How easy it is to forget the bullishness that homebuilders have for the future.

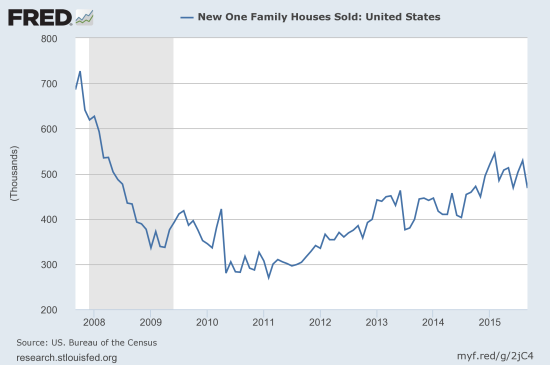

The Census Bureau reported disappointing new home sales data for September, 2015. The negative feel was further underlined by “consensus expectations” which turned out far too high. Single-family new home sales dropped 11% month-over-month. That SEEMS awful until you read further to understand that year-over-year sales are up 2%. Not great, but far from heralding the end of the housing recovery. Moreover new home sales are still trending upward. If anything, new home sales are could simply establish a new range at its highest level since the recovery began.

Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], retrieved from FRED, Federal Reserve Bank of St. Louis, October 26, 2015.

All regions were in the red month-over-month. Year-over-year, the South and West were both up over 8%. The big laggard was the Northeast with a whopping 57% drop (and no weather to blame!). Year-over-year sales were still positive at 2% because the South and West represented 85% of all sales for September (a typically high share).

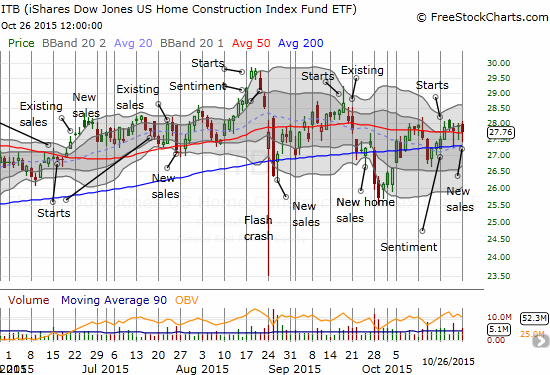

The housing recovery has been sluggish at an aggregate level. Whenever analysts and economists produce high expectations, I assume they are more than likely over-extrapolating from the most recent data. If I were trading The iShares US Home Construction ETF (ITB) actively, I would have faded this dip in ITB with the full expectation that in very short order the losses would reverse as the market sorted out headlines from data. The general market’s tease with overbought conditions also gives me pause before trying such an aggressive trade.

The inventory of new homes also provides another point of interest. Inventory sits at 5.8 months at the current pace of sales. Six months is considered a point of balance. Given a lack of inventory has often been a source of friction in many markets, the prospect of more balance, particularly if it comes in the hottest markets, bodes well for future sales.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long ITB call options