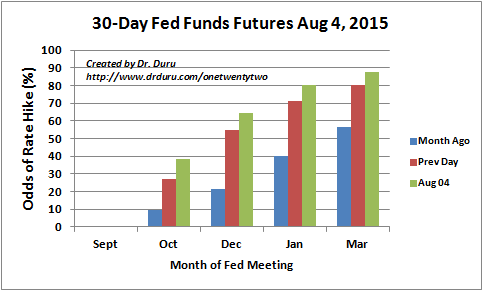

Reuters reported on August 4, 2015 that Atlanta Federal Reserve President Dennis Lockhart insisted to the Wall Street Journal that he firmly supports a rate hike in September. Only a “‘significant deterioration’ in the U.S. economy” would deter Locker. The 30-Day Fed Funds futures market was unimpressed – Locker might as well been screaming into the wind. While the odds of hiking rates in future months zipped upward, the odds of a rate hike in September sat quite comfortably at zero. I include the chart from the market’s reaction to Friday’s disappointing data on wage growth for reference on the volatility.

Source: CME Group FedWatch

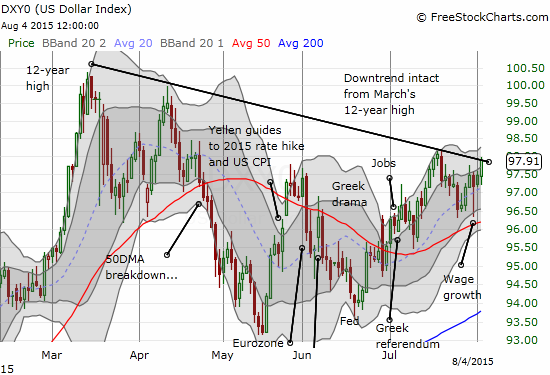

Given the odds of a rate hike in December firmed up (above 50%), it is no surprise then that the U.S. dollar index gained ground. Locker almost helped to push the U.S. dollar into a breakout from its downtrend from the 12-year high in March.

Source: FreeStockCharts.com

If the dollar index finally pushes through the downtrend, I will get much more aggressive on my long dollar plays primarily against the euro and the Japanese yen by taking on larger positions and trying to hold them longer than usual.

Be careful out there!

Full disclosure: net short the U.S. dollar

Note that as of August 5, 2015, the CME Group stopped publishing numbers for the odds of the nearest meeting. So from now on we will only be able to say the odds are LESS THAN the odds for the second meeting out.