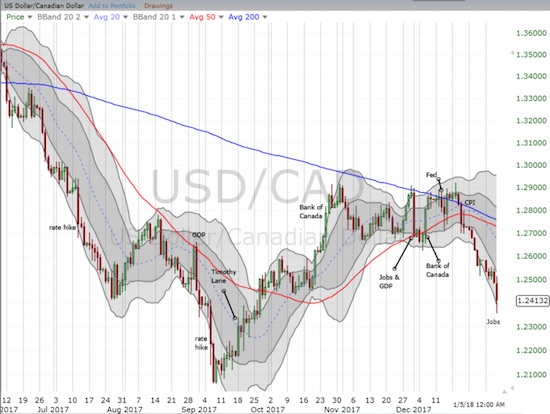

Last week, I wrote about how economic data overrode the apparent desire of the Bank of Canada (BoC) to apply brakes to the strength of the Canadian dollar (FXC). Friday’s jobs report all but sealed the deal on the bullish case for the Canadian dollar and makes it more likely that the BoC will be forced to hike rates again sooner than later.

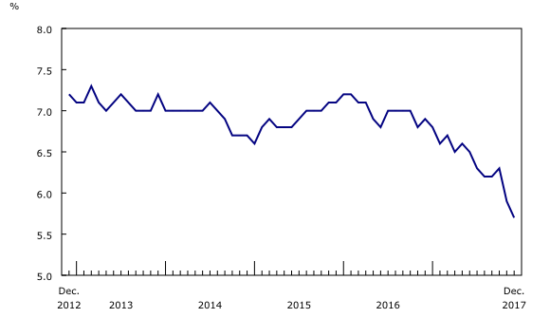

The unemployment rate in Canada dropped from 5.9% to 5.7%, creating a record low since Canada started tracking comparable data exactly 42 years ago. Quarterly employment growth was at its strongest since the second quarter of 2010.

Source: Statistics Canada

Speculators are still sleeping on the Canadian dollar. Last week, net long contracts declined again and settled at just 14,739. The anemic level of bullishness augurs well for further strength in the Canadian dollar when speculators get active again. I had a short USD/CAD position in play ahead of Friday and closed it out in the favorable wake of the jobs report.

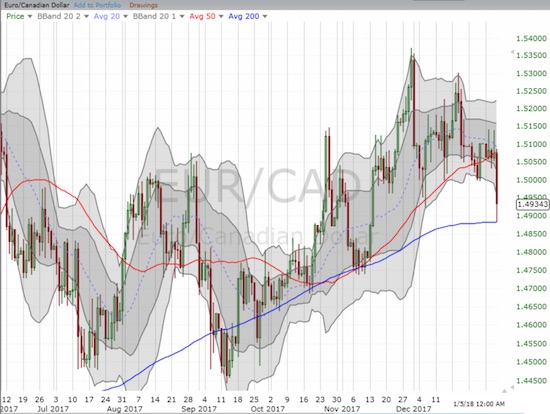

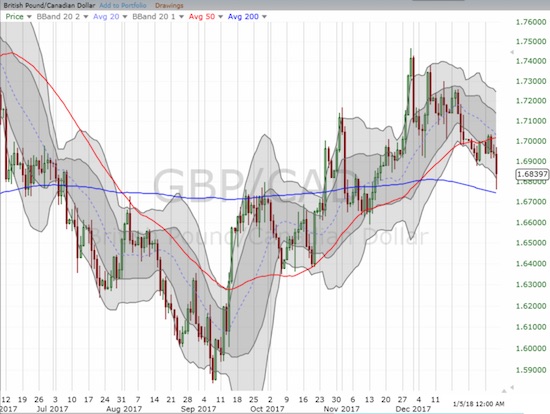

Here are additional charts to confirm the relative and building strength of the Canadian dollar.

Source of charts: FreeStockCharts.com

Be careful out there!

Full disclosure: no positions