The Mexican peso is trading at levels last seen 10 months ago against the U.S. dollar (USD/MXN).

Source: FreeStockCharts.com

The rate hike from the Federal Reserve yesterday, along with an official launch of the Fed’s effort to reduce the size of its balance sheet, helped USD/MXN rally. Normally, I would fade USD/MXN here at the top of the short-term downtrend. However, I am still assessing the market’s reaction to the news about the balance sheet reduction. Moreover, Banco de Mexico meets next week, June 22nd. I am looking for Banco de Mexico to keep pace with the Federal Reserve’s rate hike. If it does not, USD/MXN will likely rally quite a bit further from current levels (on top of whatever adjustment is occurring to account for the launch of balance sheet reduction).

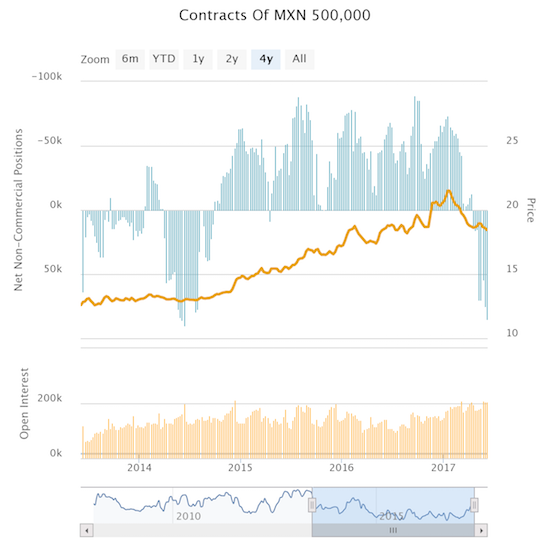

In the meantime, speculators remain enthusiastic for the Mexican peso. At least last week, speculators accumulated net longs to a new 3-year high.

Source: Oanda’s CFTC’s Commitments of Traders

Note that speculators were even more bullish on the Mexican peso from 2010 to 2013 so there is plenty of room left to run before reaching “maximum bullishness.” Next up will be to see how speculators react to the Fed and then Banco de Mexico.

With an overnight interest rate target at 6.75% the Mexican peso is also still a great carry trade. I am just a little more cautious and more motivated to be patient for the next entry given the fundamental backdrop may be shifting slightly.

Be careful out there!

Full disclosure: no position

Hard to have a strong fundamental bias on mxn. banxico one would think would be inclined to cut rates now that they don’t have to defend mxn and inflation due to FX depreciation is no longer a major danger. In fact, with China slowing, why wouldn’t they move to an easing bias. 6% is crazy in the long term given where everyone else’s rates are. US rate forwards might move down more than Mexican ones but I doubt it.

I would be inclined to go long usd.mxn and short usd.cad, or long mxn.cad. Still waiting for the long interest to be wrung out of cad. Euro and mxn are attractive to short due to the developing long spec interest. As you say, it could go for a while longer but I think it has already gotten to excessive levels, euro spec interest hasn’t been this long for around 5 years, so the fat pitch is waiting for this to ripen and to short at some stage.

I meant long cad.mxn

As long as spec interest is trending, I tend to follow it. It is only when it gets to “maximum” levels, like the highest since at least 2008, do I start thinking seriously about betting the other way. Even then, I wait for the catalyst to move against the consensus. For example, that catalyst has occurred with the Canadian dollar (which I am writing about next!).

The carry trade has a strong gravitational pull. It should take a fresh macro-economic calamity to drive a trend against MXN. Note how even oil’s latest tumble has barely slowed down MXN. Pull back and look at the longer-term chart of USD/MXN and I see a currency pair that has rallied a LOT and might just be getting started rolling back those multi-year gains. Regardless, I am too timid to get back in until I see how the Bank of Mexico reacts to the Fed and their own economic situation and then see how the market reacts to the policy statement. As you said, Banco really doesn’t have to hike rates. Yet, after accomplishing it mission in rolling back post-Trump losses, Banco should also be very reticent about dropping rates for fear of igniting fresh weakness. You know how the market can be – once a Central Bank changes policy, suddenly the market tends to extrapolate that policy extending well into the future.