(This is an excerpt from an article I originally published on Seeking Alpha on October 16, 2016. Click here to read the entire piece.)

It looks like UK Prime Minister Theresa May will not be able to proceed with Brexit plans, hard or not, unchecked by other powers in the UK. The UK Parliament demanded a say on Brexit proceedings and on October 11th, May essentially acquiesced to those demands. {snip}

The response in currency markets was immediate. The British pound experienced a sharp bout of relief. {snip}

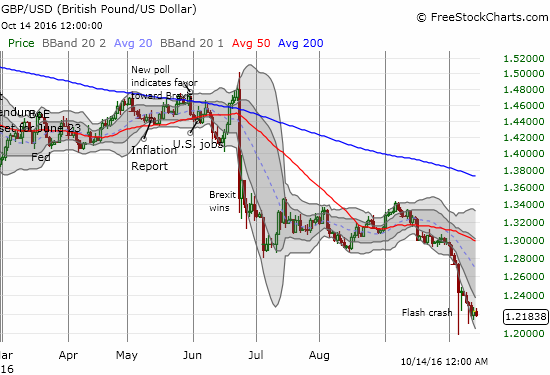

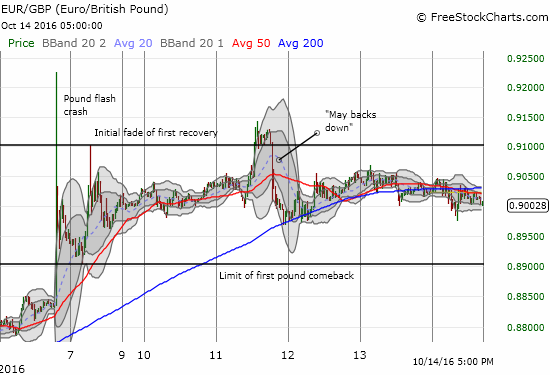

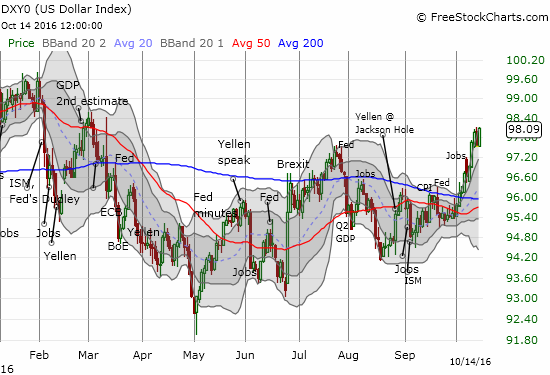

The pound’s strength came just as it looked like the currency was headed to a retest of the extremes of the flash crash from the previous week. The graph above shows how EUR/GBP briefly surpassed the level marking the initial fade of the pound’s recovery against the euro. I now use EUR/GBP as my technical marker instead of GBP/USD because the U.S. dollar has started rallying on U.S. interest rates. EUR/GBP should more closely reflect the pound’s European dynamics.

{snip}

EUR/GBP not only shows how the pound rebounded from the brink, but also the round number 0.90 is a clear pivot point. So now I am looking at EUR/GBP above 0.915 as a freshly bearish signal on the pound and below 0.89 as hopeful of at least a relief rally for the pound. {snip}

Scotland may also look to constrain May’s ability to break completely free of the EU. Nicola Sturgeon, the leader of the Scottish National Party (SNP) and Scotland’s First Minister, vigorously raised the specter of Scottish independence in response to a hard Brexit in a keynote speech to the SNP Conference in Glasgow. {snip}

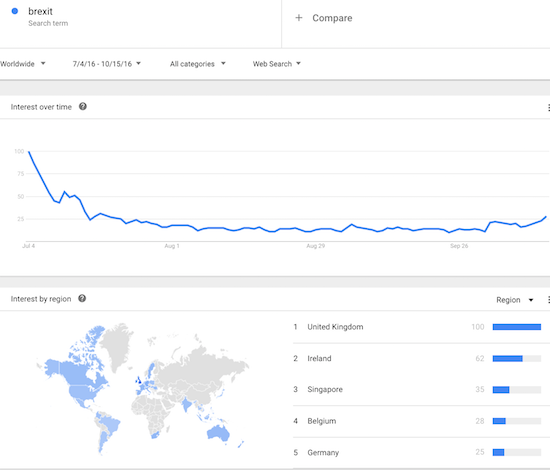

Source: Google Trends

Be careful out there!

Full disclosure: net long the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on October 16, 2016. Click here to read the entire piece.)