(This is an excerpt from an article I originally published on Seeking Alpha on August 3, 2015. Click here to read the entire piece.)

Lost during last Friday’s alarm over U.S. wage growth was the report on May GDP for Canada from Statistics Canada. Canada reported its fifth consecutive monthly decline all but guaranteeing the country will breach the technical definition of recession once the full second quarter report is ready.

GDP only declined 0.2% month-over-month, but the weakness was broad-based. The output of both goods and service producing industries fell, changes of -0.6% and -0.1% respectively.

{snip}

The weak GDP for May is of course little surprise given the poor economic news the Bank of Canada delivered a week earlier. {snip}

Source: FreeStockCharts.com

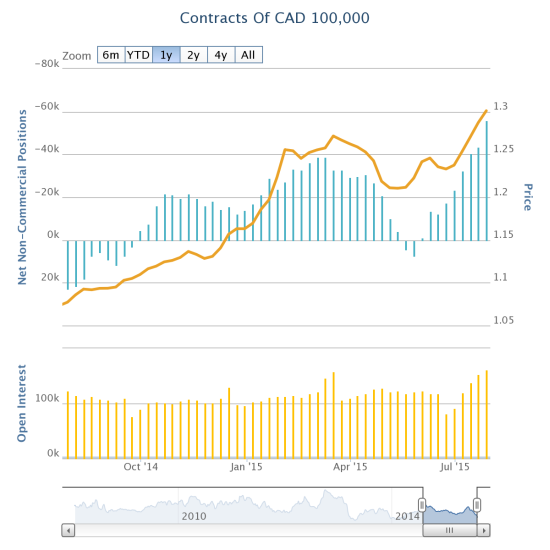

The Canadian dollar has not weakened as fast as I expected since the Bank of Canada’s rate cut, especially with speculators continuing to ramp their net short bets against the Canadian dollar.

Source: Oanda’s CFTC’s Commitments of Traders

As a result, I am still clinging to my short USD/CAD position. {snip}

Be careful out there!

Full disclosure: long FXC, short USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on August 3, 2015. Click here to read the entire piece.)