(This is an excerpt from an article I originally published on Seeking Alpha on July 13, 2016. Click here to read the entire piece.)

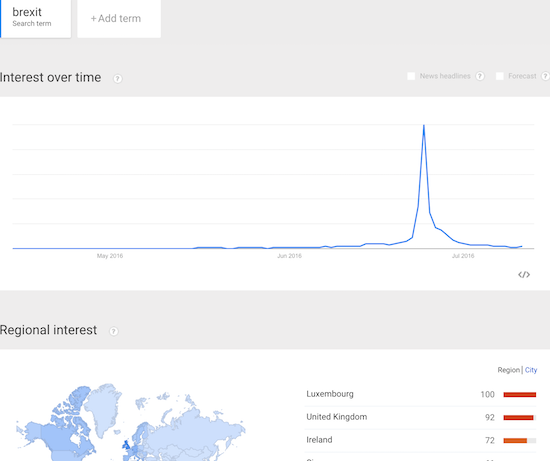

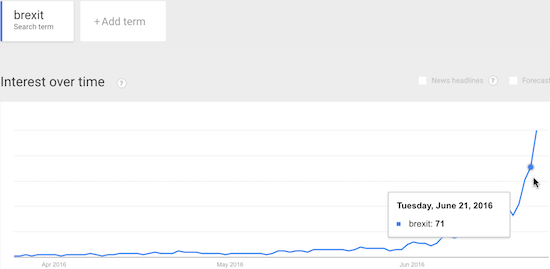

And so ends the flurry of sentiment on Brexit. The Google Trends chart makes “Brexit” look like a big anxiety bubble.

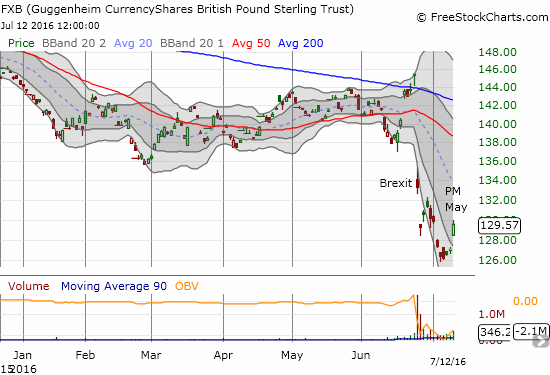

While sentiment has calmed down, the British pound (FXB) is still coping with a post-Brexit aftermath. A common assessment says that the pound is destined for lower lows. Here is a highlight reel of some of the overhanging conclusions looming over the British pound:

{snip}

On July 6, Bloomberg reviewed analyst forecasts for the pound. Of 62 analysts, 11 predict GBP/USD will fall to at least $1.20 by the end of 2016. {snip}

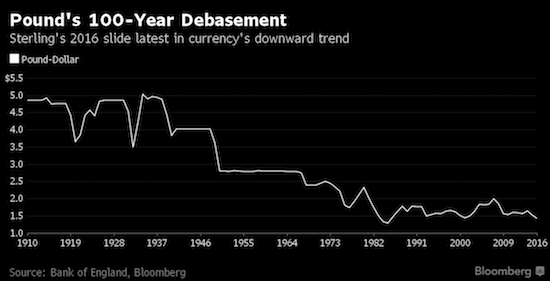

The most bearish predictions are looking for clues of a bottom along the extended history of decline for the British pound. {snip}

Source: Bloomberg

Here is a summary of the pound’s downfall over time:

{snip}

What I like about trying to bet on some kind of crisis bottom in the pound is that so much sentiment seems to be about as negative as it can get. {snip}

Source: FreeStockCharts.com

The rapid weakening of the Swiss franc (FXF) that I took as a sign of quickly receding Brexit concerns was apparently engineered by yet more currency intervention by the Swiss National Bank (SNB). {snip}

{snip} Governor Mark Carney and company are trying to step into the breach of confidence. {snip}

{snip}

Note that one critic pointed to the BoE’s plans and claimed that Carney and company are actually weakening banks by allowing them to operate with less equity than previously planned. {snip}

Notably absent from Carney or the FPC’s remarks was an attempt to restore confidence in the pound or at least to give it a boost. {snip}

After it is all said and done, my post-Brexit trading strategy remains the same. {snip}

Be careful out there!

Full disclosure: long FXB; in forex, net long the the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on July 13, 2016. Click here to read the entire piece.)