As expected, First Solar’s earnings last week did not print any big surprises. Read a brief summary provided by earth2tech or flip through the earnings presentation for more details. The mixed results provided no clear trading catalyst, putting key technical levels in play that I was looking to trade. Support at the 200-day moving average held, and First Solar (FSLR) delivered a near picture perfect bounce on Wednesday. Buying volume even showed up. In keeping with the strategy discussed earlier (puts on indices, bullish post-earnings bias for individual stocks, mainly calls), I unloaded the post-earnings position into the rally.

Even if FSLR quickly recoups its post-earnings losses, I think it will be capped by its longer-term pattern of lower highs until some good catalyst provides the necessary momentum. A continuation of the market rally could provide that catalyst given FSLR is a member of the S&P 500 index. Otherwise, the stock will likely continue to drift around in trading limbo from one key technical level to the next.

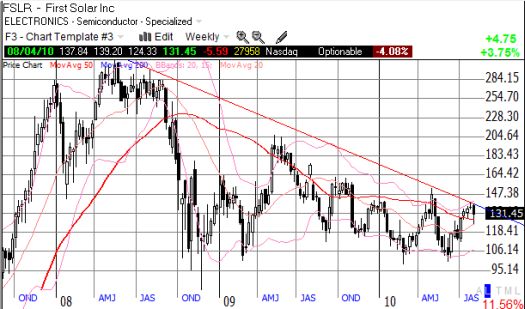

The chart below summarizes the mechanics of the bounce. The downward sloping line cutting across the July top is from a longer-term downtrend line that I make more clear in the second chart. The longer-term chart still looks like a wedge/triangle forming in slow-motion).

*All charts created using TeleChart:

Be careful out there!

Full disclosure: long SSO puts