Almost two months ago, I explained my decision to sell my position in iShares MSCI Brazil Capped (EWZ). I also pointed to a 20% correction as the next time I will consider buying again. Since then, EWZ rallied, dipped slightly to a lower low, and then resumed its current rally. That rally accelerated a bit this month. EWZ is up a healthy 10.5% in October (which is also equates approximately to the gain since my last post).

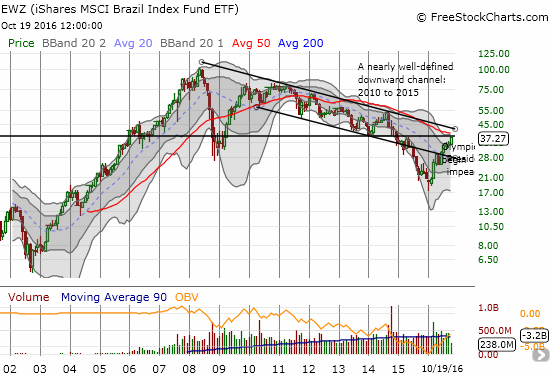

This rally has also pushed EWZ to a key resistance level from 2015’s high. I marked this point with a horizontal black line in the chart below. The chart also reminds us that EWZ is still trading within a presumed long-term downtrending trading channel. A breakout from 2015’s resistance will almost surely send EWZ to its first test of the channel in over two years.

Source for charts: FreeStockCharts.com

EWZ is up an astounding 80% year-to-date. This rally cleaved through a lot of bad news from political wrangling over a Presidential impeachment, hand-wringing over the Olympics, drought, and on-going economic woes including a recession. This is quite an amazing record that suggests that EWZ could even summon the momentum to break out of the downtrending channel. I will continue to monitoring EWZ closely as Brazil clearly still presents strong investment potential.

Be careful out there!

Full disclosure: no positions