Stock Market Commentary

After weeks of persistent selling, the stock market finally delivered bear market relief, with all major indices posting solid gains to end the week. Market breadth notably improved, signaling a shift in buying power that could indicate the start of a sustainable low. Note well that a sustainable low is NOT the same thing as a bottom; we only recognize bottoms in retrospect and after a substantial amount of time. For example, in bear markets, oversold conditions can repeat multiple times before a true bottom forms.

While Friday’s action is encouraging, overall bearish trends remain intact, and volatility remains elevated. The resolution of the U.S.’s latest self-inflicted budget crisis looked like a catalyst for Friday’s action, but I think the technicals were far more important. Looming over the technicals is the Federal Reserve’s meeting on Wednesday which could tip the scales for the next major market moves.

The Stock Market Indices

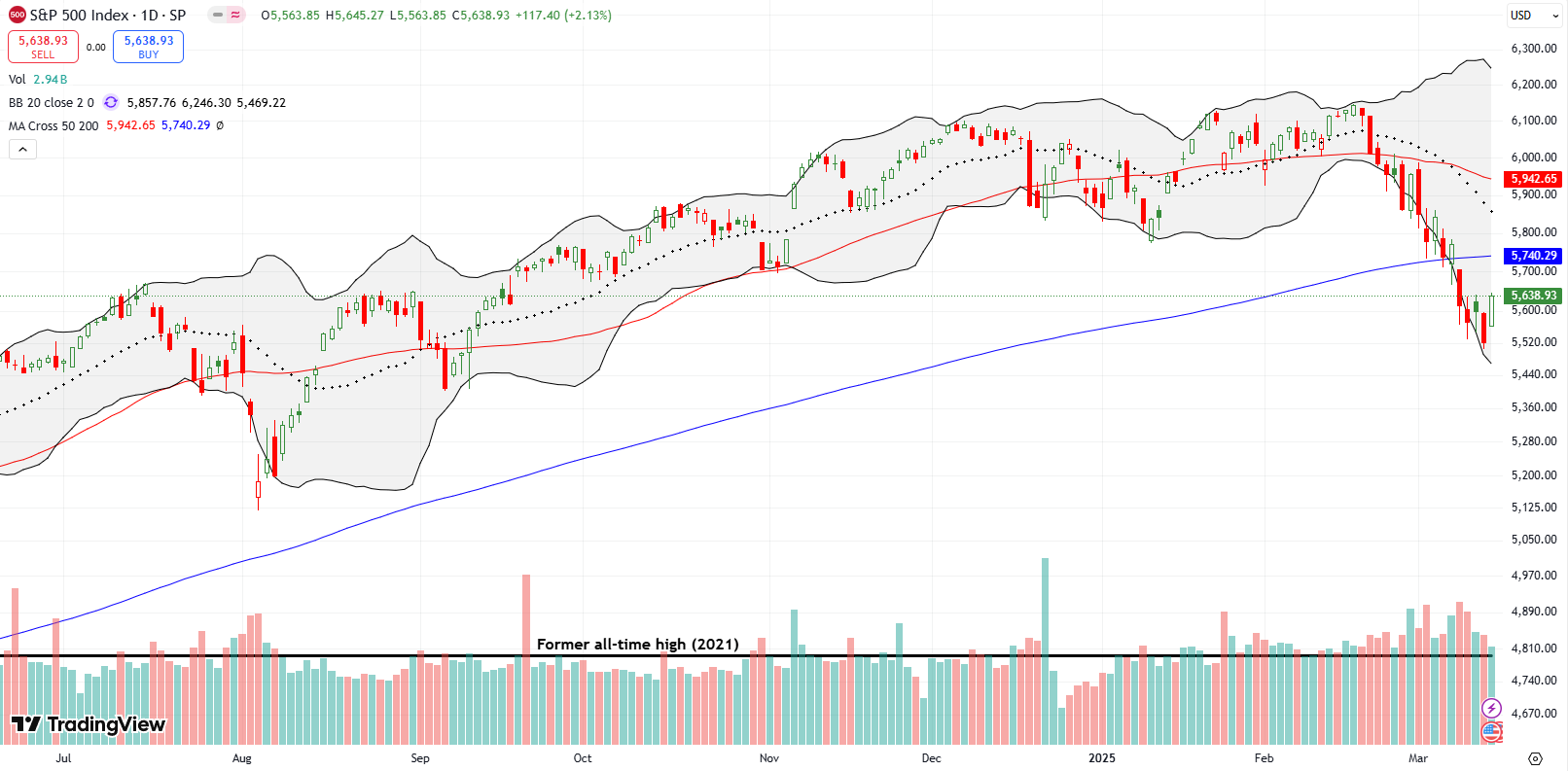

The S&P 500 (SPY) gained 2.1%, marking a strong rebound from recent lows. Despite this relief, the index remains in a clear downtrend, alternating between large down days and temporary rebounds. If this pattern continues, short-term traders may look to buy weakness for quick flips. A continued bear market would feature the reverse with short-term traders continuing to fade every rally.

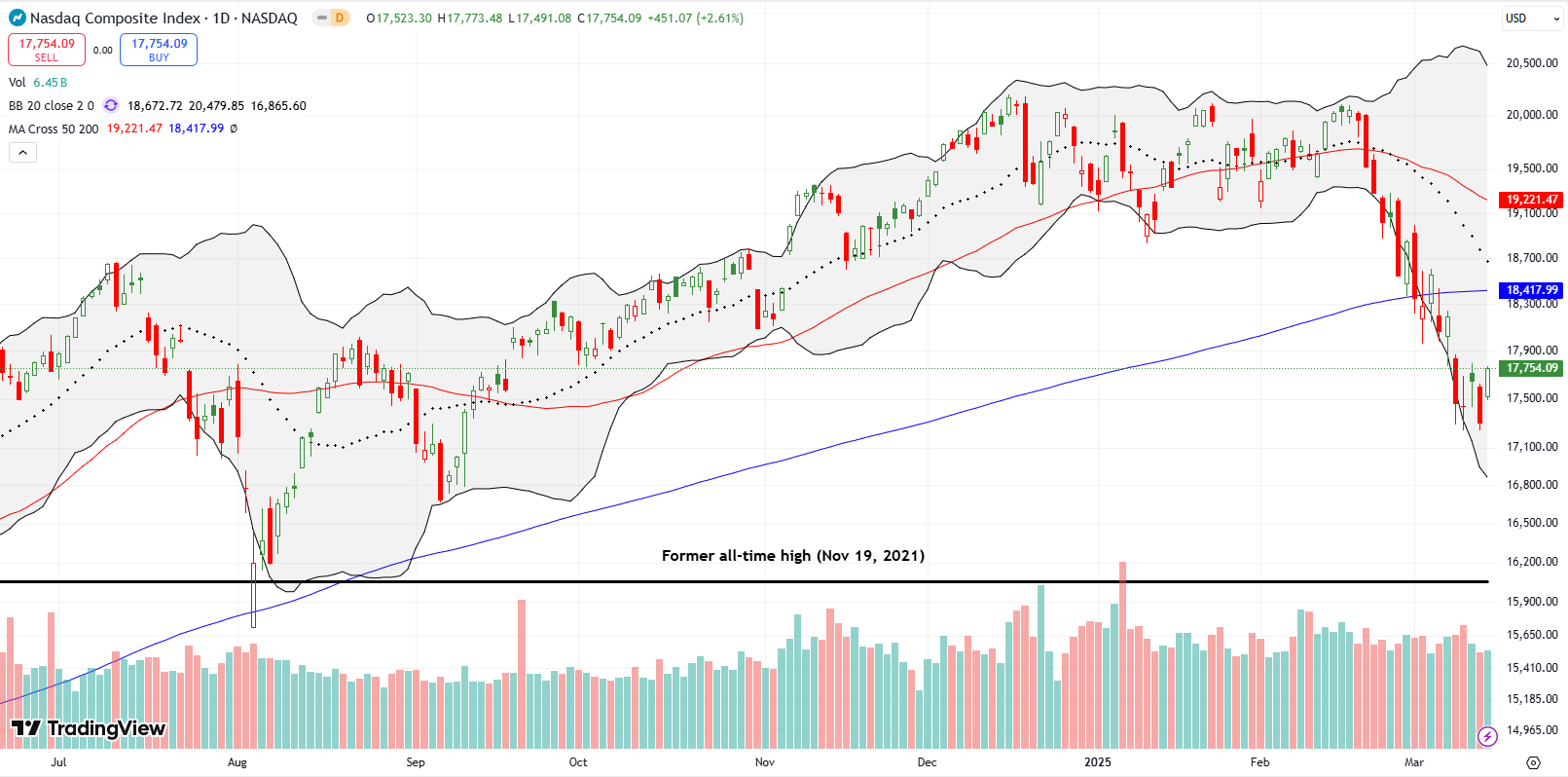

The NASDAQ (QQQ) rose 2.6%, recovering from recent selling pressure but still well below its 200-day moving average (DMA) (the blue line). The tech-laden index remains in deep bearish territory, with price action reflecting a volatile mix of false rallies and continued selling pressure. Like the S&P 500, the NASDAQ gained enough on Friday to make the week look like churn.

The iShares Russell 2000 ETF (IWM) gained 2.4%. While IWM is the index closest to an official bear market (20% off the all-time high), continued rally could push the ETF toward downtrending resistance from its 20DMA (the dotted line). I bought a weekly call option after the open as a play on the potential for a further advance.

The Short-Term Trading Call With Bear Market Relief

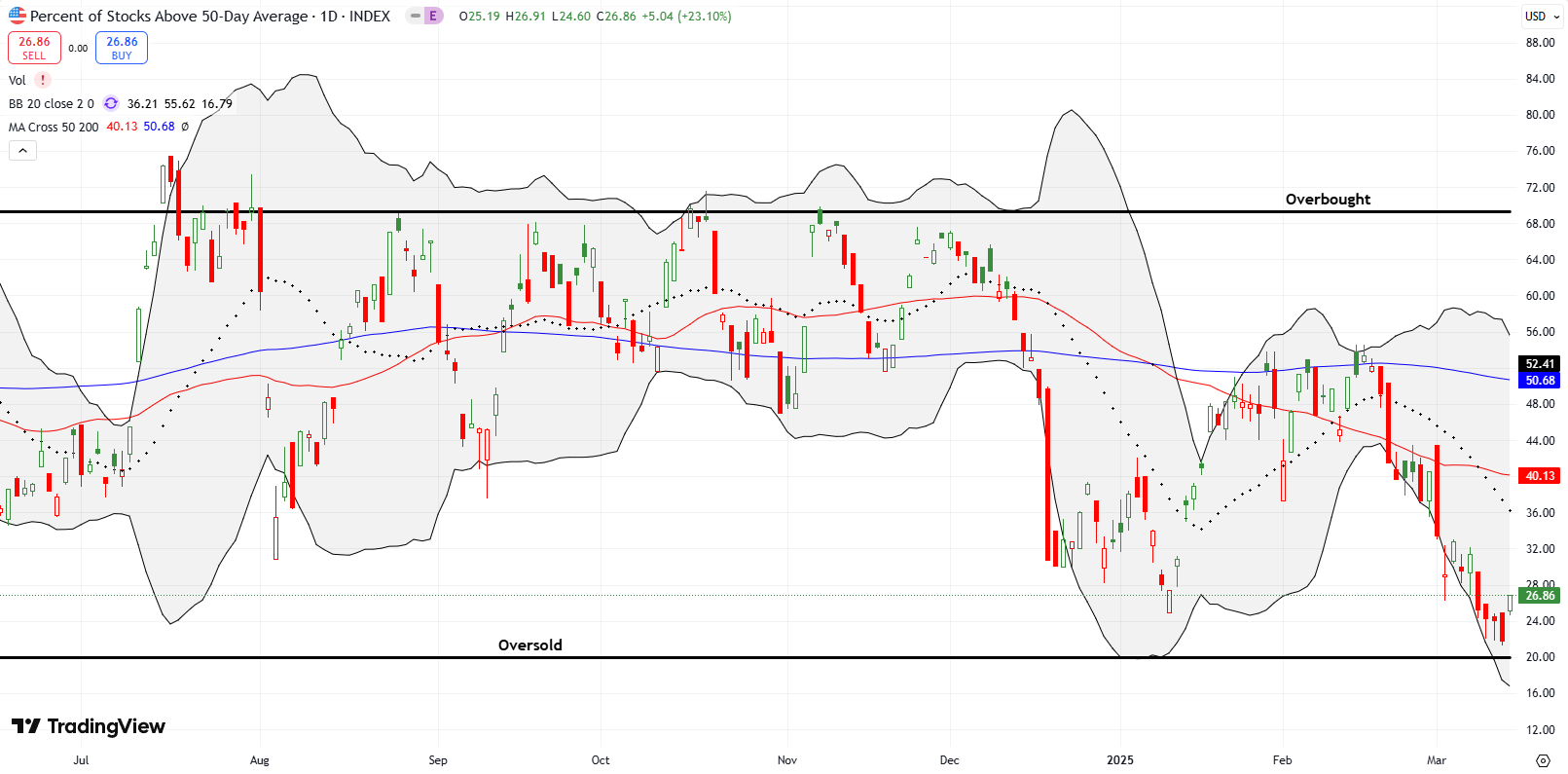

- AT50 (MMFI) = 26.9% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 37.5% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, climbed 5 percentage points to 26.9%, reflecting broad participation in the rebound. This strength signals a potential shift in sentiment. The Federal Reserve could squelch this budding momentum or further encourage it. AT200 (MMTH), the percentage of stocks trading above their respective 200DMAs, displayed even stronger and more convincing improvement for this bear market relief, rising nearly 5 percentage points to 37.5%. This move cleared the highs of the past three days, reinforcing the strength of the rally.

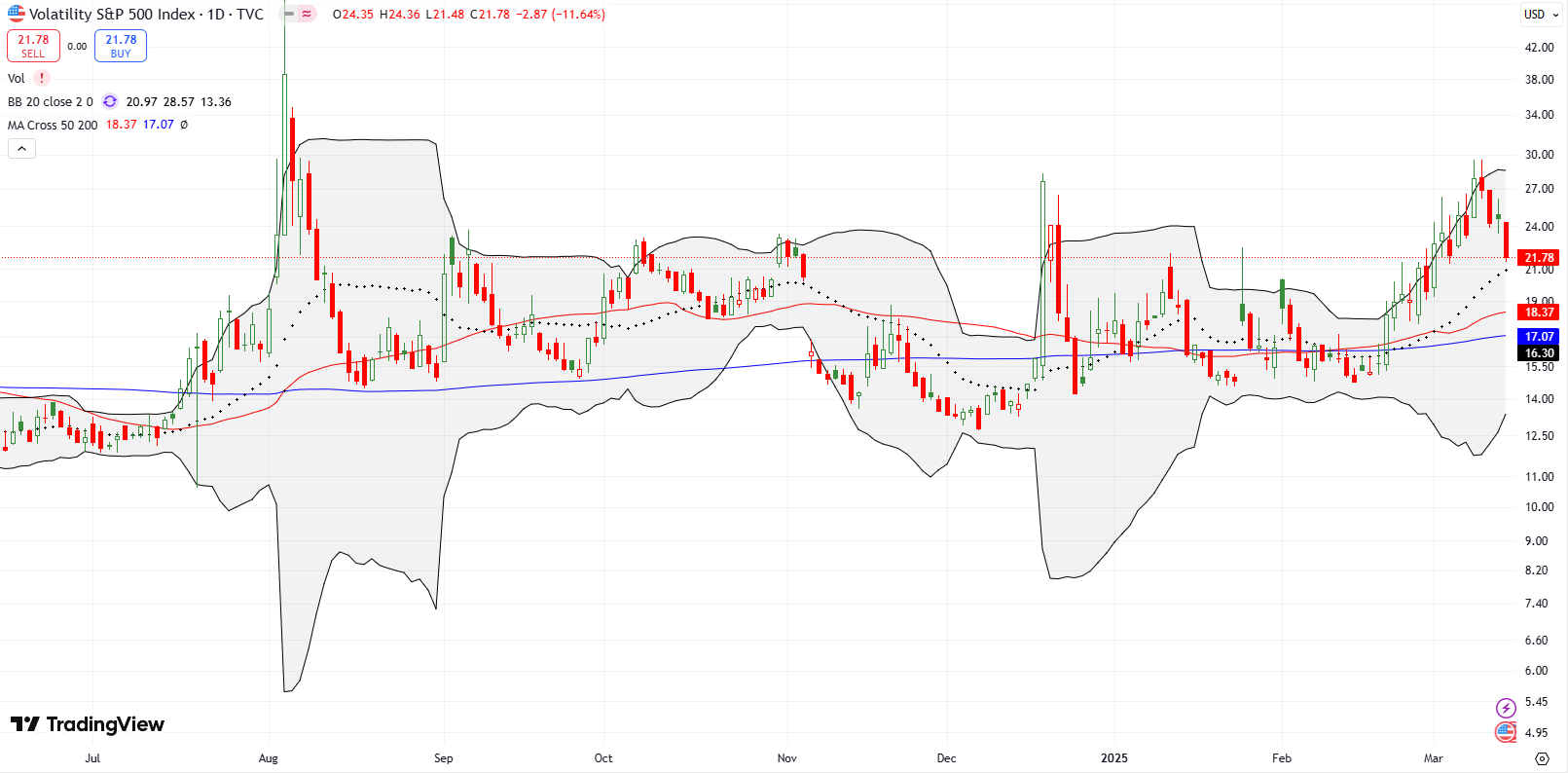

The volatility Index (VIX) continued to decline, adding more support to the bear market relief. Still, the lack of a sharp collapse in VIX leaves me wary and unable to aggressively trigger the AT50 trading rules. The VIX remains elevated. If the downtrend in volatility holds, confidence in a more stable market environment should increase.

The Equities: In Bear Market Relief

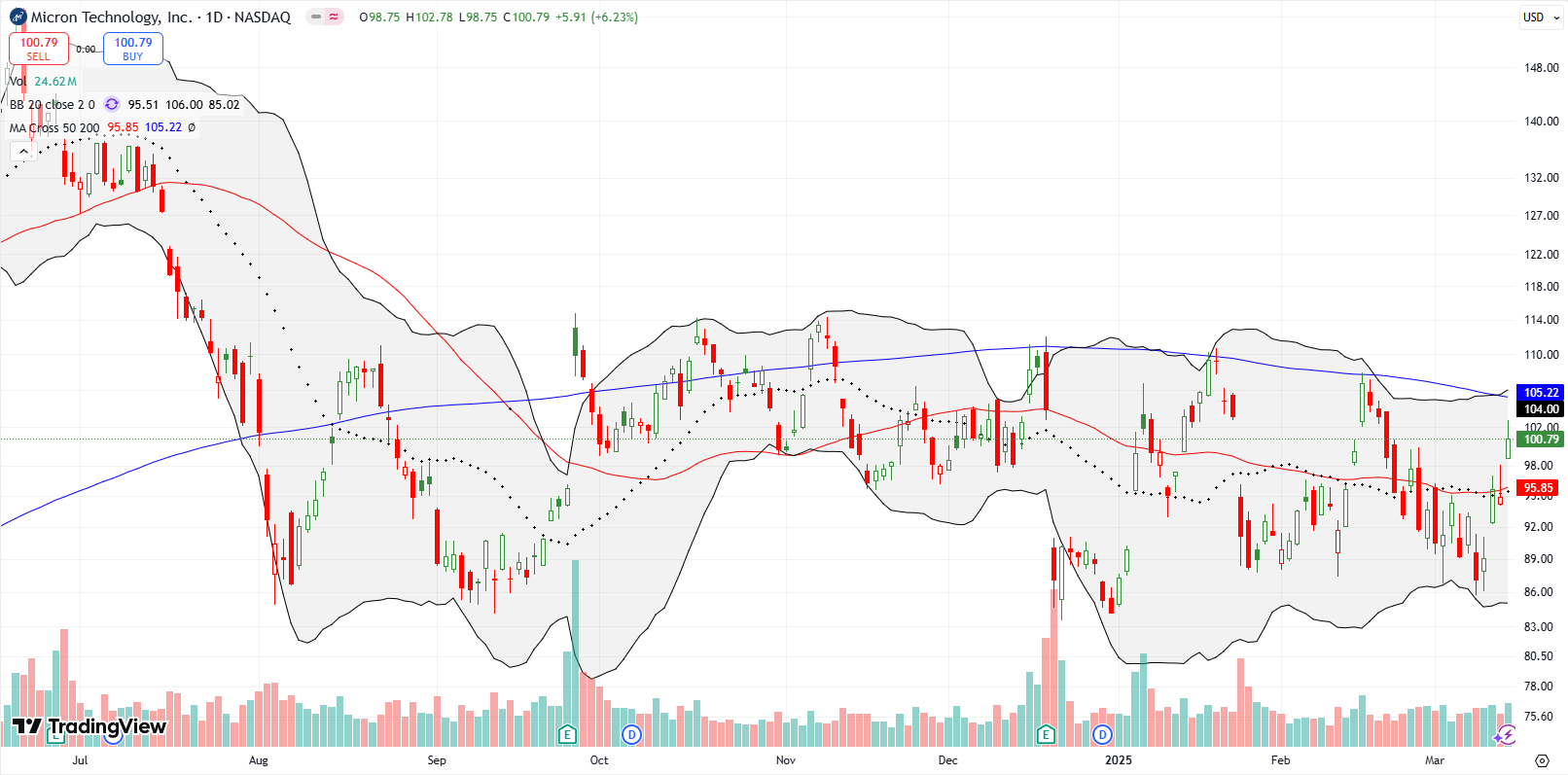

Micron Technology (MU) has earnings approaching and is showing relative strength compared to the broader market, especially tech stocks. MU remains stuck in an extended trading range, with its 200DMA acting as relatively consistent resistance. If earnings push MU above its 200DMA, I will look to buy the breakout. Note that previous false breakouts above the 200DMA wave a flag of caution.

Hershey (HSY) provided a defensive safe haven that I enjoyed as a shareholder but failed to understand. The rotation flipped against HSY as buyers migrated back to the rest of the market. As a result, HSY suffered heavy losses and left behind a potential topping pattern with an “evening star” where a sharp fade from an intraday high is followed by a significant day of selling. This topping pattern is particularly ominous given the resulting fake 200DMA breakout. While HSY may stabilize, its recent reversal aligns with broader market improvements, hinting at a shift in investor sentiment.

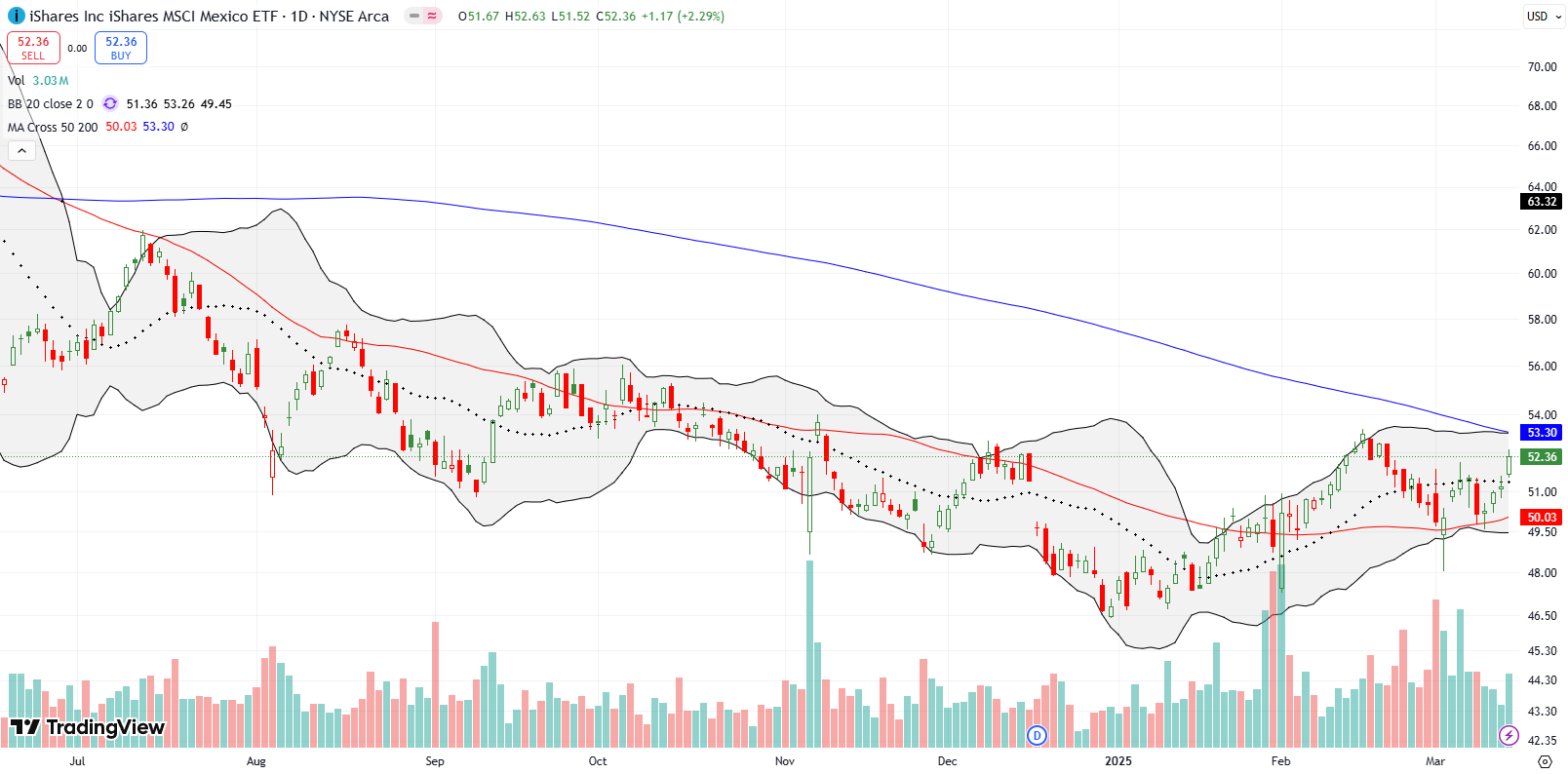

The iShares Mexico ETF (EWW) displayed surprising resilience in the middle of ongoing tariff concerns. The ETF bottomed on Tuesday witha successful test of 50DMA support and proceeded to rally for the rest of the week. Although EWW has yet to break above its 200DMA, price action suggests a potential bearish to bullish reversal. I tried to buy some EWW on Friday, but my bid was too conservative. I will try again Monday.

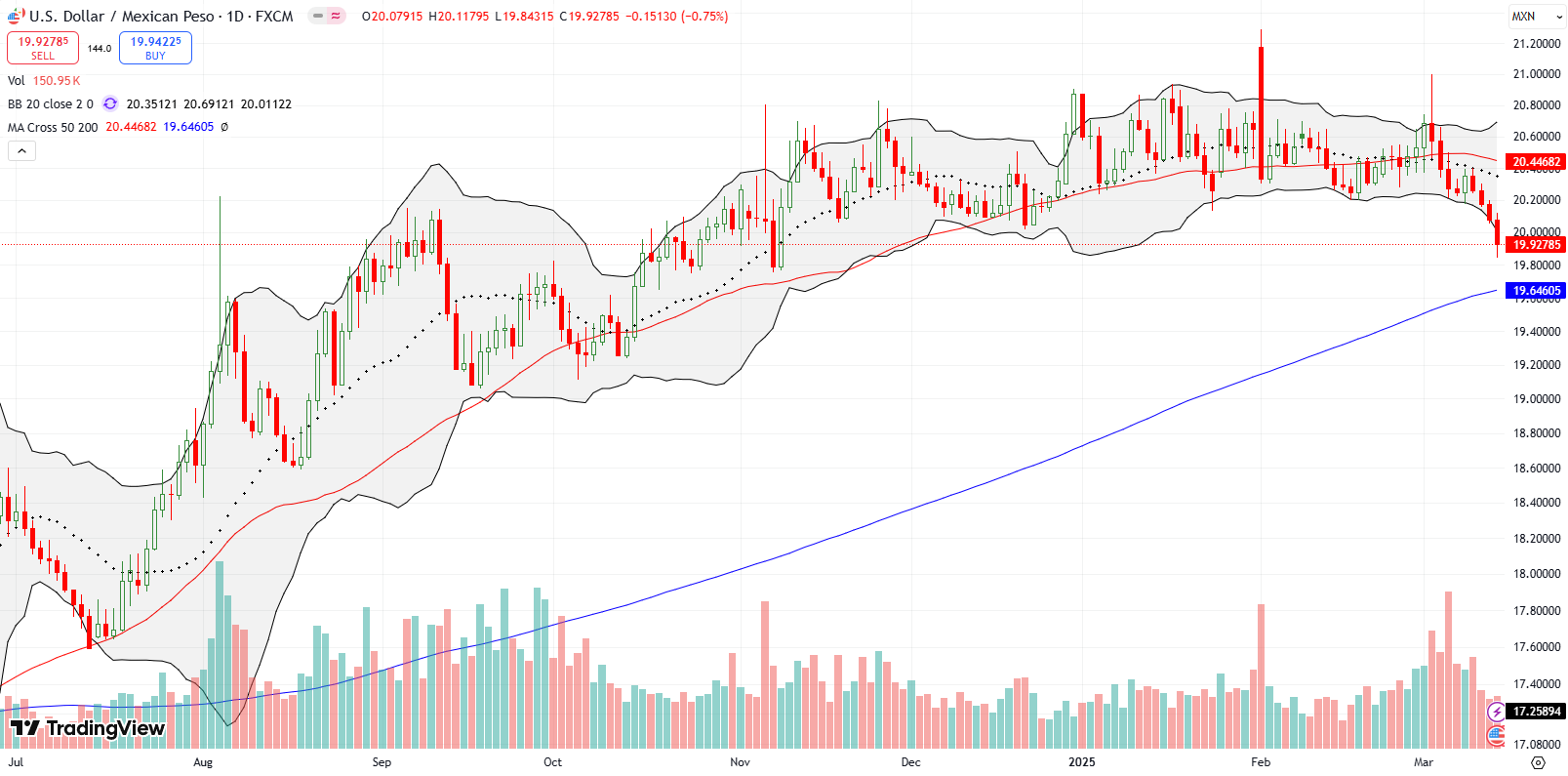

The Mexican peso (USD/MXN) has strengthened throughout March, confirming improving sentiment toward Mexico-related trades. USD/MXN even looks like it is slowly printing a rounded top. The case I made a week ago for a pairs trade long the peso and short the Canadian dollar is already working out.

The SPDR EURO STOXX 50 ETF (FEZ) continues to outperform the U.S. market, reflecting a strong European market backdrop. While the U.S. market struggles with self-inflicted economic issues, FEZ has maintained an uptrend since the start of the year. The latest “excitement” in Europe has come from the prospect of increased defense spending, and Germany’s apparent desire to open the spigot on fiscal spending. This European ETF is now on my watchlist for diversification beyond U.S.-centric holdings.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #313 over 20% (overperiod), Day #5 under 30% (underperiod), Day #10 under 40%, Day #22 under 50%, Day #49 under 60%, Day #150 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM call, short USD/MXN, long HSY shares and short a call option, long VXX put options

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

* Blog notes: this blog was written based on the heavily edited transcript of the following video that includes a live review of the stock charts featured in this post. I used ChatGPT to process the transcript.