I have a feeling I will be writing about the British pound a lot more in the coming weeks leading into the June 23rd referendum on the UK’s membership in the European Union (EU), aka Brexit.

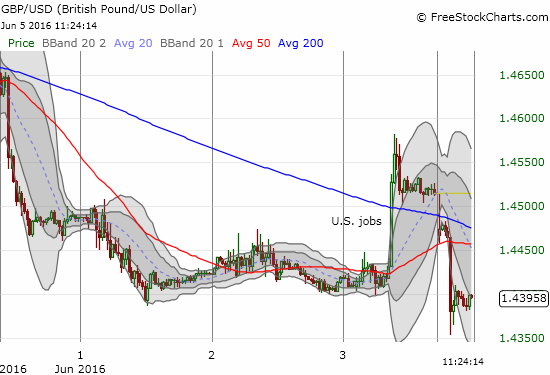

Out the gate this week, the British pound (FXB) gapped down in early trading before the Asian open. This follow-through selling is strong enough to completely reverse the gains the pound briefly enjoyed over the U.S. dollar in the wake of the poor U.S. jobs report. I use a 30-minute chart to make clear the reversal at the time of writing…

Source: FreeStockCharts.com

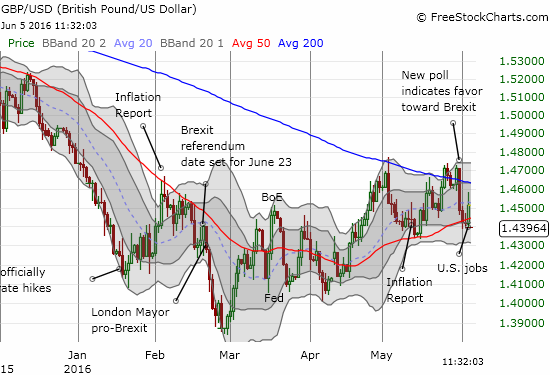

On the daily chart, GBP/USD is on the edge of a major breakdown below support at its 50-day moving average (DMA). I strongly suspect such a breakdown will hold through the remainder of this pre-Brexit vote period.

Source: FreeStockCharts.com

This gap down validates, so far, my conclusion that the market has re-awakened to the coming event risk in the British pound – see “The Currency Market Is Lagging A Dramatic Shift in Brexit Sentiment.” Given this validation, I will continue with my trading strategy to aggressively short the British pound. For now, this means fading rallies in various currency pairs with the British pound. The strategy could quickly include pursuing breakdowns as well.

Be careful out there!

Full disclosure: net short the British pound