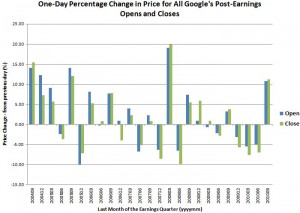

Three and a half years ago, I concluded that options for Google (GOOG) should be sold, not bought, ahead of earnings. This advice seemed to generally apply ever since as GOOG tended to move just enough after earnings to devalue near-the-money calls AND puts.

Friday’s 11% post-earnings pop was a rare, and impressive, exception to the rule. This was the fifth largest move – positive or negative – ever, and the largest post-earnings move since a record open of 19% on April 18, 2008 (GOOG closed up 20% that day).

(Click image for a larger view)

Source: Google earnings reports

I am sure a lot of folks joined me in drowning themselves with a barrel full of hindsight for not taking a flyer on the October 580 or 590 calls. Just to antagonize my second-guessing, I casually reviewed the options action to see how much money could have been made on those calls (the answer = “a lot”).

Much to my surprise, I noticed a massive amount of put volume on the Oct 590s: something like 20,000 puts had traded versus 116 open interest within the first 30 minutes or so of trading. These options would expire at the end of the day. Given the stock was slowly dripping downward, I interpreted this action to mean traders were eagerly anticipating a strong post-earnings fade. (Note that open interest was so small because before earnings, these puts were worth about $6000 each – an extremely inefficient way to place a negative bet ahead of Google’s earnings.) So, in I went to join the bandwagon.

For all of 30 minutes or so this looked like a great move as GOOG continued to drift ever so slightly downward. After that, the stock bottomed on its way to close ABOVE the $600 pin to $601.45.

A friend of mine sent me a snapshot of the options action at 2pm Eastern. Only then did it dawn on me what was more likely happening with the options volume. In my haste, I completely missed the even more massive volume trading on the 600 calls, some 40,000 by 2pm Eastern. This evidence suggested to me that the bias was actually toward the long side, with the put volume likely representing put-sellers speculating that GOOG would go no lower than $590.

(Click image for a larger view – ignore the time stamp on the chart: the actual time was 2pm Eastern)

Source: Yahoo!Finance GOOG options

Traders who bought Oct 600 calls at the open lost money as well as the put buyers of Oct 590s. The calls opened at $340, got as high as $590, and dropped as low as 20 cents before beginning the slow and steady ascent for the rest of the day to close around $1.40.

So, in this rare case, selling options AFTER earnings, not before, was the big winner. Of course, for anyone getting over-aggressive with selling options before earnings, Friday’s rare event could have been sufficient to wipe out the earnings from many quarters of post-earnings action (I personally would never sell naked calls and mainly stick with selling spreads which tightly cap potential losses).

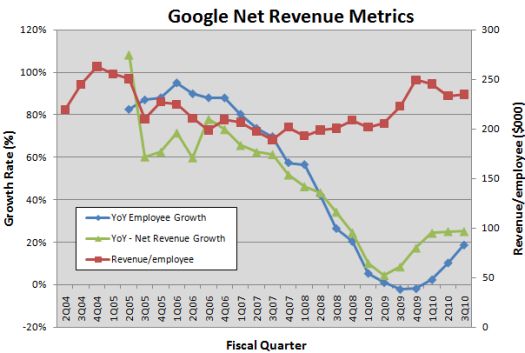

In related news, Google is hiring again. This is positive news for the economy-at-large. The pace of hiring this year has steadily accelerated. The impact has been to cap revenue per employee as revenue growth has not kept pace with the growth in workers. This hiring is the longest stretch of year-over-year growth since Google’s first year as a public company.

Source: Google earnings reports

(Click here for a collection of additional posts on Google technicals and earnings).

Be careful out there!

Full disclosure: no positions