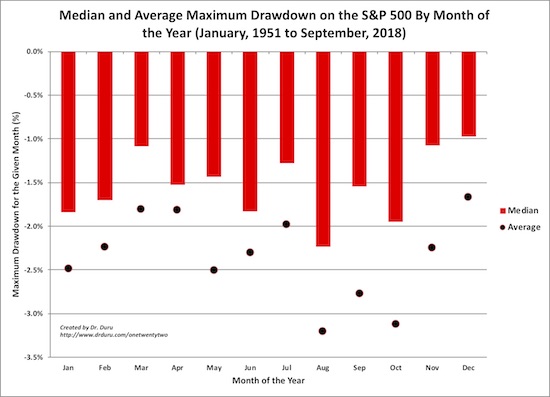

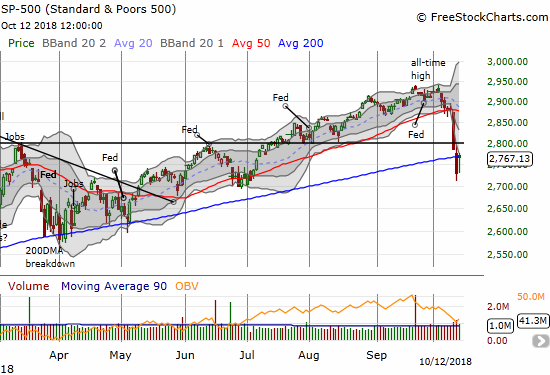

October is the stock market’s second most dangerous month based on average drawdown on the S&P 500 (SPY). This year’s October is living up to the reputation after an October, 2017 that never delivered a close below September’s month-ending price. So far this month the S&P 500 has lost 5.0% with a maximum drawdown of 6.4% on a closing price basis. Since 1951, the average maximum drawdown for October is 3.1% and the median is 1.9%.

Source for data: Yahoo Finance

It is tempting to conclude that this October has likely seen its low since the maximum drawdown has already exceeded the average. However, the historical distribution of outcomes is important. The standard deviation, which covers about 66% of the range of outcomes on either side of the average, is about 5 percentage points. In other words, I want to brace for the potential of a maximum drawdown of 8% or so. That calculation produces a 2681 downside target, or a drop of 3% from Friday’s close.

With an average drawdown of 3.1% and a median of 1.9% there is a slight skew to the right for the historic distribution (a shift to the right from what would otherwise be a symmetrical normal distribution). October experienced two extreme outliers with the October, 1987 crash (maximum drawdown of 30.1%) and the collapse of October, 2008 (maximum drawdown of 27.2%) which skew the distribution and inflate the average. Removing those two points gives an average maximum drawdown of 2.1%, a standard deviation of 2.6%, and a median of 1.9%. With THIS adjustment, suddenly it looks likely October, 2018 has indeed hit its bottom already. So it is all a matter of how much we believe the two big crashes of October figure into the realm of future possibilities.

I am tracking the prospects for a bounce from the lows in my Above the 40 posts. Breadth indicators suggest that market has sold off enough to form a likely bottom, but additional downside risks obviously exist for this month if the market is transitioning from a bullish to a bearish phase.

Be careful out there!

Full disclosure: no positions

This is very interesting. Thanks for your analysis.

How did you go about calculating the median and average drawdowns? Do you have an Excel sheet that you can share?

I’d be curious to see what the average and median (as well as min/max, etc) rolling drawdowns for the SPX are for, say, 25 trading days (~5 weeks), over the past 1, 5, 10, 20, and 50 years. Would your Excel sheet be able to calculate such a thing?

Thank you for your thoughts,

Andrew

Hi Andrew,

I downloaded all the S&P 500 data from Yahoo Finance. I went ahead and posted the spreadsheet I am using here: https://drive.google.com/file/d/1S37_fXr1yuX19Uf9pbQiOCZ8H0ZLHH7T/view?usp=sharing

Here is a key in the sequence you should read the tabs:

1. ^GSPC is the raw data with additional calculated fields that are useful for the additional steps below.

2. Pivot gives me the lowest closing price of each month of the year. Copied over to the MonthMinimum tab.

3. The EndofMonthPrice tab is the result of copying over a pivot where I set the day to max for each given year and month combination

4. The drawdown tab uses 2 and 3 to calculate the drawdown

The other tabs can be ignored. I was playing around with different representations of the data.

I hope this helps!