(This is an excerpt from an article I originally published on Seeking Alpha on January 31, 2012. Click here to read the entire piece.)

{snip}

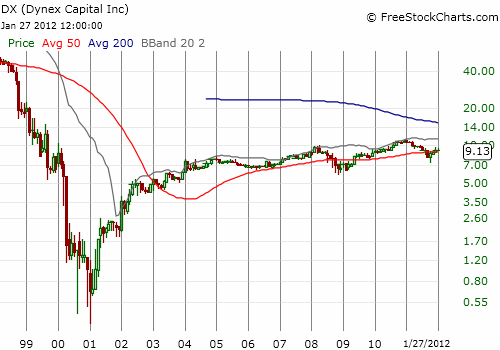

Dynex Capital (DX) is one of several companies in the business of buying mortgage-backed securities. Specifically:

{snip}

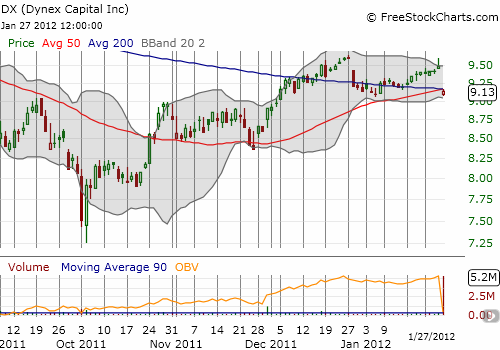

Dynex Capital (DX) came to my attention because on Friday the company raised more equity capital by pricing a 12.5M offering of stock at $114M (or about $9.12/share). This represented a small 3.8% discount from Thursday’s close. Given the tremendous surge in trading volume to 5.2M shares, it seems that the market welcomed the increase in liquidity in the company.

{snip}

A yield of 11.8% makes Dynex worth the wait. I bought a first tranche of stock on Friday just in case I do not get an opportunity to buy a lot more at even lower prices (yes, I am kicking myself for missing this one in last year’s sell-off). The dividend was last raised December 8, 2011 from $0.27 to $0.28 per share with the following statement:

{snip}

The ultimate clincher for me with Dynex is that company executives loaded up on stock last year. Chairman and CEO Thomas Bruce Atkins purchased 81,088 shares for a total value slightly over $700,000. Executive Vice President and Chief Investment Officer Byron L. Boston purchased a much smaller stash of 2,297 shares for a total value of $19,000. {snip}

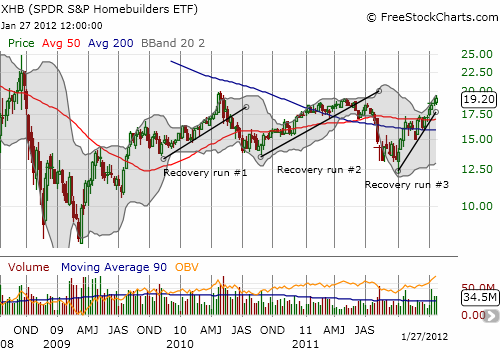

The biggest concern with moving into housing-related stocks at this point is that the stocks representing this industry have run so far, so fast in the past few months. In fact, we have been here before, twice.{snip}

Source for all charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 31, 2012. Click here to read the entire piece.)

Full disclosure: long DX, KBH