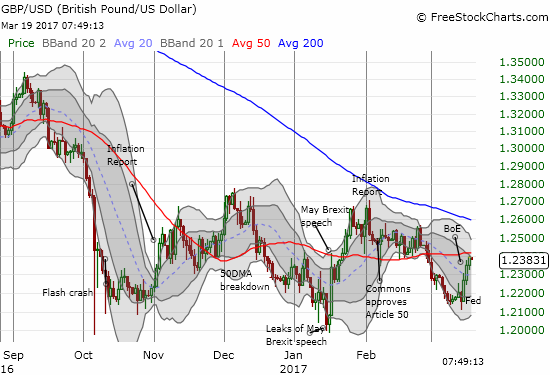

Now I understand better why and how the British pound (FXB) soared so much in the wake of the latest announcement on monetary policy from the Bank of England (BoE).

Source: FreeStockCharts.com

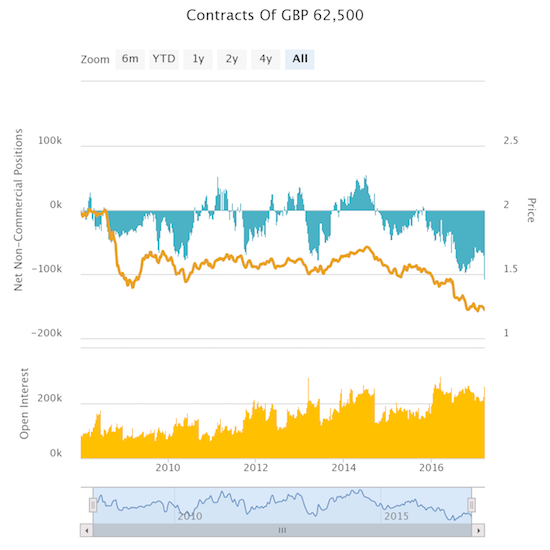

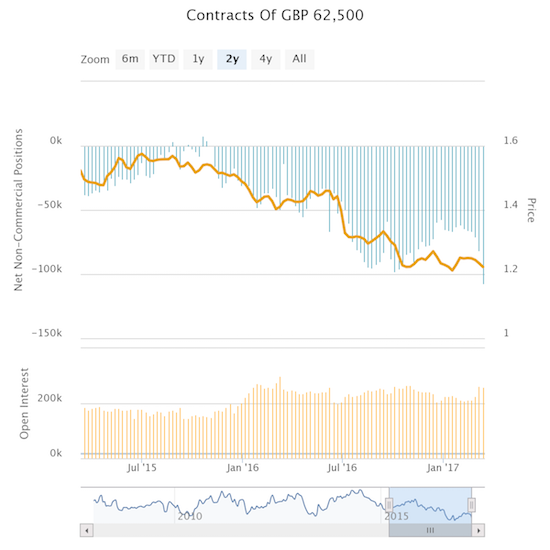

Going into last week’s monetary events, speculators increased their net short contract position to levels not seen since at least 2008.

Source: Oanda’s CFTC’s Commitments of Traders

With shorts suddenly crowding in, I have to assume they were anticipating large and bearish catalysts. With none forthcoming, a small short squeeze ensued. The next CFTC report will shed more light on that theory, but I think it is a useful working theory for how to trade the pound going forward.

The Federal Reserve announcement was interpreted as more dovish than expected, but I expect in due time the U.S. dollar will stabilize and resume some upward momentum.

The Bank of England announcement was interpreted as being more hawkish than expected, but I think such an assessment came mainly as the result of ONE Bank member (Kristin Forbes) recommending a rate hike. The Bank was very clear that its assessments from February’s Inflation Report remain intact. In reminding financial markets that the Bank has limits to the length of time it will allow inflation to run hotter than its remit, the Bank outlined three very familiar points:

“As the Committee has previously noted, there are limits to the extent that above-target inflation can be tolerated. The continuing suitability of the current policy stance depends on the trade-off between above-target inflation and slack in the economy. The projections described in the February Inflation Report depend in good part on three main judgements: that the lower level of sterling continues to boost consumer prices broadly as expected, and without adverse consequences for expectations of inflation further ahead; that regular pay growth does indeed remain modest, consistent with the Committee’s updated assessment of the remaining degree of slack in the labour market; and that the hitherto resilient rates of household spending growth slow as real income gains weaken, without a sufficient offset by other components of demand.”

With GBP/USD sitting at resistance, I have every reason to short here in anticipation of some kind of pullback. I expect the entire rally from last week to reverse in due time. In fact, I have been looking for a retest of January’s low when financial authorities deftly leaked Prime Minister Theresa May’s Brexit speech: the move allowed the market to roil and exorcise its demons ahead of the full news. Once May delivered her speech, the contents were treated as “old news” and certainly not as bad as previously feared. The ensuing relief rally was tremendous and lasted into the February Inflation Report. The Bank of England delivered a decent dose of reality at that point.

Even if GBP/USD manages to crack 50DMA resistance before a reversal, I am looking to downtrending 200DMA resistance to hold tight just as it did last month. If the U.S. dollar weakens further, then I will also look to stronger currency pairs as longs against the pound.

Full disclosure: short GBP/USD