(This is an excerpt from an article I originally published on Seeking Alpha on Feb 2, 2015. Click here to read the entire piece.)

It is never good to see a negative print on a GDP growth number. It is even worse when it is below market “expectations.”

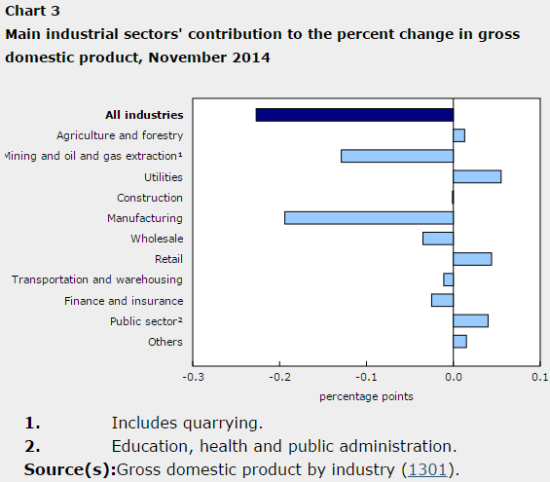

When Statistics Canada reported a GDP decline of 0.2% from October to November, the print came in below expectations for a flat report. What I am sure stuck out the most was the negative performance of mining and oil and gas extraction.

Source: Statistics Canada

It looks like the long-feared economic decline of Canada’s oil patch has begun.

{snip}

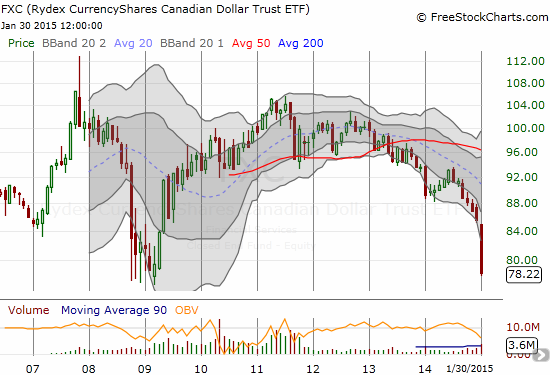

The reaction in currency markets was dramatic and underlined the fresh fear that the Canadian dollar’s weakness still has plenty of room to run. For the third day in a row, the Canadian dollar lost significant ground to the U.S. dollar. The monthly chart below shows that CurrencyShares Canadian Dollar ETF (FXC) has almost returned to 2009 levels.

Source: FreeStockCharts.com

Normally, this kind of retest would get me interested in trying a buy. In THIS case, I am lot more cautious. The downward trend in the Canadian dollar has lasted longer and extended further than even my most bearish assessments from 2013 to 2014. {snip}

Be careful out there!

Full disclosure: long USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on Feb 2, 2015. Click here to read the entire piece.)