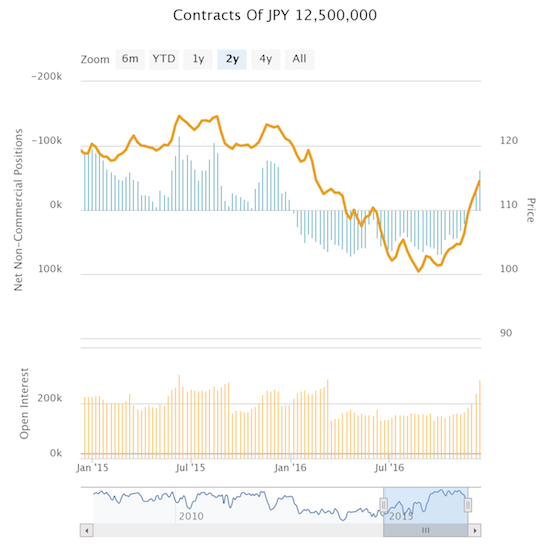

A little over two weeks ago, I wrote “Yen Bulls Finally Back Down” to mark an important milestone: for the first time in a year, currency speculators went net short the Japanese yen (FXY). I closed out my long USD/JPY position and waited for the U.S. Federal Reserve meeting as well as confirmation of the market’s newfound yen bearishness. That confirmation has arrived.

Currency speculators have accumulated a net short position in rapid order. In the previous two weeks on record, net shorts went from just above zero to net 63.4K contracts. The race to earlier highs of 100K is on.

Source: Oanda’s CFTC’s Commitments of Traders

The chart above suggests that as long as this net short position persists against the yen, the Japanese yen will bias toward weakness.

From a technical standpoint, USD/JPY freshly broke out thanks to the Federal Reserve. I am now tentatively buying intraday dips and selling rallies until USD/JPY can prove the next hurdle above 119. Such a breakout will further validate the current uptrend channel that has sustained an intense rally in USD/JPY. If (once?) USD/JPY reverses its post-Fed gains, I will stop trading USD/JPY from the long side until it tests important support like the 50-day moving average (DMA).

Source: FreeStockCharts.com

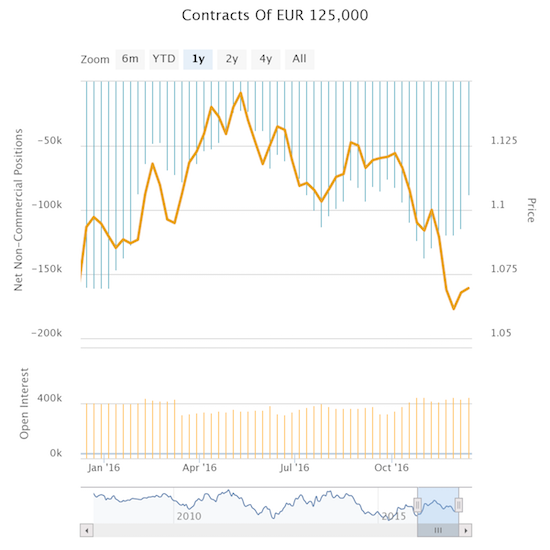

While yen bears are celebrating a return to dominance, euro bears are “quietly” shrinking net shorts.

This reduction is not yet dramatic enough to change my bearishness on the euro or bullishness on the U.S. dollar index (DXY0). However, I duly note that this reduction in bearishness is happening as EUR/USD approaches parity. If the current patterns persist, I am guessing parity may serve as extended support and a springboard much like the 100 level did for USD/JPY.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long USD/JPY, short EUR/USD