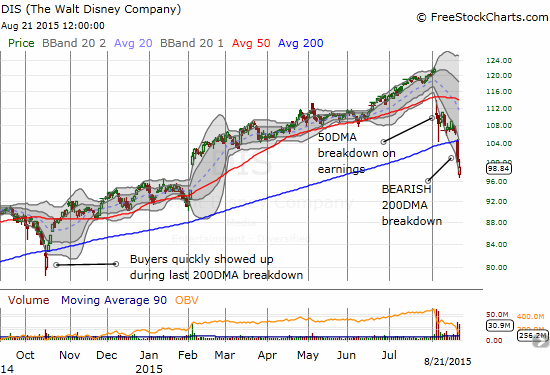

The stock of Disney (DIS) has suffered a massive and very bearish breakdown this month. At the time of writing, the stock has lost 19% since closing at its last all-time high.

Source: FreeStockCharts.com

Disney’s first breakdown came earlier this month. The stock lost 9.2% and closed below its 50-day moving average (DMA) on extremely high trading volume. The headlines were abuzz about poor ratings on ESPN and cord-cutting millennials who apparently will never watch another Disney show (and never have kids who will demand Disney products or go to Disneyland?). For Disney bulls, the drop looked like an excellent buying opportunity. I even jumped at the chance to get back into a long-term option (expiring January, 2017) and successfully managed to flip short-term call options to help pay for the long-term position.

The very next day delivered a warning that this time may be different. DIS lost as much as another 5.6% before bouncing away from its 200DMA line of support. Trading volume was almost as high as the previous day. Interpretation: there were still PLENTY of investors who wanted to get out of DIS. From that second day, DIS dribbled slowly downward toward its 200DMA. That line broke in spectacular fashion on August 20th. Trading volume ramped up again as DIS followed (or led) the general market into a large sell-off.

On Friday, Disney sellers finally took a RELATIVE break as DIS “only” lost 1.2% with the S&P 500 (SPY) losing a whopping 3.2%. (I know DIS is a member of the Dow Jones Industrial Average, but I ignore that index given its price-weighting – a completely outdated and outmoded way of measuring performance in the stock market). Buyers even showed up to pick DIS off its lows. This relative strength is encouraging and short-term traders can play this attempted bounce with a stop-loss at the lows. But what about longer-term investors?

Long-term investors could completely ignore this temporary bout of selling. They could rest in a comfortable assumption that the market will come back around to the bullish case with little to no additional downside risk to the portfolio. I am assuming you are NOT one of those content folks if you are bothering to read this post. This kind of blissful blindfold is a dangerous approach. DIS has broken down in a bearish fashion, so I am assuming the odds of a continued sell-off are high enough to make most bulls uncomfortable. If the selling continues, even long-term investors who have not taken steps to reduce risk will be VERY tempted to capitulate just when the fear and panic is high enough to create a sustainable bottom in the stock. Very bad.

I propose two investing scenarios for consideration that investors can apply to any stock. The first scenario offers fully invested investors an option for trading off risk for the opportunity to buy cheaper shares. The second scenario offers investors already itching to accumulate more shares a structured and disciplined approach to buying with lower risk. Note that these scenarios share the same buying strategy but differ in how to apply cash.

Scenario #1: Fully invested in Disney

Investors in this position have the MOST to lose. Presumably, you have no spare cash to buy more shares, so you will be most eager to protect profits (or limit losses) if DIS continues to fall. You will be most vulnerable to disposing of your shares just as DIS makes a final bottom amid a peak in panic and fear. Building up fortitude NOW should pay off in the long-run.

If looking ahead you could withstand, say, a 50% loss in DIS without breaking a sweat, then you can stop reading now. If not, then the bearish breakdown below 200DMA represents a critical event. A prudent investor could sell at least half his/her shares and put the cash aside as a buffer. If DIS makes a quick comeback, then use half of the buffer to buy back into DIS after it closes above its 200MDA two days in a row. The 2-day rule reduces the odds of getting whipsawed by a false breakout. The other half of the buffer sits waiting for the next buying opportunity. If DIS continues to sell-off then apply the entire buffer according to scenario #2…

Scenario #2: Looking for buying opportunities in Disney

Investors in this position can stay more relaxed with a lot less to lose and cash at the ready to reduce the cost basis of current holdings and enhance future long-term returns. Take the investible cash and divide it into three equal parts. The first buying scenario is the same 200DMA conditional described in scenario #1 above. If DIS continues along its bearish ways before crossing above the 200DMA, then identify three buying points. The last buying point does not apply if you were unfortunate enough to get whipsawed by a fake breakout above the 200DMA.

The first buy point is a fill of the February post-earnings gap up which would be a price around $94. This point has multiple layers of importance. Not only was it the last time positive news catapulted DIS to such a large gain, but also it marks a significant breakout that established the subsequent run-up for DIS. A complete reversal means investors are getting another shot at buying DIS at a price I am guessing you thought you would never see again.

The second buy point comes from the lows from 2014 where DIS last broke down below its 200DMA. That price is around $80, a gut-wrenching additional 19% loss from current levels. The significance of this point is more technical. October was a significant bottom where the entire market became oversold as panic and fear climaxed. If Disney’s long-term story remains intact this level should certainly hold firm.

The worst case scenario comes from sellers succeeding in pushing Disney through this critical $80 level. At THAT point, even Disney bulls will need to re-evaluate the bullish thesis. Either way, it will be time to press the reset button, and I hope to be ready to rewrite the investing strategy for DIS.

The rules around these scenarios apply some structure and discipline to managing risk and making purchases. I like targeted buy points rather than more or less random successive purchases which are typically done in the hope that the selling has reached some kind of extreme. This latter approach also carries the “affectionate” name “trying to catch a falling knife.”

For managing risks even more tightly, I prefer using options. I like using options even MORE in a case such as Disney where a significant breakdown has occurred. The structured buying rules are nice, but they are no substitute for a crystal ball. Disney could fall further for longer than any of us could imagine sitting here now. Options offer a way to significantly reduce downside risk while maintaining significant upside opportunity.

For investors in either scenario #1 or #2, the first two buys go into call options. One call option offers the right, but not the obligation, to buy 100 shares of the underlying stock at a price called the “strike price.” The third buy should be in shares of Disney. At THAT point, you are truly digging in your heels and committing to Disney for the very long time it will take for shares to recover. Since you only lost the purchase price of options on the first two buys, you will have plenty of cash on hand left for the shares.

Determine the MAXIMUM amount to spend on options by the amount you are willing to lose in Disney if you were to buy shares. Since you are a long-term Disney bull who probably wants to participate in the coming hype over Star Wars, etc…, you want to go for the January, 2017 call options. Let’s see how this works.

Start with a long-term price target. Since you are long-term bullish, you can certainly believe that DIS can re-obtain its all-time high by January, 2017. So, let’s set a long-term price target of $123 or a 24% gain in 17 months. Without context, such a target sounds aggressive. Of course, it is not so aggressive considering Disney was trading at this level almost three weeks ago. DIS is up a whopping 546% from the historic 2009 lows. DIS has doubled since the end of 2013. These are heady gains that have probably spoiled a lot of investors!

Let’s assume you are willing to lose a maximum of $750 on this incremental investment. The January 2017 call option with a strike price of $110 costs $750. This option expired on January 21, 2017. If DIS hits the $123 price target at the time of expiration of the call option, it will be worth $1300. Subtract the $750 to get a total profit of $550, excluding commissions. This is a 73% return in 17 months while the underlying stock gained just 12%. You risked only $750 to get this gain. To earn $550 on Disney shares on the same 12% gain in the stock, you would have to buy, that is RISK, $4583 worth of Disney shares (at the current price this amounts to 46 shares).

The benefit of this call option extends beyond trying to nail a specific price by January, 2017. Let’s say we turned out far too pessimistic about Disney’s recovery – for example, the stock hits $123 by next April, 2016. The call option will deliver even more profit because it will retain significant time premium. The time premium compensates the seller of the option for the risk of selling you the option. The longer the time to expiration, the wider the range of possibilities for the stock and thus the greater the time premium. If DIS hits $123 by April, not only will it have an intrinsic value of $1300, but also it will include some of the time premium embedded in the $750 you paid for the option. Note that since DIS currently trades below $110, the entire $750 represents time premium right now.

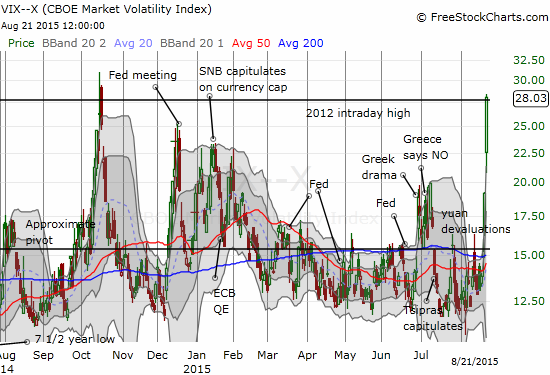

Additional nuances exist with volatility pricing, but for simplicity, I am not accounting for changes in volatility (isn’t this post long enough?). Suffice to say that the market is finally taking risks seriously again. The higher the volatility, the more pricey the option because of the implicit increase in the range of price scenarios by expiration.

My bottom-line for long-term investors: avoid assuming that your valuation model is the correct one. The market actually does not know or care what you think. It is going to go where it is going to go on its own schedule no matter what or how you buy or sell (unless you are Carl Icahn reading this or something!). So, when the market is going through a serious disruption, take risk management seriously and check and re-check your rationale for your bullishness. Invest according to your convictions, but do not allow those convictions to cripple your ability to navigate your way forward. If Disney’s bullish case does indeed remain intact, then January, 2017 should provide PLENTY of time for the market to come back around to believing as you do.

Please consult a financial advisor if needed before trying any of these trading strategies, especially if you are unfamiliar with options. I am of course not guaranteeing any specific return or result. I am just describing some possibilities and some options for managing risk in a highly volatile and uncertain time. These principles apply generally to almost any stock with buy points well-defined by historic milestones.

Suggestions and feedback welcome!

Be careful out there!

Full disclosure: long DIS call options