(This is an excerpt from an article I originally published on Seeking Alpha on November 13, 2014. Click here to read the entire piece.)

On November 13th (in the morning in Australia), Christopher Kent, an Assistant Governor at the Reserve Bank of Australia (RBA), delivered a speech discussing business cycles in Australia. The big news from this speech is what he said afterward (presumably during Q&A). From the Sydney Morning Herald:

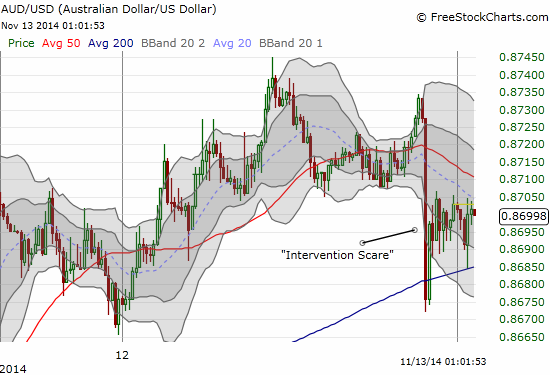

“RBA assistant governor Christopher Kent may have scared a few traders by not ruling out an intervention to bring down the dollar, but few see it happening anytime soon.”

The reaction to Kent’s tease was sharp but relatively shallow all things considered for the Australian dollar (FXA)…

Source: FreeStockCharts.com

Kent’s tease resonates given what his boss, Governor Glenn Stevens, said on August 20, 2014 in the Q&A period of his presentation of the Reserve Bank of Australia Annual Report 2013 at Australia’s House of Representatives Standing Committee on Economics.

The Chair of the committee asked the following question regarding currency intervention: “What would it take for the bank to intervene in FX markets to get the Australian dollar to move lower? In the past we have had submissions about jawboning, but what about taking other measures?”

{snip}

Be careful out there!

Full disclosure: net long Australian dollar (short versus the U.S. dollar)

(This is an excerpt from an article I originally published on Seeking Alpha on November 13, 2014. Click here to read the entire piece.)