Credit Suisse downgraded Peloton Interactive (PTON) from outperform to neutral. The analyst at Credit Suisse also slashed their price target from $112 to $50. Despite a price target higher than the previous day’s closing price of $40.70, PTON still fell 5.4% to $38.51 and a 19-month low. So why did PTON sink on an analyst rating allowing 25% upside?

A price target with 25%+ upside from current prices looks like a buy signal. However, the psychology of a downgrade can weigh heavy right past the price target. This belated bout of pessimism helped remind investors of the downside surprise from earnings. Credit Suisse called out “improving mobility and a return to in-person fitness after a strong 2021.”

More importantly, Credit Suisse warned “Peloton has been increasing advertising and discounting more to fight slowing demand, which change[s] the economic model.” This reported change is damaging because Peloton Interactive’s business has sunk back into negative quarterly operating income after just four quarters of small operating income at the height of the company’s revenues. An increase in spending in the face of slowing demand threatens deepening losses at a time when the stock market is penalizing unprofitable (or expensive) growth. In other words, Credit Suisse conjured up images of on-going downward momentum in the business and thus the stock’s price.

(Note I highly doubt Peloton’s appearance in a fictional, tragic storyline had anything to do with the stock’s decline on the day. If so, THAT reaction is definitely something to fade.).

Potential Analyst Downside To Come

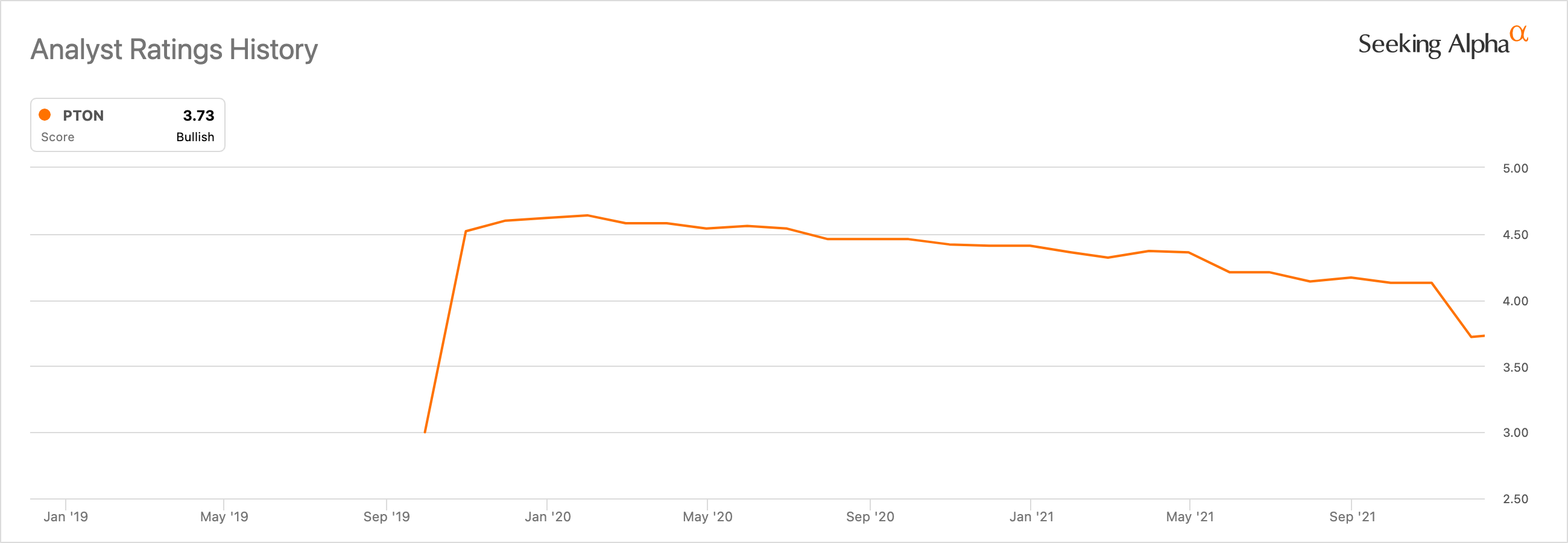

Analysts remain overall bullish on PTON with an average price target of $77.56. Accordingly, there remains plenty of room for bullishness to turn bearish in cascading bouts of analyst capitulation. Credit Suisse signaled this downshift is on-going and could bring lower and lower price targets. In fact, according to Seeking Alpha, analysts slowly backed away from PTON after an initial rush of post-IPO optimism. As a group, analysts were slow to appreciate pandemic-drive tailwinds. The last earnings report accelerated the ratings downtrend as analysts recognize the waning tailwinds.

The Trade

Even with the end of the pandemic-driven tailwinds, PTON is making a lot money. At some point, the company should find a way to return to profitability with a lower run rate. Evidence of such an achievement should signal stabilization and even a bottom in the stock. Peloton clearly recognizes action is necessary. From the Seeking Alpha transcript:

“…we are taking significant corrective actions to improve our profitability outlook, which will impact the back half of fiscal year 2022 and into fiscal year 2023. While it’s important for us to optimize fixed cost across the company, we won’t compromise our Net Promoter Score position in the process. We remain committed to our goal of winning Connected Fitness and our long-term thesis of fitness moving into the home is unchanged.”

For now, the market is in “prove it” mode. FY 2023 feels like an eternity away. Accordingly, the downward price momentum looks headed at least to a complete reversal of PTON’s first pandemic era breakout. (I am also positioned for such a move with a put spread). PTON broke out above $35 just ahead of May, 2020 earnings which drove the stock up 16% and launched an epic uptrend.

Be careful out there!

Full disclosure: long PTON put spread