(This is an excerpt from an article I originally published on Seeking Alpha on Feb 24, 2013. Click here to read the entire piece.)

{snip}

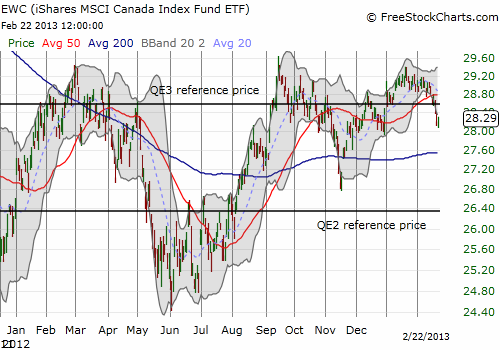

Source: FreeStockCharts.com

{snip}

In 2012, the yield curve for Canadian government bonds flashed a major warning signal. In particular, the gap between 2-year and 5-year bond yields fell dramatically from March to May following a more steady decline in 2011 (note the coinciding peak in EWC in April, 2012). {snip}

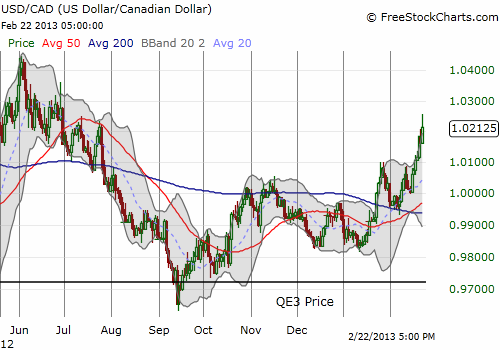

Source: FreeStockCharts.com

{snip}

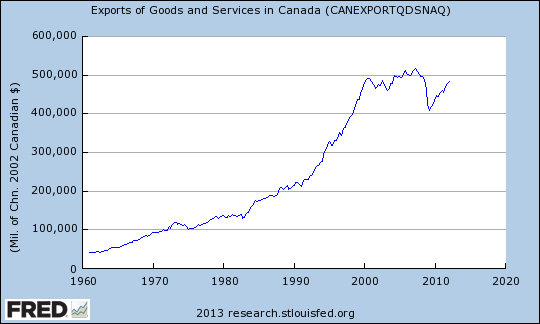

The case for a weaker Canadian dollar is demonstrated in Canada’s poor export performance ever since the U.S. dollar began its secular decline in 2000. {snip}

Source: St. Louis Federal Reserve

Source: DailyFX.com charts

I focus here on exports because the Canadian economy is so heavily dependent on exporting goods and services to the U.S. {snip}

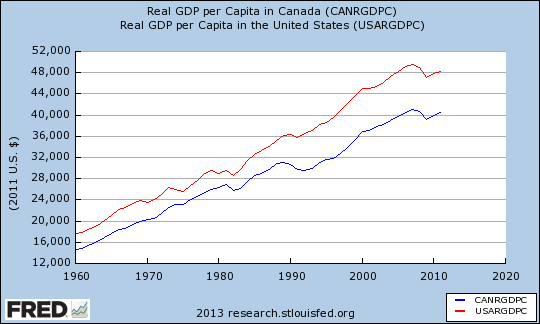

Source: St. Louis Federal Reserve

With such tight linkages, the exchange rate between the U.S. dollar and the Canadian dollar becomes an important arbiter of relative success of the two economies. It seems the time has finally come for the Canadian dollar to weaken, perhaps substantially from current levels. The performance of the U.S. economy is of course a main wildcard.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on Feb 24, 2013. Click here to read the entire piece.)

Full disclosure: short USD/CAD