Just as I had hoped and anticipated, the Banco de Mexico hiked its interest rate to 7.0% on June 22nd and kept pace with the U.S. Federal Reserve’s rate hike. Apparently, this rate hike was not a news flash. According to Reuters, the consensus opinion also anticipated a rate hike:

“Analysts expected Mexico would match the Fed’s quarter-point rate hike last week in a bid to maintain the appeal of peso-denominated debt to yield-hungry investors.”

Now the question is the future path for rate hikes. Banco de Mexico suggested that rates are now high enough to contain a spike in inflation that has risen to 6.3% (the highest since 2009) and guide the economy back down to the 3% target. Reuters quoted Governor Agustin Carstens from a Bloomberg article:

“‘We believe that where we are now will lead us to the 3 percent (inflation target) level at some point. We are ready to make the statement that up to today we think it is sufficient but we will be very vigilant.'”

The peso strengthened accordingly against the U.S. dollar but only after an initial intraday “sell the news” reaction. The resulting rise in USD/MXN allowed me a fresh opportunity to fade and get a cheaper starting point for taking advantage of the next round of peso strength. I locked in the profits during Friday’s continuation selling in USD/MXN.

Source: FreeStockCharts.com

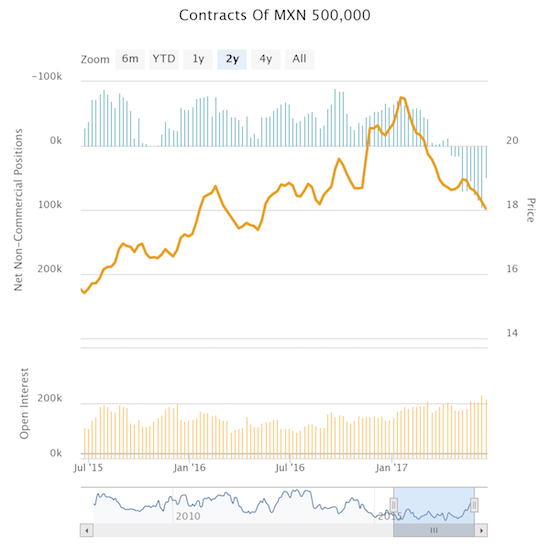

Interestingly, speculators harbored the same hesitation I had going into the Banco de Mexico statement on monetary policy. Mexican peso bulls significantly withdrew with net long contracts dropping from 95,814 to 48,985, a near 50% cut.

Source: Oanda’s CFTC’s Commitments of Traders

This retreat completes a sweet spot for USD/MXN that includes a clear downtrend, yields high enough to continue encouraging carry trades against a wobbly U.S. dollar, and fresh upside for speculators to rebuild net shorts. While I am content to fade bouts of strength in USD/MXN, I prefer USD/MXN to achieve a clear breakdown to a new low. At that point I will again feel very comfortable aggressively shorting USD/MXN. If the downtrending 20-day moving average (DMA) continues to provide overhead resistance, USD/MXN could set that new (13-month) low in another two weeks or so.

Be careful out there!

Full disclosure: no position

Addendum June 26, 2017: Bloomberg interview with Banco de Mexico Governor Agustin Carstens:

Hello Dr Duru

I have been following you for a while and have been meaning to ask:

What’s the best way to trade the MXN without an FX account?

Many Thanks & Kind Regards

James

Hi James!

Thanks for reading!

Unfortunately, there does not seem to be an ETF or ETN that allows us to trade the Mexican peso. Really too bad too. The closest you can get is the Mexican stock ETF EWW, but I would not trade it just because it is easier to know what’s going on with the currency than the collection of companies in EWW.

— Duru