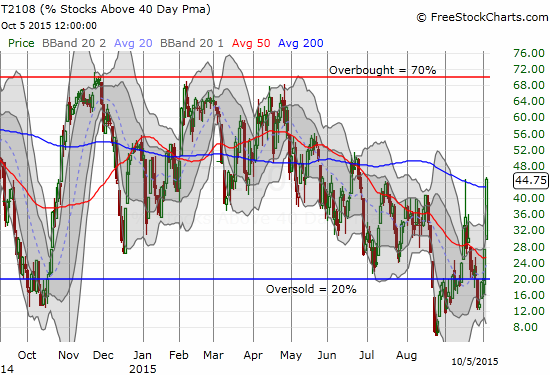

(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 44.8%

T2107 Status: 24.5%

VIX Status: 19.5

General (Short-term) Trading Call: Bullish (upside target of 1996 on the S&P 500 before overbought conditions finally occur again. See “From the Edge of A Breakout to the Ledge of A Breakdown” for more details).

Active T2108 periods: Day #2 over 20%, Day #1 over 30% (ends 12 days under 30%), Day #1 over 40% (ends 33 days under 40%)(underperiod), #94 under 50%, Day #111 under 60%, Day #316 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

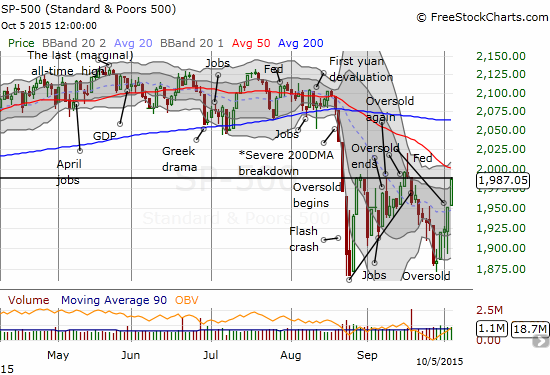

The S&P 500 (SPY) printed a near picture-perfect follow-through to the end of the last oversold period. The index gapped up and just ripped higher for the rest of the day. The move pinned bears, who were too greedy to release their grips on positions during the oversold period, into a world of hurt.

Accordingly, T2108 surged. My favorite technical indicator gained a whopping 63% to end the day at 44.8%. This move put an end to the primary downtrend defined by the 50DMA.

The volatility index, the VIX, looks ready to reverse all the angst of the past few months just as T2108 has done already.

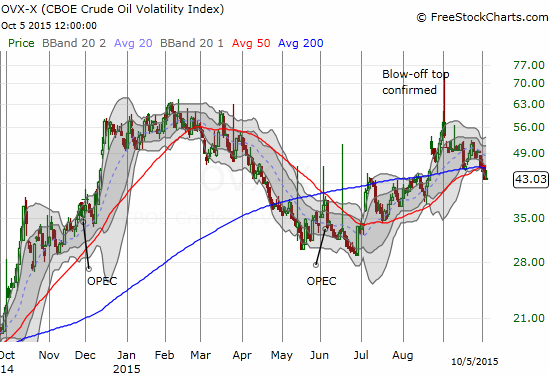

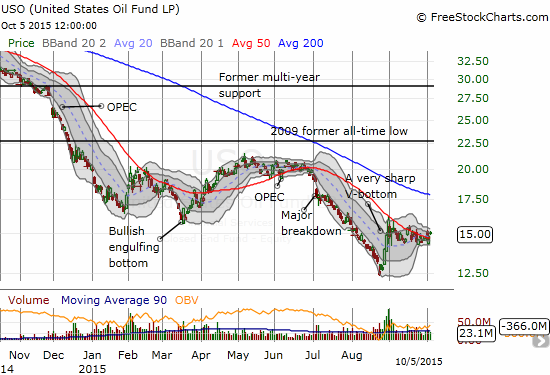

The volatility on oil is also beating a retreat. The CBOE Crude Oil Volatility Index (OVX) has confirmed the blow-off top from a month ago with a confirmed breakdown from 50 and 200DMA support. This decline has put my anti-volatility, rangebound bet on United States Oil (USO) into the green.

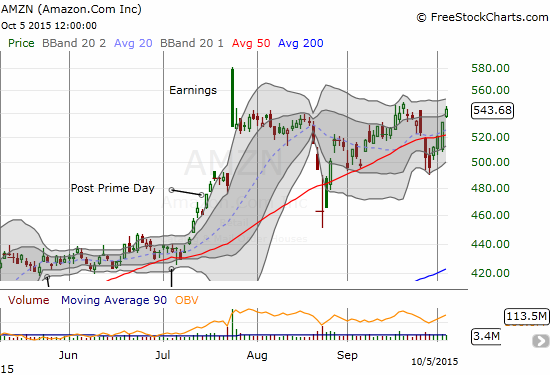

Big cap tech is back in effect. Amazon.com (AMZN) clocked its second highest close ever and Netflix (NFLX) finally broke through 50DMA resistance. I remain bullish on AMZN, but I am going to wait and see before I change my standing bearish technical opinion on NFLX.

It seems like a time to jump for joy and celebrate. However, there are a number of important caveats to keep in focus. These points should at least slow down anyone who is late to this rebound because they chose to sit in fear rather than buy in the oversold period(s).

- The S&P 500 closed right at the 1987 pivot that has somehow become important since the first oversold period began. More importantly, the 50DMA looms overhead as downtrending resistance.

- The S&P 500 is just 9 points, less than a fraction of a percent, away from my upside target (see the trading call above). At least the good news here is that T2108 is still nowhere near overbought status here.

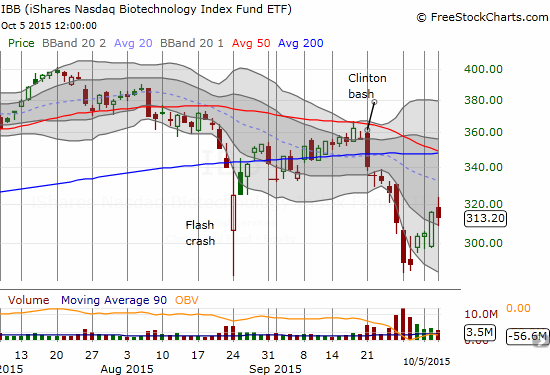

- My new favorite for speculative fervor, the iShares Nasdaq Biotechnology ETF (IBB), faded after an initial gain. I was quite surprised to see such a dramatic shift to relative weakness. Chart below.

- T2107, the percentage of stocks trading above their 200DMAs, is still well within the range of the angst from the past several months. The GOOD side of this position is that if the S&P 500 does indeed manage a 50DMA breakthrough soon, T2107 is telling us there could be significant upside ahead as stocks rise to test 200DMA resistance points. See chart below.

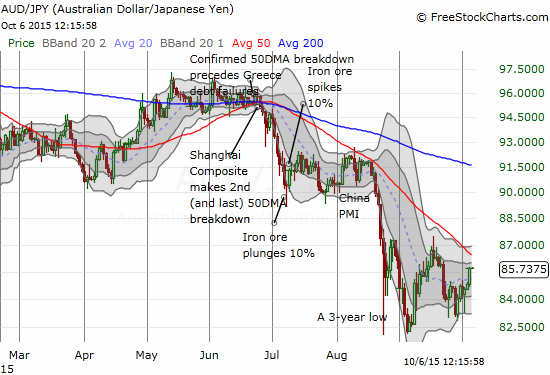

- The Australian dollar (FXA) has also not confirmed or lead a breakout. Against the Japanese yen (FXY), one of the currency market’s favorite indicators of risk appetite remains below a downtrending 50DMA. See chart below. At the time of writing, the release of the Reserve Bank of Australia’s latest decision on monetary policy is sparking a further relief rally even though the RBA said nothing new or surprising.

Mind you, I am far from bearish. I would love to see the market continue to power higher from here. However, given I went into the last oversold period very slim on hedges (and per rules, I closed out most of them at that time), I have used this strong, yet unproven, rally as an opportunity to rebuild some hedges. My favorite, Caterpillar (CAT), is experiencing a VERY strong relief rally. CAT soared 5.3% on the day and has gained about 10% from its post-earnings low. A close right below the downtrending 20DMA marks a good spot to rebuild my favorite hedge against bullishness.

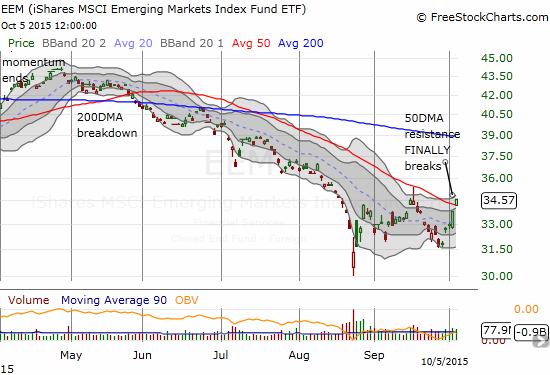

I also decided to lock in profits on the long side of my strangle play on iShares MSCI Emerging Markets (EEM). I locked in the profits on my call options (which were in the money). I am now left with the short-side, the put options. EEM has broken above its 50DMA for the first time in May. So I am actually on watch here for further follow-through. A close above last month’s high (which faded from the 50DMA) will refocus me on the upside possibilities for EEM.

Next up, earnings season!

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SVXY shares, long SSO shares, long IBB call options, short CAT, short USO put options and call spread, short AUD/JPY