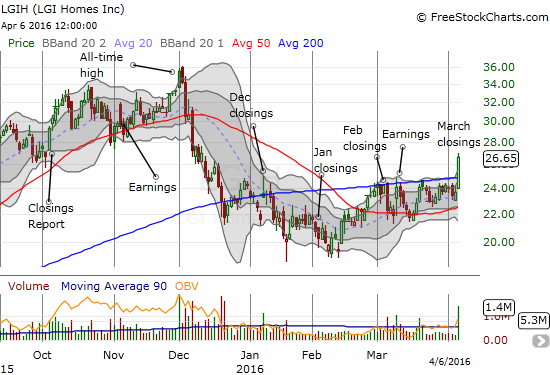

LGI Homes (LGIH) has been trapped underneath its 200-day moving average (DMA) for the entire year of 2016. Earnings reports and closing reports could not re-ignite last year’s enthusiasm in the stock. Finally, the report on March closings did the trick. In response to the March closing report, LGIH soared 12.7% on almost three times its average volume over the last 90 trading days.

Source: FreeStockCharts.com

Here is what LGIH had to say about March’s closings:

“…367 homes closed in March 2016, up from 298 home closings in March 2015, representing year-over-year growth of 23.2%. In addition, the Company announced quarterly closings of 844 for the first quarter of 2016. This represents a 25.8% increase over the 671 homes closed in the first quarter of 2015.”

This report should finally calm fears that the collapse in the oil patch will hurt LGIH’s business. LGIH has remained resilient throughout the decline in oil. The collapse is approaching the two-year mark, and LGIH is yet to show signs of following oil downward – LGIH’s reliance on Houston has also slowly edged down. I interpret the breakout shown above as the market’s signal that it is ready to stop worrying about the potential impact of oil prices on LGIH and ready to start revving up the engines once again.

Be careful out there!

Full disclosure: no positions