(This is an excerpt from an article I originally published on Seeking Alpha on June 8, 2015. Click here to read the entire piece.)

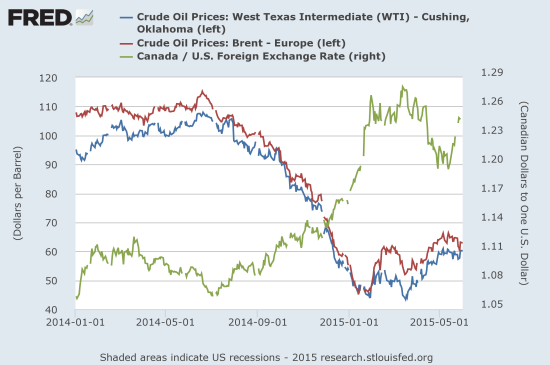

Over the past month the Canadian dollar (FXC) has significantly diverged from oil prices.

Source: The St. Louis Federal Reserve

This divergence is not a surprise given the weak correlations between the currency and oil prices since at least 2008. However, the sharpness of the divergence since mid-May IS a surprise that I do not think will sustain itself for much longer. {snip}

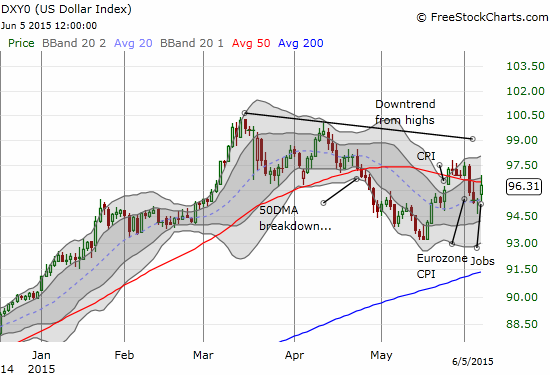

Source: FreeStockCharts.com

{snip}

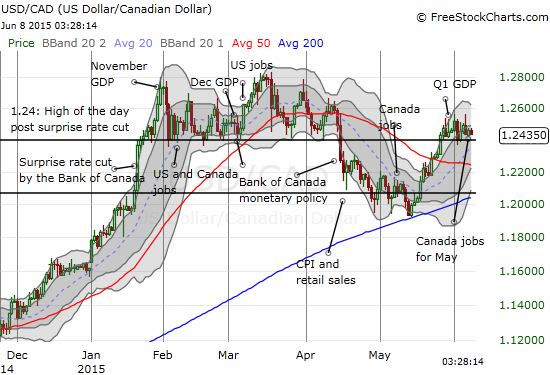

Source: FreeStockCharts.com

{snip}

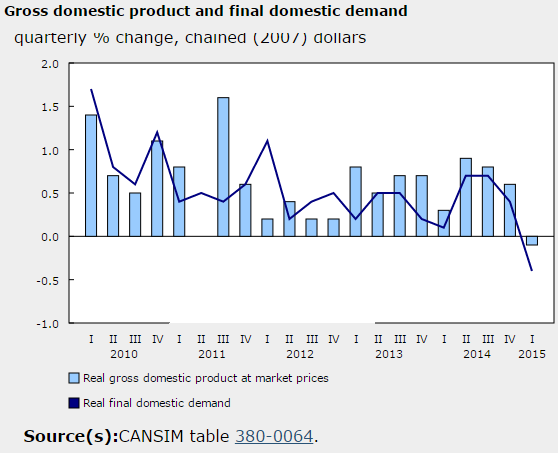

Source: Statistics Canada

Of the biggest drivers of the negative GDP print, exports concern me the most since it implies that a weaker Canadian dollar did not deliver as expected and hoped. {snip}

This export performance added to a fourth quarter in a row of declining terms of trade for Canada. {snip}

The jobs report is also a source of optimism. {snip}

The current “stalemate” comes right back to oil then as a possible “tie-breaker” until the next refresh for GDP and jobs. {snip}

Source: StockCharts.com

Since the Canadian dollar and oil typically do not experience persistent divergences, I am expecting the Canadian dollar to regain some strength in the short-term even if oil just remains stable. Such a move would be consistent with a return to the top of the current trading range. Of course, this adjustment could also happen with fresh weakness in oil, so I am also on alert to trade USO bearishly if it breaks below recent lows. I am assuming that a fresh bounce in oil prices would be an unqualified positive for the Canadian dollar.

{snip}

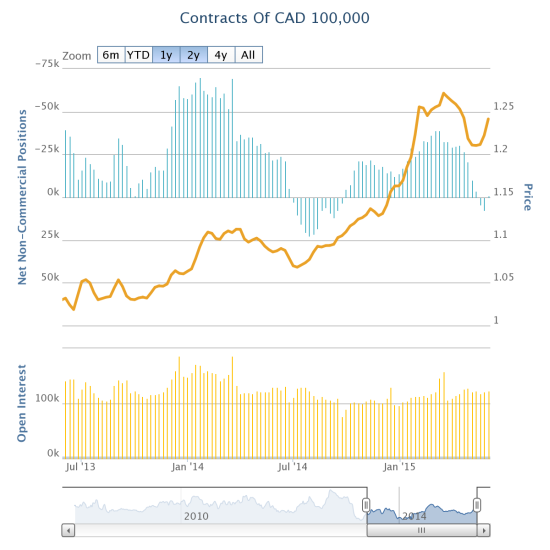

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: long FXC

(This is an excerpt from an article I originally published on Seeking Alpha on June 8, 2015. Click here to read the entire piece.)