First Solar (FSLR) reports earnings this evening. Unlike the last two rounds, I have no strong feelings about the potential upward or downward moves this time around. I went neutral on FSLR after closing out positions on the great post-earnings pop in April, and I have not done much else since then with the stock (I did play the bounce from the recent lows, but cashed out well ahead of current levels).

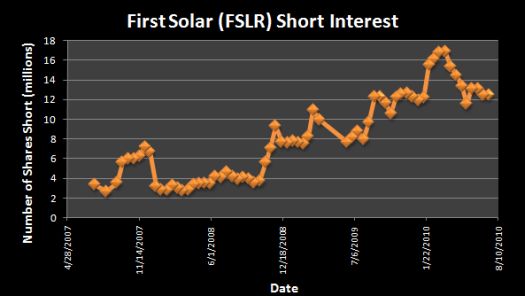

There has been little in the way of market-moving news, and I suspect tonight’s earnings will not contain any surprises. I am interested to know whether the rally in the euro has helped FSLR’s earnings and whether they start baking in a stronger currency into guidance. Other than that, I will continue to keep an eye on the technicals. FSLR has had a very strong rally since the June lows and has had a strong July although it has stalled out ahead of earnings. I do not like the anemic buying volume during the July rally. Shorts have also pulled back ahead of earnings lowering somewhat the potential for a squeeze. So, I am not motivated to risk buying ahead of earnings. (I post charts for stock price and short interest below).

I would not short FSLR ahead of earnings because the downside potential is not quite large enough to warrant the risk (7% down to likely support at the 200-day moving average). And, again, I am not anticipating potential for a strong, negative surprise from earnings.

Not even the valuation provides a strong reason to trade: FSLR is not particularly cheap or expensive at trailing and forward P/Es around 17.

(Chart captured after 90 minutes or so of trading)

(Source: Nasdaq.com, short interest)

*All charts created using TeleChart:

Instead of taking on pre-earnings risk this time around, playing the volatility after earnings seems much more attractive. I am expecting some large moves off or to key technical levels once trading commences.

Be careful out there!

Full disclosure: no positions