(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2015. Click here to read the entire piece.)

As expected, the Bank of Canada left rates unchanged in its latest decision on monetary policy (September 9, 2015). Also as expected, the Bank did not interpret recent GDP data as indicative of a recession in Canada…

{snip}

The most interesting part of the Bank’s statement referenced the adjustment of Canada’s economy to the collapse in commodity prices.

{snip}

In other words, the Bank of Canada no longer expects a stronger second half for oil and commodities. Instead, the Bank if bracing for an extended decline in commodities. {snip}

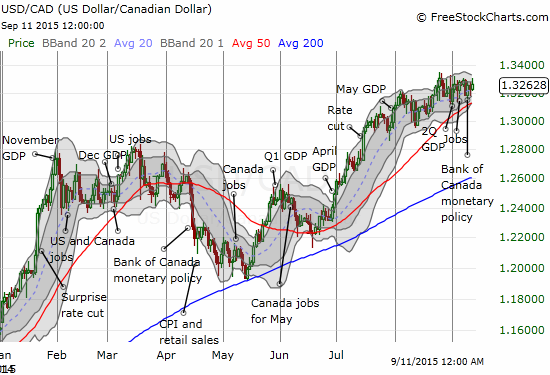

Source: FreeStockCharts.com

Also as expected, the Bank of Canada continues to pin its hopes on a strong recovery in the U.S. and exports in general:

{snip}

Canada’s link to fortunes in the U.S. makes the Canadian dollar my top currency of interest going into the much anticipated September 17th decision on monetary policy from the U.S. Federal Reserve. Whether the Fed triggers incremental strength or weakness in the U.S. dollar, I expect the moves to be particularly amplified AND sustained in the Canadian dollar. I will executed the next short term trade on USD/CAD accordingly.

Be careful out there!

Full disclosure: long FXC

(This is an excerpt from an article I originally published on Seeking Alpha on September 14, 2015. Click here to read the entire piece.)