““As we look ahead, we currently do not anticipate any relief from inflationary cost pressures in the third quarter. We expect aggregate global economic growth to remain positive with end-use market activity comparable to the second quarter, adjusted for traditionally lower seasonal demand. However, uncertainties exist regarding global trade policies, which may create uneven demand by region and in certain industries. Specific to PPG, we expect that the previously announced architectural customer assortment change will lower our third quarter year-over-year sales volume growth rate by between 120 and 150 basis points. We remain confident that our leading-edge technologies and products, which are bringing value to our customers, will facilitate our growth going forward….

Currently the new tariffs are starting to add some modest cost to our raw materials. Based on the strength in the US dollar in the second quarter, we expect foreign currency exchange rates to have an unfavorable impact to our sales in the third quarter”

This was the essence of the guidance industrial paint company PPG Industries (PPG) provided in its 2nd quarter earnings report. I added the emphases because the warnings on inflation and international demand were clear precursors to the company’s pre-earnings warning tonight. The stock traded down about 10% in after market trading in response to significant cuts in revenue and earnings guidance. I was most interested in the explanation which made the second quarter’s caution come to life (emphases mine)…

““In the third quarter, we continued to experience significant raw material and elevating logistics cost inflation, including the effects from higher epoxy resin and increasing oil prices…These inflationary impacts increased during the quarter and, as a result, we experienced the highest level of cost inflation since the cycle began two years ago.

“Also, during the quarter, we saw overall demand in China soften, and we experienced weaker automotive refinish sales as several of our U.S. and European customers are carrying high inventory levels due to lower end-use market demand…Finally, the impact from weakening foreign currencies, primarily in emerging regions, has resulted in a year-over-year decrease in income of about $15 million. This lower demand, coupled with the currency effects, was impactful to our year-over-year earnings and is expected to continue for the balance of the year.”

Instead of moderating, inflationary pressures are mounting on PPG. The weakness in China is telling in the context of the trade war with the U.S. The lower “end-use market demand” points to the trickle-down impact of “peak auto.” These warnings are each important given PPG has a market cap of $26.5B and trailing 12-month revenue of $15.4B. I fully expect other industrial companies to deliver similar news this earnings season.

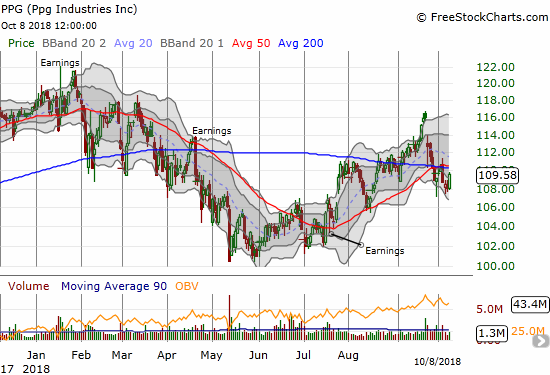

Interestingly, Credit Suisse downgraded the stock in late September and the market responded by taking PPG down 2.8% on relatively high trading volume. The gap down confirmed the end of PPG’s post-earnings run and breakout above 200-day moving average (DMA) resistance. Until the downgrade the stock finally looked ready to challenge its 2018 high.

Source: FreeStockCharts.com

The market is supposed to be a forward-looking mechanism, so it is natural to wonder why PPG was rallying so well in the first place. I do not put all the blame on investors. I assume the company itself was partially responsible through its sizable share repurchase program. For the first half of 2018, PPG spent $1.1B on its own shares: 4.1% of the company’s current market capitalization. With this kind of aggressiveness, PPG should quickly move in on the new 52-week low to add to take out even more shares.

As earnings season unfolds, I will be paying close attention to company commentary on trade woes and inflation. The stock market has spent most of the past several months ignoring risks, so there are a good group of over-priced stocks out there waiting their turn for a douse of realty. Collectively, these warnings could be the catalyst that delivers the oversold market conditions I am anticipating.

Full disclosure: no positions