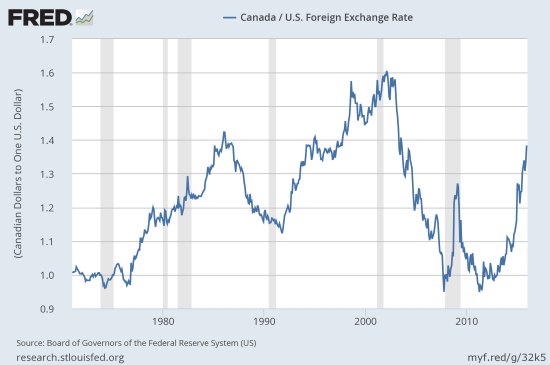

August 27, 2003. This was the last trading day where USD/CAD traded above the 1.40 mark. Until now. The Canadian dollar (FXC) slipped hard and fast in overnight trading to hit 1.408 for USD/CAD at the time of writing.

Source: Board of Governors of the Federal Reserve System (US), Canada / U.S. Foreign Exchange Rate [DEXCAUS], retrieved from FRED, Federal Reserve Bank of St. Louis, January 5, 2016.

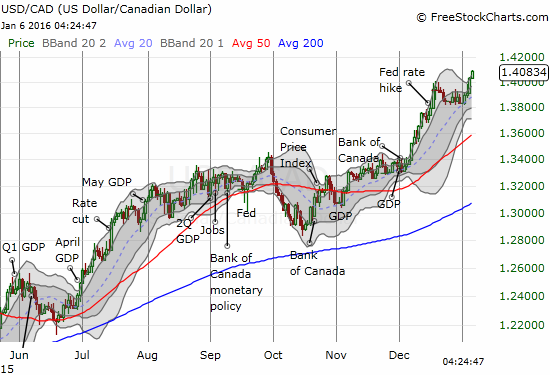

Source: FreeStockCharts.com

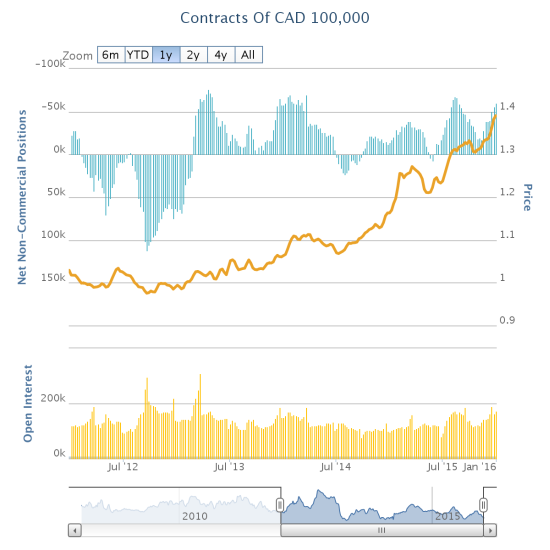

The on-going weakness in oil has directly driven the Canadian dollar to this weakness. The Bank of Canada has helped greased the wheels by emphasizing its dovishness on monetary policy combined with two rate cuts in 2015. The first one was a huge surprise. Interestingly, speculators are just now clamoring to rebuild net short positions against the Canadian dollar despite the clear trend. Net short positions and open interest are not quite back to prior peaks when the Canadian dollar was stronger.

Source: Oanda’s CFTC’s Commitments of Traders

As I have indicated in past posts, I established a very small position in CurrencyShares Canadian Dollar ETF (FXC) in anticipation of an eventual return of strength for the Canadian dollar. This return looks further and further away with every fresh wave upward for USD/CAD. In the meantime, I have gone to the forex markets with periodic long positions on USD/CAD (buying dips). With USD/CAD trading through 1.40, I will add to the long-term FXC position and kick my USD/CAD trades up another notch until USD/CAD drops below 1.40 again. As an added twist, at the time of writing, I made a small bet that USD/CAD will retest the 1.40 level in the immediate term; this is also a very small hedge against on has become a very large overall bullish bet on the U.S. dollar. I think this is my first attempted short on USD/CAD in about a year…

Be careful out there!

Full disclosure: long FXC, short USD/CAD (very short-term – I past the current trade, I remain bullish on USD/CAD), net long the U.S. dollar

1 thought on “The Canadian Dollar Hits A Fresh Milestone”