The trading volatility in Bitcoin (BTC) is delivering a healthy number of extremes. These accumulating extremes are helping me build associations between Bitcoin price action and Google search interest in the cryptocurrency. The latest round of extremes delivered some eye-opening associations which could help traders in the near future.

This week, on January 15th, Bitcoin made a very extreme move by briefly cracking the $10,000 level and completing a 50% and more decline from its all-time high. For about 10 minutes, Bitcoin traded close to the $9300 level before buyers rushed in to send the cryptocurrency quickly over $10,000 again. The abiding catalysts came from fresh news about potential crackdowns from South Korean and China.

Source: Yahoo Finance

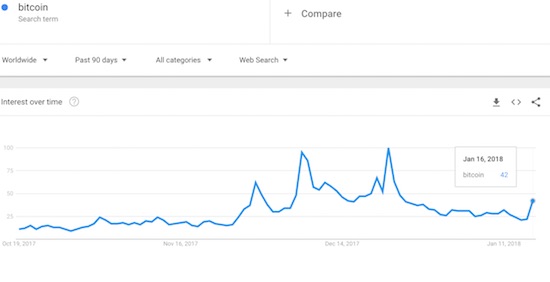

Preceding the most extreme components of Bitcoin’s sell-off were surges in Google searches on “Bitcoin.” In an earlier post, I pointed out how jumps in Google search interest marked off a top and then a bottom in Bitcoin trading action. Search interest in Bitcoin experienced a rapid decline after the December bottom and signaled waning interest in trading. Sure enough, Bitcoin’s recovery quickly stalled out and hit its last peak just over $17,000 on January 5th.

Source: Google Trends

When I use Google Trends for assessing extremes, I look for a surge of search interest at a price extreme to signal an imminent reversal of the price extreme. This time around, traders flipped the script.

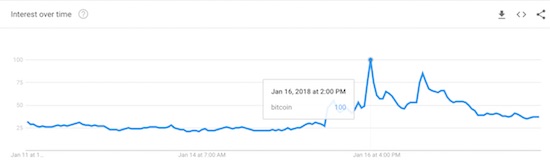

Zooming to the hour-by-hour search action reveals a close correlation that surprised even me and encouraged me even though the correlation was in the opposite order I would expect. Hourly search interest surged to a peak at 2pm Eastern on January 16th. A little over three hours later, Bitcoin swooned to its first test of the $10,000 level; that test succeeded. However, search interest surged to another hourly peak at 7am the next day. A little over three hours later, Bitcoin made its final swoon to the current local low of $9300.

Source: Google Trends

It is possible to back into an explanation and consider that traders were scrambling for information on government crackdowns, found bad news, and proceeded to sell until all motivated sellers exhausted themselves. We may never know the underlying reasons. Instead, we just have the correlations which still suggest that Bitcoin price extremes and Bitcoin search extremes go hand-in-hand. Perhaps search extremes without a price extreme should flag a warning signal for sellers and a “get ready” signal for eager buyers. Regardless, the price extremes reversed relatively quickly when associated with search extremes.

In other words, the evidence continues to grow that Google search trend behavior is a meaningful barometer of Bitcoin trading. If more corroborating data piles up, I will look to find similar patterns in other highly liquid cryptocurrencies.

In the meantime, I will be watching for signs of the durability of this latest Bitcoin bottom. If search interest wanes quickly, I will expect the recovery phase to fizzle relatively quickly like last time. If search interest remains robust, I will accordingly expect the recovery period to last longer.

Regional interest

The regional interest in Bitcoin through search trends presents a fascinating dichotomy. At the country level, the U.S. ranks only 10th over the last 7 days. Yet, 4 out of the top 5 cities are not only in the U.S. but also in the San Francisco Bay Area (Mountain View, Sunnyvale, San Francisco, and Fremont). Surat, India rounds out the top 5 although India as a country ranks just 33rd. Jersey City and Irvine are the two U.S. cities in the next 5 (ranked #9 and #10 respectively). Over the past 90 days, the ranking of cities completely changes with the San Francisco Bay Area completely dropping out the top 21 and Los Angeles appearing at #3 and New York at #5. It seems there could be regional patterns at play influencing the nature of the relationship between the Bitcoin price extremes and Google search extremes.

(Interested readers can click here for live Google Trend charts)

Be careful out there!

Full disclosure: no positions