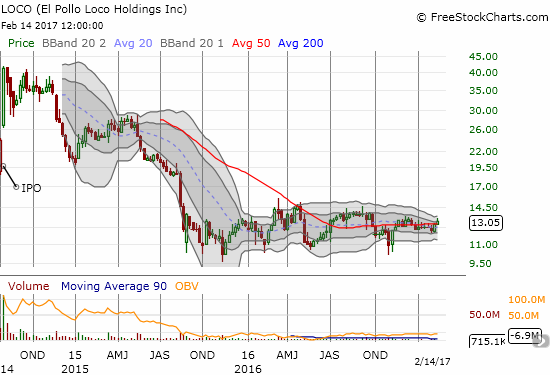

A little over two years ago, El Pollo Loco Holdings (LOCO), a quick serve restaurant that “offers individual and family-sized chicken meals, Mexican-inspired entrees, sides, and, alternative proteins,” was mentioned as a potential acquisition target of Jollibee Foods Corp, the largest fast food franchisor in the Philippines. LOCO closed that day at $26.25 and with a healthy 10.5% gain on the week. This turned out to be a rally between two large sell-offs that have defined the stock.

Source: StockCharts.com

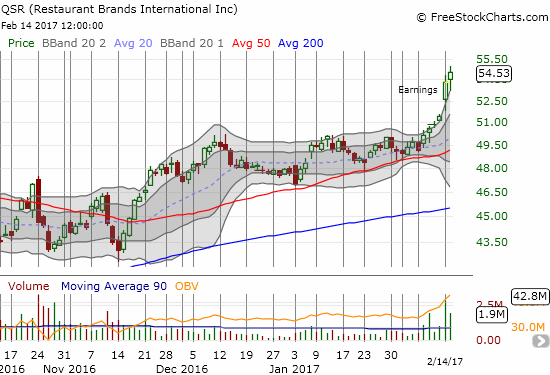

Today (February 14) LOCO became the feature in another takeover rumor this time with Restaurant Brands (QSR) as the suitor. This rumor (reported by briefing.com) briefly sent LOCO higher by 3.8%. Unlike the previous day’s rumor about QSR’s interest in Popeyes Louisiana Kitchen (PLKI), LOCO promptly gave up ALL its gains before bouncing slightly from the low of the day and eking out a 1.6% gain. Trading volume of 850K was 5 times higher than the 90-day average of 168K.

Source: StockCharts.com

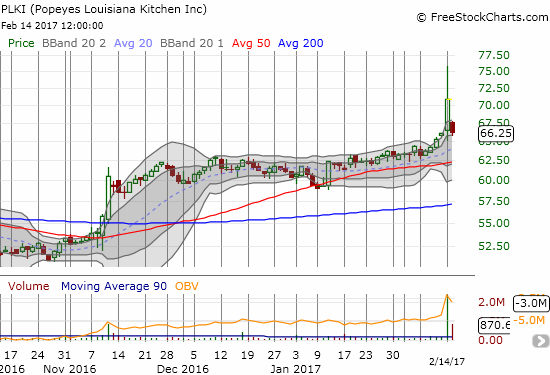

This “chicken run” was the same trick as the previous day’s QSR takeover rumor but with a different result. PLKI soared on its QSR takeover rumor and enjoyed gains for a full day. With LOCO, the gains lasted about an hour.

I am surprised the run was so much shorter. LOCO is a cheaper stock than PLKI and thus a more likely takeover target for the likes of QSR. According to Yahoo Finance, LOCO has a trailing P/E of 21.8, forward P/E of 18.6, price/sales of 1.3, and price/book of 1.9. Its market cap of 502M is less than half that of PLKI. Overall, LOCO is a bite-sized morsel that QSR could easily swallow. So when LOCO pulled back, I decided to speculate and buy the stock. At a minimum, I can play the current trading range. In the best case scenario, some company finds LOCO too cheap to resist.

The pairs trade I proposed for shorting both PLKI and QSR did not make sense in this case because LOCO never acquired a significant premium. The attractiveness of shorting against such a premium shone brightly as PLKI finished giving up its entire gain in the wake of rumors QSR had pulled out of a potential deal (briefing.com).

Source: StockCharts.com

With PLKI back to its pre-rumor price, I decided to buy a small amount of stock as speculation on some kind of deal, or the rumor of one, occurring. PLKi is also a play on an uptrend defined by a 20-day moving average (DMA) that turned sharply upward and confirmed by a successful test of 50DMA support last month.

Full disclosure: long PLKI, long QSR put options, long LOCO