(This is an excerpt from an article I originally published on Seeking Alpha on July 21, 2016. Click here to read the entire piece.)

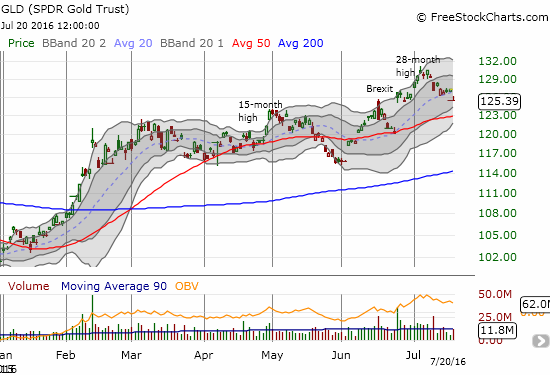

The post-Brexit run-up in the SPDR Gold Shares (GLD) ended today.

Source: FreeStockCharts.com

The entire post-Brexit gap could easily fill if current momentum in other gold-related indicators continues.

{snip}

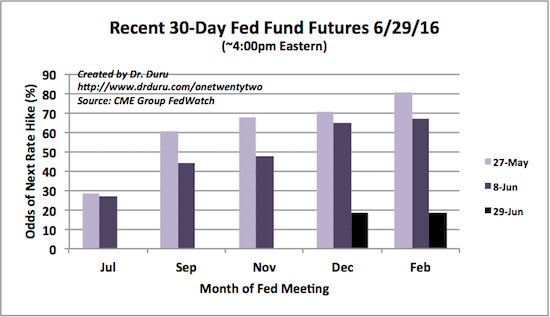

Source: CME FedWatch Tool

{snip}

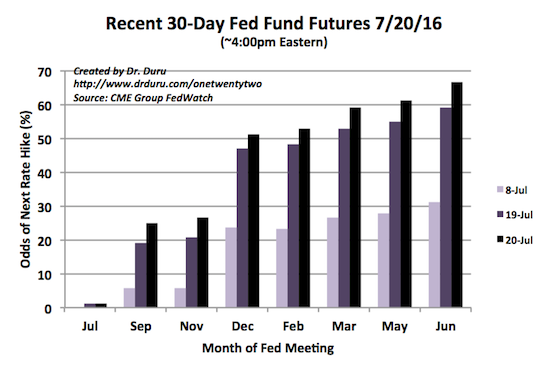

Source: FreeStockCharts.com

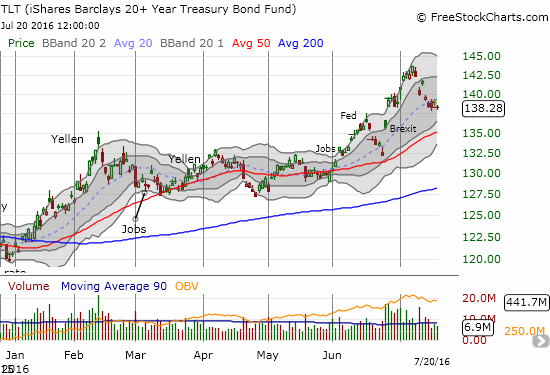

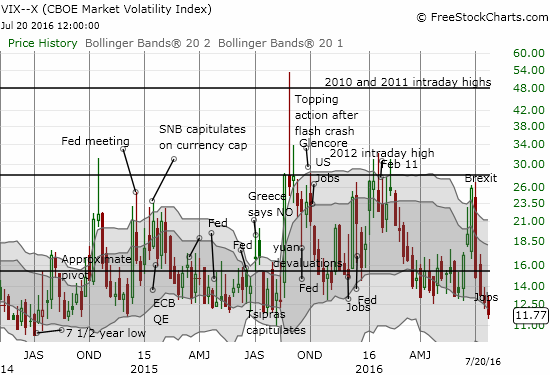

The volatility index, the VIX, confirms the market’s comfort level (aka complacency?). The VIX last closed this low on August 26, 2014. Since the financial crisis, the VIX experienced its lowest close on July 3, 2014 at 10.3.

Source: FreeStockCharts.com

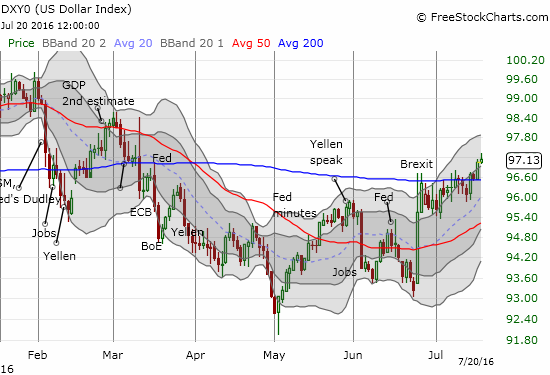

The U.S. dollar index (UUP) is adding to the headwinds for gold. The index recently topped its 200-day moving average (DMA), a very bullish move. {snip}

Source: FreeStockCharts.com

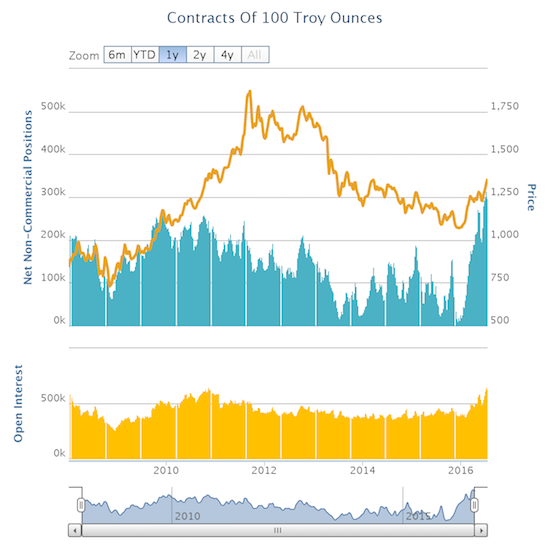

And then there is the sentiment of speculators. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

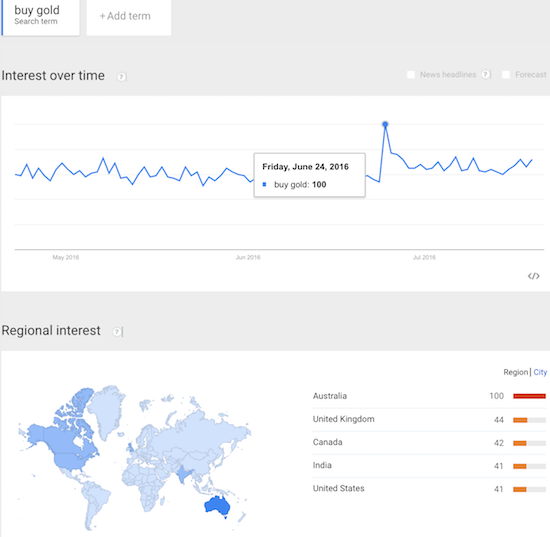

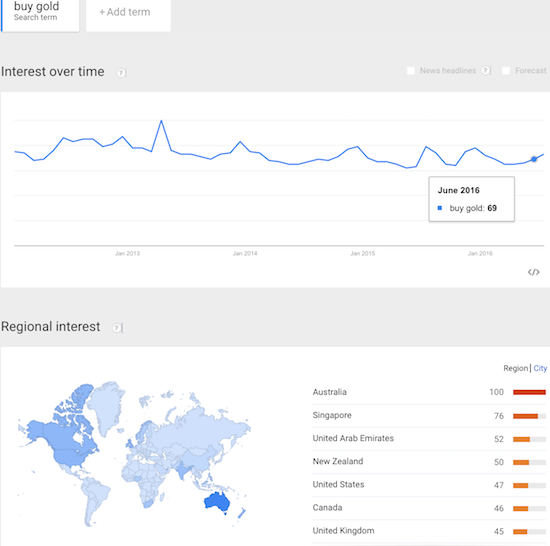

My favorite check on gold sentiment is the index for Google Trends on the search “buy gold.” I have been watching this indicator for over 8 years and the current episode has been the toughest yet to decipher. I have been on a vigil for a blow-off top in GLD since mid-June when sellers took down GLD in a technical topping pattern. {snip}

There was a very well-reported and notable spike in “buy gold” on the day after Brexit…

Source: Google Trends

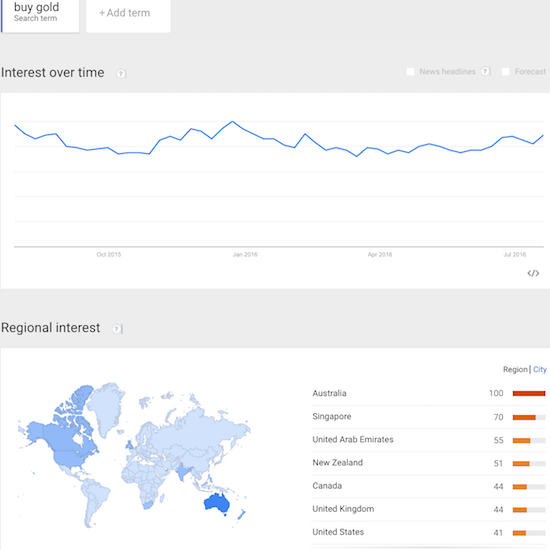

But this spike was not quite enough to push the monthly trend to an extreme spike and the following weeks have not quite delivered either.

Source: Google Trends

For my trading strategy, this potential topping in gold has meant I have stayed away from trading around my core GLD position since I sold my call options in VanEck Vectors Gold Miners ETF (GDX) in early June. {snip}

Be careful out there!

Full disclosure: long GLD, net long the U.S. dollar

(This is an excerpt from an article I originally published on Seeking Alpha on July 21, 2016. Click here to read the entire piece.)