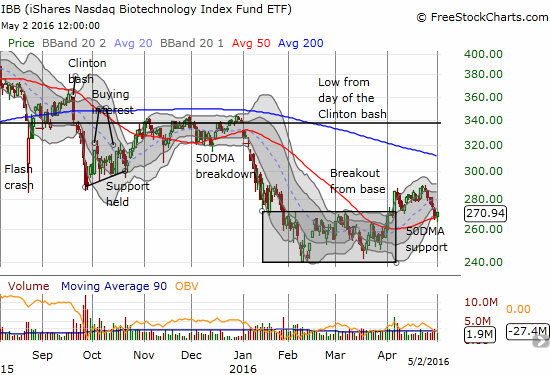

At the current pace of trading The iShares Nasdaq Biotechnology ETF (IBB) will not likely recover its losses from the “Clinton Bash” before the November elections.

The iShares Nasdaq Biotechnology ETF (IBB) failed to build on its momentum from last month’s breakout from consolidation. IBB is now clinging to support at its 50-day moving average (DMA).

Source: FreeStockCharts.com

After I wrote about buying IBB with confidence, I managed to make one winning and one losing trade using call options to net roughly even. The lack of sustained momentum hurt last week’s attempt. As IBB struggled today to hold 50DMA support, I decided to make one last trade on call options even though technically IBB has reversed and broken April’s breakout. Violation of 50DMA support will put IBB right back into bear territory.

Seeking Alpha author Ed Wijaranakula lays out a great guide for upcoming trading catalysts for IBB in “IBB Expecting A Rebound Ahead Of ASCO.” Specifically:

“Investors actually may want to avoid the biotech sector altogether during the weeks that the Senate Special Committee on Aging conducts their hearings on drug prices, as it has been a disaster for the IBB ETF in the past. Prior to Wednesday, the Senate Special Committee on Aging had conducted two hearings on drug pricing, one on December 9 and the other on March 17, when the IBB sold off 3.57% and 4.05%, respectively, during the week of the hearing. IBB, however, recovered 3.63% and 1.71%, respectively, during the week after the hearing. If history repeats itself, we expect IBB to recoup some of its losses this week…”

In other words, politics and regulation are going to weigh heavily on IBB for some time to come. In my book, such catalysts make IBB a poor investment in the current climate. IBB should still be good for shorter-term trades. I will do better going forward keeping these big calendar events on the radar as they can easily trump technicals. Hopefully, my timing this week works out just right.

Be careful out there!

Full disclosure: long IBB call options

It would seem that the diminishing volatility premium works against buying calls to play the recovery from the damage caused by the hearings. Better to use a call spread – or simply go long the ETF.

I have mostly focused on short-term calls to play immediate swings. I don’t have enough conviction to look beyond that right now.