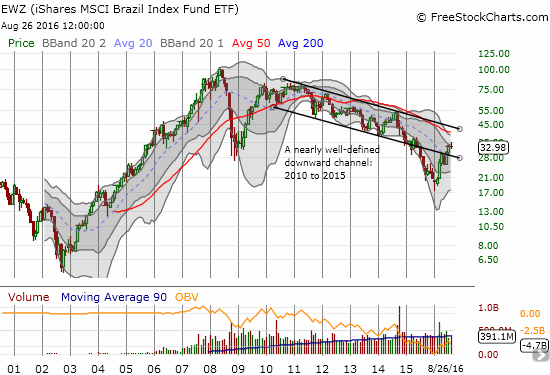

Back in October, 2009 When Brazil won the 2016 Summer Olympics, I heralded the news as an opportunity to invest in a country that promised to grow faster than the United States. The iShares MSCI Brazil Capped (EWZ) never quite matched its peak from 2008 but managed to ride the wave of a post-recession, commodity boom into 2010/2011. After that, Brazil began an orderly multi-year tumble. Needless to say, Brazil severely disappointed.

Source: FreeStockCharts.com

As the Brazilian story unravelled, I switched gears to more short-term trading starting with an idea that came after Brazil reversed its post-Olympics gains: buy EWZ after a 20% pullback. I formalized this rule in May, 2010 after observing EWZ rally twice from 20% corrections and trading through them.

After 2011, I took a three-year hiatus. I bought the iShares MSCI Brazil Capped (EWZ) once more in October, 2014. My purchase came at a time when EWZ was tumbling toward the bottom of a multi-year downtrend channel. For the next 8 months, EWZ struggled with the bottom of that channel before finally breaking down on the way to prices last seen in late 2004. I stubbornly stuck to my position but failed to build on the position as the news from Brazil appeared so dire. From there to the Olympics, EWZ doubled, and I finally decided to take my loss.

Source: FreeStockCharts.com

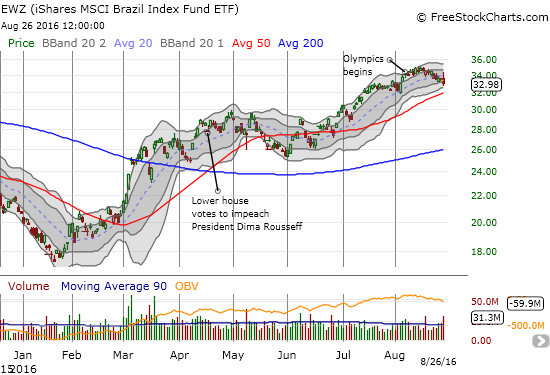

The timing of my sale was not an accident. With the 2016 summer Olympics ending and a presidential impeachment process looming, I figured the good cheer could come to an end (almost like sell on the news). I waited for a full week to see whether momentum would resume. After observing the gyrations in the wake of the Economic Symposium at Jackson Hole, I decided it was a good time to sell. As the daily chart above shows, the Olympics is starting to look like a definitive peak in EWZ. At minimum, a retest of the bottom of the previous downward channel is likely in play.

I learned a major lesson from this experience. First of all, I left my EWZ position on “automatic” for far too long. I never re-examined my trading thesis and never even constructed a plan for adding more to the position to profit from what I should have concluded would be an eventual recovery. If I had, I could have even made money on the trade.

So now, I wait for the next 20% correction in EWZ from its last peak. Such a pullback would put the ETF at $28 and just below the bottom of the previous downward trend channel. My alerts are ready. Stay tuned.

Be careful out there!

Full disclosure: no positions