Soon after Google’s earnings I bought a November 570/580 call spread given that the year-over-year revenue growth rate finally seems to be turning around and revenue per employee looks ready to trend upward as well. I am finally getting around to explaining the move (as I promised to do) now that GOOG has reversed all its post-earnings gains.

I have long been interested in the behavior of trading in GOOG directly before and after earnings. In particular, I have looked at the impact these moves have on GOOG’s options. In early 2007, I concluded that, on balance, it is better to be a seller of GOOG options than a buyer before earnings. Since then, only 2 out of 11 earnings cycles have provided options buyers – who happened to be on the correct side of the price movement – good profit-making opportunities. Given this challenge, I decided to expand an analysis I did in late 2006 on the timing of GOOG’s minimum and maximum price moves between earnings. I tried to find consistent patterns in the data that would generate a rule for how to trade GOOG after earnings given the initial reaction to the earnings announcement. I was quite disappointed to find little consistency in GOOG’s post-earnings trading. (For one of many comparisons, click here for a review of exotic options trades ahead of GOOG earnings.)

The most interesting relationship I found is that 67% of the time when GOOG opens up in reaction to earnings, the maximum price appreciation from that opening price exceeds 10% by the close of trading before GOOG announces its next earnings. (GOOG has had 21 earnings cycles since its IPO in 2004). These are the odds I chose to play after GOOG opened up around 3.5% – with the additional strong assumption I could get the bulk of the expected 10%+ move within a month.

At the time of purchase, the call spread cost $2.80 (not including commissions). GOOG’s stock price was $550, so I needed GOOG to increase by at least 5.5% in a month to realize the maximum profit of $7.20 and a return of 257% – a very good risk/reward considering my read on earnings. I chose a call spread because I still considered the odds to be high for a major correction by the end of October. My plan was to close the short side of the spread if the market got to some oversold condition. That point was reached on Friday after the market sold off again after an oversold bounce. The total loss stood at $1.95 whereas the loss for buying the Nov 570 call alone would have been $6.88.

At that point, GOOG had completely reversed its post-earnings gain. The risk of a sell-off compelled me to choose the call spread, and it happened to work out. I covered the short side of the spread (the price of the Nov 580 call fell from $6.48 to $1.55!), and I am now fully exposed to whatever upside GOOG may still have in the next two weeks. This position comes at a much cheaper cost than if I had purchased calls outright. Of course, if GOOG continues to fall from here, I will end up paying a slightly higher overall price given I covered the short position above zero. I will also lose some of my gains if I hold until expiration and GOOG closes above $580 by then (very unlikely at this point!).

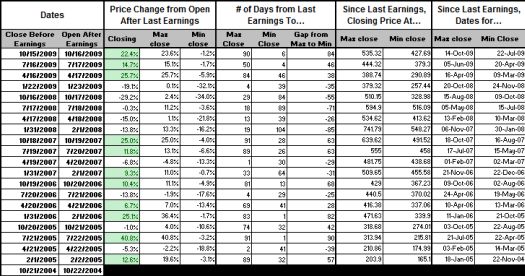

To think through the GOOG post-earnings play, I tried multiple ways of uncovering simple relationships based on information available once earnings are known and the market has reacted. For completeness, I have posted below my raw data and the set of relationships I examined.

Finally, here is a raw list of relationships that I discovered manipulating this data. I also tried to see whether taking into account NASDAQ price levels made a difference (it did not).

CORRELATIONS

0.13 – Correlation of the post-earnings one-day price change to the price change from the post-earnings close to the close the day before the next earnings

0.19 – Correlation of the post-earnings one-day price change to the maximum price change from the post-earnings close to the close the day before the next earnings

0.25 – Correlation of the post-earnings one-day price change to the minimum price change from the post-earnings close to the close the day before the next earnings

CONDITIONAL OCCURRENECES

50% – If GOOG opens up post-earnings, % of times it is higher by next earnings

38% – If GOOG opens down, % of times it is lower by next earnings

60% – % of times the maximum close between earnings is at least 10% above post-earnings open

45% – % of times the minimum close between earnings is at least 10% below post-earnings open

67% – % of times the maximum close between earnings is at least 10% above post-earnings open when GOOG opens up

50% – % of times the minimum close between earnings is at least 10% below post-earnings open when GOOG opens down

50% – If GOOG opens up post-earnings and NASDAQ is up since last GOOG earnings, % of times GOOG is higher by next earnings (only two earnings cycles qualified, excluding October)

67% – If GOOG opens down post-earnings and NASDAQ is down since last GOOG earnings, % of times GOOG is lower by next earnings (only three earnings cycles qualified)

-0.15 – Correlation between NASDAQ price change since last GOOG earnings to the GOOG opening post-earnings price change

0.19 – Correlation between NASDAQ price change since last GOOG earnings to the GOOG opening post-earnings price change for the next earnings

NASDAQ/GOOG ratio

0.22 – Correlation of price change between earnings and one-day earnings change

-0.20 – Correlation of maximum price change after earnings to one-day earnings change

-0.21 – Correlation of minimum price change after earnings to one-day earnings change

63% – If ratio opens up after earnings, % of times GOOG is higher by next earnings

50% – If ratio opens down after earnings, % of times GOOG is lower by next earnings

Be careful out there!

Full disclosure: long GOOG calls

Great analysis! Really deep, & enjoyed reading.

From my experience option vol collapsing post-earnings is universal. In bull markets or bear, that does not change. I don’t trade options for clients but know that over time, into most earnings reports its better to sell straddles (or other “explosive” combos) than to buy them.

Thanks, Buck! Of course, the biggest problems for selling straddles (options in general) are margin requirements and accounting for the outlier risk that could generate the occasional, extremely large loss.