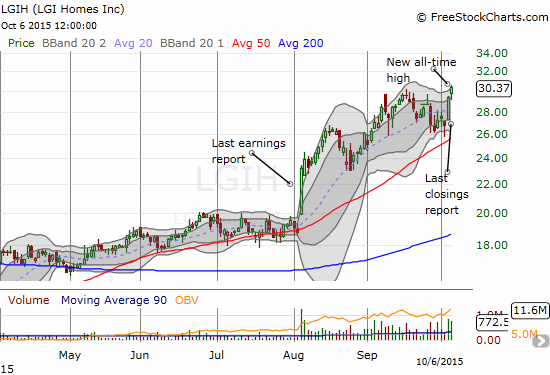

Almost a month ago, I performed some risk management and trimmed my bulging portfolio of homebuilders by selling LGI Homes, Inc. (LGIH) (see “LGI Homes Is Now A Bit Hot To The Touch“). Since then, LGIH has chopped around and even came close to testing support at its 50-day moving average (DMA) on its way to printing a new all-time high.

Source: FreeStockCharts.com

The last catalyst for LGIH was its report on home closings for September and the third quarter of 2015. Once again, LGIH delivered for investors with strong numbers. From the report:

- 934 homes closed for 3Q 2015 – 68% year-over-year growth

- 2,458 homes closed for the first 9 months of 2015 – a 44.2% year-over-year growth rate

- 50 active selling communities – a 47% year-over-year growth rate

This news sets up for another strong earnings report in November. The stock reacted by surging a whopping 9.7% on a very strong day for the stock market. While I will not buy back shares ahead of the November report, I am eagerly awaiting confirmation that LGIH’s future prospects remain very attractive.

Be careful out there!

Full disclosure: no positions